Talking Points:

- US manufacturing continues to slump, despite ‘beat’ on headline.

- String of weak US economic data extends back to late-August.

- EURUSD eases back to $1.1050.

Weaker US economic data has been a theme of recent, a trend that started back in late-August/early-September after soft CPI, retail sales, and jobs growth readings. Although today’s release of the September US Durable Goods Orders report didn’t technically disappoint expectations, it still wasn’t a good print; it was just less worse than anticipated.

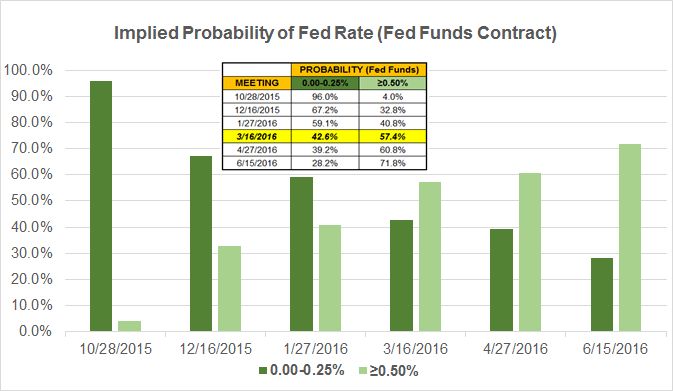

The US economy appears to have entered a soft patch at the end of Q3’15, further supporting the Federal Reserve’s decision to keep rates on hold in September. Even though the Fed is gathering for its October policy meeting, in recent weeks market measures of rate expectations have all but priced out a rate hike tomorrow (see chart above: Fed funds futures contract peg a 4% chance of a hike in October).

Here’s the data moving the US Dollar this morning:

- USD Durable Goods (SEP): -1.2% versus -1.5% expected, from -3.0% (revised lower from -2.3%) (m/m).

- USD Durables ex Transport (SEP): -0.4% versus 0.0% expected, from -0.9% (m/m).

See the DailyFX economic calendar for the week of October 25, 2015

EURUSD 1-minute Chart: October 27, 2015

After the data, EUR/USD declined from near its session highs, falling from $1.1078 to as low as $1.1044. At the time this report was written, the pair was trading back to $1.1052. Similar price action was observed elsewhere, with GBP/USD slipping from $1.5356 to as low as $1.5326.

Read more: EUR/USD Flag Break Hinges on US Data, FOMC Tomorrow

--- Written by Christopher Vecchio, Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form