Talking Points:

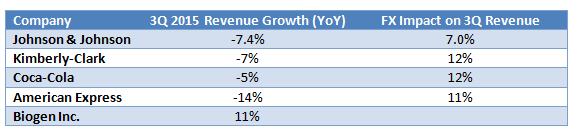

- A number of multinational firms saw revenues decline in 3Q due in part to a stronger US dollar

- American Express reported 3Q revenue down 14 percent compared to 2Q 2014

- Biotechnology firm Biogen Inc. reported an increase in revenues by 11 percent in 3Q 2015

There has been a common theme among multinational corporations reporting declines in net revenues this earnings season - a strong US dollar. Consumer goods giant Johnson and Johnson saw their revenue decline in the third-quarter of 2015 attributing the results to unfavorable exchange rates that reduced the value of overseas sales. Kimberly-Clark reported similar declines in income this past session and said that exchange rates reduced sales by 12 percent. Coca-Cola had also forecasted Wednesday a 7 point currency headwind on net revenue for the fiscal year 2015, as the company’s third-quarter revenue fell.

American Express posted a third-quarter profit of $1.26 billion, or $1.24 per share. The bottom line for the company was under analysts’ estimates, down 11.4 percent from the same quarter last year. Overall revenue for American Express in the third-quarter was down 14 percent compared to third-quarter 2014. The company attributed the decline in revenue to three factors: the reoccurring effects of a stronger US dollar, higher spending on growth initiatives, and earlier changes to certain renewed co-brand partnerships.

Global biotechnology company Biogen Inc. was another high profile earnings headline. The company posted a profit of $966 million, or $4.48 per share for the third-quarter. That beat analysts’ estimates of $3.77 per share by 18 percent. On the topline, net revenue for Biogen increased 11 percent in the third quarter 2015 compared to the same period a year ago. Operating expenses were benefited by the company’s restructuring which has included an ongoing reduction in its global workforce by 11 percent. As part of one of the fastest growing industries biotechnology - an industry that has shown signs of faltering lately – Biogen Inc. strong earnings report has helped to give some confidence to the high-flying sector going forward. Many Biotech companies will report in the coming weeks.

Don’t know where to start in forex trading? Check out our courses here.