US DOLLAR PRICE OUTLOOK: ALL EYES ON NONFARM PAYROLLS REPORT

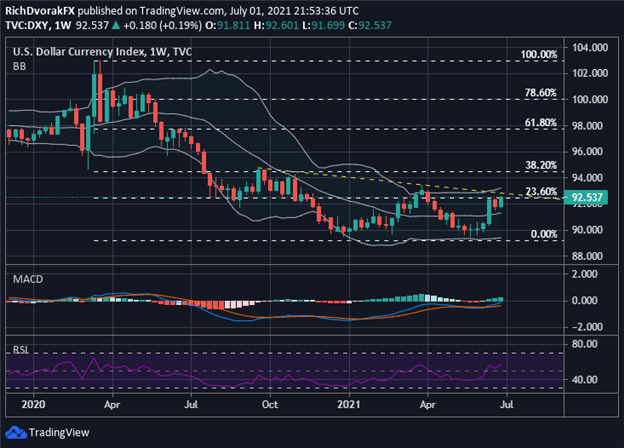

- Broad-based US Dollar strength is propelling the DXY Index to 12-week highs ahead of NFPs

- US Dollar bulls are flexing their muscles due to the threat that FOMC officials may taper QE

- Nonfarm payrolls might need to top 845K to catalyze a sustained breakout by the US Dollar

- Bookmark and revisit our Real Time News page for timely market news and analysis

USD price action gained ground across the board of major currency pairs on Thursday. US Dollar strength was most notable against the Pound, Yen, and Aussie. The broader DXY Index climbed 0.2% on balance to the 92.50-price level and is pacing its highest close since early April. This was an extension of the prior session’s rally as markets focus their attention on event risk posed by the upcoming release of monthly nonfarm payrolls data due Friday, 02 July at 12:30 GMT.

The often high-impact NFP report carries weight insofar that it has potential to sway monetary policy at the Federal Reserve. This is particularly the case given the current backdrop for markets with regards to speculation around Fed tapering. While there understandably has been a lot of attention placed on recent inflation, FOMC officials will also consider labor market conditions, perhaps with greater emphasis in the central bank’s pursuit of making substantial further progress toward policy goals.

HOW MIGHT FED POLICY & MARKETS BE IMPACTED BY NFP DATA DUE?

After all, Fed Chair Jerome Powell noted during his most recent congressional testimony how record low unemployment was a big benefit of the long economic expansion into 2019. Powell has conveyed how the traditional jobless rate understates the shortfall in employment as well. Fed Chair Powell nevertheless expects strong labor demand to lift wages and curb unemployment. To that end, we just saw Challenger job cut announcements drop to the lowest level in over two decades and JOLTS total job openings soar to the highest reading on record.

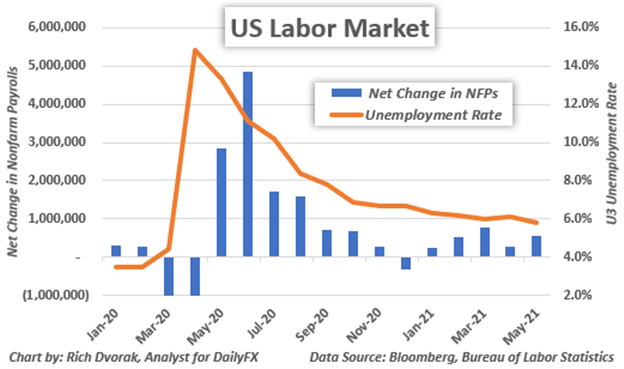

That said, markets are currently expecting the headline change in nonfarm payrolls to show 720,000 jobs gained in June according to the median consensus forecast. The standard deviation of estimates is +/- 125K. The unemployment rate is anticipated to tick lower to 5.6% from 5.8%. Actual figures will be reported in real-time on the DailyFX Economic Calendar. So what are the different scenarios and playbook for traders watching the NFP report release?

NFP Report Misses Forecast: Worse-than-expected nonfarm payrolls data likely stands to fuel a sharp unwind of recent US Dollar strength and Fed taper bets. This could occur with lack of improvement in the unemployment rate or a headline NFP figure that is below 595,000. A weaker US Dollar could also be accompanied by higher gold prices and a strong bid beneath stocks in response to reduced odds of an expedited Fed taper timeline.

NFP Report In-Line with Forecast: The goldilocks scenario where NFPs neither miss nor beat expectations materially might be viewed as a disappointment to US Dollar bulls and Fed hawks. Correspondingly, USD price action could be mixed and choppy with a slightly bearish tilt. This is seeing that a ‘good but not good enough’ print on nonfarm payrolls likely affords the Federal Reserve more time to be patient with starting to unwind asset purchases and tighten financial conditions.

NFP Report Beats Forecast: Better-than-expected NFP figures has potential to accelerate US Dollar buying pressure. I will be watching for the net change in NFPs to top 845,000 as markets would likely interpret this as a very strong reading to the point that it may up the pressure on FOMC officials to communicate a timeline for tapering. The unemployment rate, labor force participation rate, and wage growth components of the NFP report will likely be scrutinized for signs of improvement as well.

DXY – US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (DEC 2020 TO JUL 2021)

Chart by @RichDvorakFX created using TradingView

The DXY Index might look to contend descending trendline resistance and its upper Bollinger Band if nonfarm payrolls data sparks a bullish reaction in the US Dollar. The upper Bollinger Band and the 31 March swing has stand out as the next potential resistance levels. Conversely, disappointing NFP data might see US dollar bears send the DXY Index snapping lower toward last week’s low and the 20-week simple moving average.

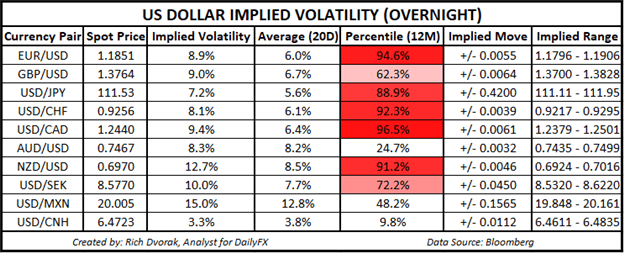

USD PRICE OUTLOOK – US DOLLAR IMPLIED VOLATILITY TRADING RANGES (OVERNIGHT)

Taking a quick look at overnight implied volatility readings for key US Dollar FX pairs underscores the high-impact event risk posed by nonfarm payrolls data due. USD/CHF and USD/CAD could be worth watching in particular given their overnight implied volatility readings of 8.1% and 9.4%, respectively. USD/CHF could snap higher with better-than-expected NFPs while USD/CAD might be a good candidate for a reversal back lower if NFPs disappoint and crude oil prices remain perky.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 7% | 5% |

| Weekly | -30% | 38% | 13% |

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight