US DOLLAR OUTLOOK: USD PRICE ACTION SNAPS LOWER AGAINST MOST FX PEERS AS WEAKNESS RESUMES

- US Dollar bears look to be back in the drivers seat as Greenback weakness resumes

- USD price action turned sharply lower against EUR, CAD and AUD, but gained vs GBP

- The DXY Index appears to have rejected its downward sloping 8-day moving average

The US Dollar traded on its back foot during Thursday’s trading session. USD price action edged 0.34% lower on balance as measured by the US Dollar Index, which marks the first down day this week. US Dollar weakness was notable across most major currency pairs, but the slide by GBP/USD helped offset the Greenback’s decline thanks to no deal Brexit risk weighing negatively on the Pound Sterling.

That said, a large driver of US Dollar downside today was likely fueled by the 0.5% pop by EUR/USD price action in the wake of this morning’s ECB rate decision. Movement toward reaching a fiscal stimulus deal hinted at by US politicians, who have reportedly reached an agreement on state and local aid, could have contributed to the resumption of US Dollar selling pressure as well.

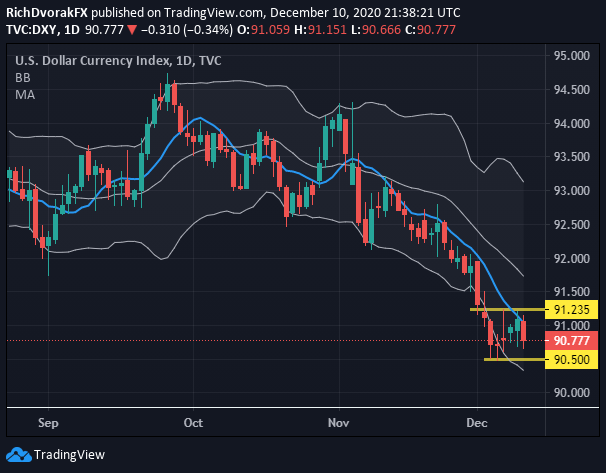

DXY - US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (24 AUG TO 10 DEC 2020)

Chart by @RichDvorakFX created using TradingView

From a technical perspective, the pivot lower by USD price action coincided with the US Dollar Index rejecting its downward-sloping 8-day simple moving average. This could suggest US Dollar bears still remain broadly in control. Nevertheless, recent consolidation on the DXY Index looks to have formed an intermittent range between the 90.500-91.235 levels. Breaching this bottom barrier could motivate a push below the 90.00-handle whereas eclipsing the potential technical resistance zone highlighted might open up the door for a relief bounce toward the 92.00-price mark.

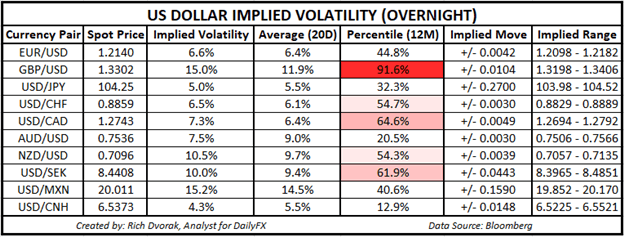

USD PRICE OUTLOOK: US DOLLAR IMPLIED VOLATILITY TRADING RANGES (OVERNIGHT)

Learn More - What is Implied Volatility & Why Should Traders Care?

GBP/USD price action is still expected to be the most active major FX pair according to its overnight implied volatility reading of 15.0%, which is above its 20-day average reading of 11.9%, and ranks in the top 90th percentile of measurements taken over the last 12-months. The Pound-Dollar remains mostly exposed to Brexit headlines. Most recently, UK Prime Minister Boris Johnson echoed the need to prepare for a no trade deal scenario. Talks between he UK and EU are expected to continue through Sunday, which could leave GBP/USD price action vulnerable to sharp swings until clarity on Brexit is provided.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight