New Zealand Dollar Talking Points

NZD/USDcontinues to pullback from the weekly high (0.7315) ahead of the update to the US Non-Farm Payrolls (NFP) report, with the Relative Strength Index (RSI) indicating a textbook sell signal as the oscillator quickly falls back from overbought territory.

NZD/USD Forecast: RSI Sell Signal Emerges Ahead of US NFP Report

NZD/USD snaps the series of higher highs and lows from earlier this week despite the limited reaction to the ISM Non-Manufacturing survey, and key market trends may continue to sway the exchange rate as the US Dollar still reflects an inverse relationship with investor confidence.

Nevertheless, the ISM Non-Manufacturing revealed an unexpected pickup in service-based activity as the index climbed to 57.2 from 55.9 in November, but a deeper look at the report showed the employment component contracting in December, with the figure narrowing to 48.2 from 51.5 the month prior.

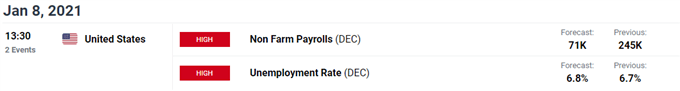

The NFP report may highlight a similar dynamic as the update is expected to show the US economy adding 71K jobs in December following the 245K expansion during the previous period, and it remains to be seen if a slowdown in employment will influence the near-term outlook for NZD/USD as the Federal Reserve remains on track to increase its “holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month.”

Looking ahead, it seems as though the Federal Open Market Committee (FOMC) will retain the current policy at its next interest rate decision on January 27 as the central bank lays out an outcome based approach for monetary policy, and Chairman Jerome Powell and Co. may pay increased attention to the incoming data prints as “various participants noted the importance of the Committee clearly communicating its assessment of actual and expected progress toward its longer-run goals well in advance of the time when it could be judged substantial enough to warrant a change in the pace of purchases.”

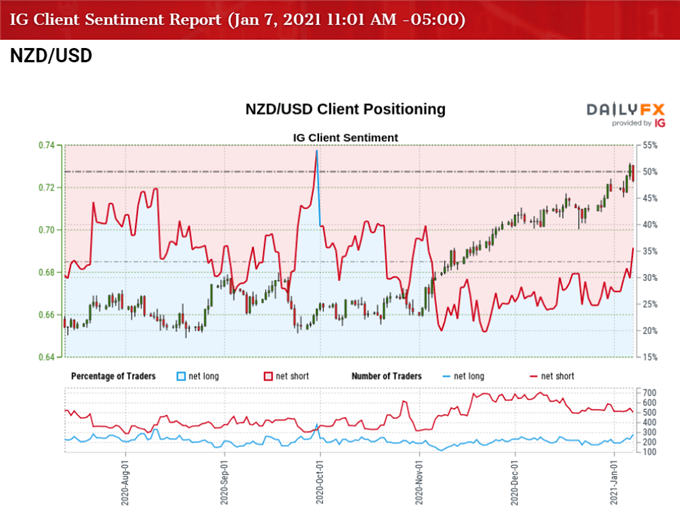

Until then, swings in risk appetite may continue to sway NZD/USD as the Fed’s balance sheet sits near the record high, and it looks as though the tilt in retail sentiment will also persist as the crowding behavior from the first half of 2020 resurfaces.

The IG Client Sentiment report shows retail traders have been net-short NZD/USD since October, with 35.05% of traders currently net-long the pair as the ratio of traders short to long stands at 1.85 to 1. The number of traders net-long is 11.34% higher than yesterday and 14.72% higher from last week, while the number of traders net-short is 3.54% lower than yesterday and 9.07% lower from last week.

The rise in net-long interest comes as NZD/USD clears the 2020 high (0.7241) during the opening week of January, while the decline in net-short interest has helped to alleviate the crowding behavior as only 30.28% of traders were net-long the pair earlier this week.

With that said, key market themes may continue to sway NZD/USD as the US Dollar still reflects an inverse relationship with investor confidence, but the exchange rate may face a larger pullback as the oscillator quickly falls back from overbought territory and indicates a textbook sell signal.

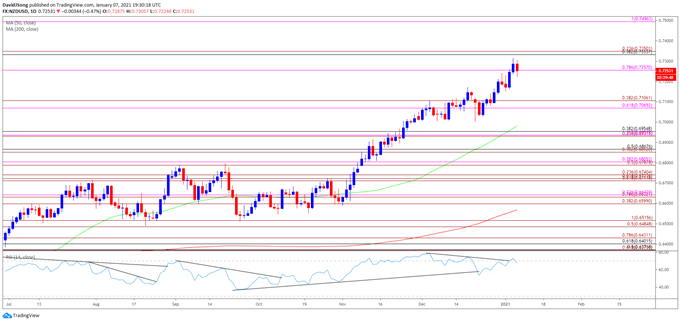

NZD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, NZD/USD cleared the June 2018 high (0.7060) during the previous month as it climbed to a fresh yearly highs throughout December, with the exchange rate taking out the 2020 high (0.7241) during the first week of January to come up against the Fibonacci overlap around 0.7330 (38.2% retracement) to 0.7350 (23.6% expansion).

- The bullish price action pushed the Relative Strength Index (RSI) pushed into overbought territory, but the move above 70 appears to have been short lived, with the oscillator indicating a textbook sell signal as it quickly falls back from overbought territory.

- Lack of momentum to hold above 0.7260 (78.6% expansion) brings the 0.7070 (61.8% expansion) to 0.7110 (38.2% expansion) region back on the radar, with the next area of interest coming in around 0.6930 (23.6% expansion) to 0.6960 (38.2% retracement).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong