Canadian Dollar Talking Points

USD/CAD trades within the June range as it snaps the ascending channel formation carried over from the previous month, and the exchange rate may continue to consolidate ahead of the Bank of Canada (BoC) interest rate decision on July 15 as the central bank is expected to retain the current policy.

USD/CAD Rate Outlook Hinges on Bank of Canada (BoC) Forward Guidance

USD/CAD remains little changed from the start of the month amid the limited reaction to Canada’s Employment report, but the update may influence the monetary policy outlook as the economy adds 952.9K jobs in June following the 289.6K expansion the month prior.

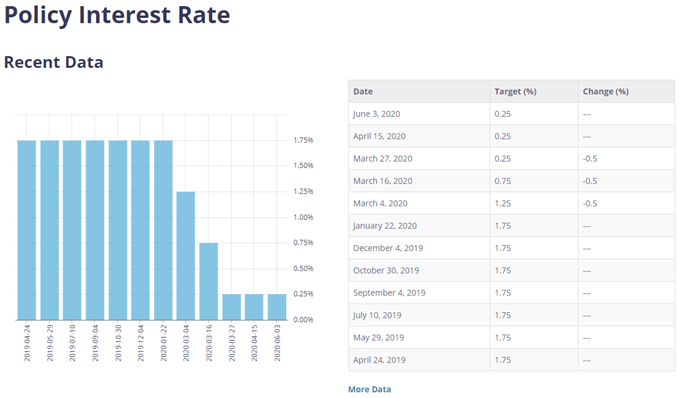

Signs of stronger job growth is likely to keep the Bank of Canada (BoC) on the sidelines as the Canadian economy appears to have avoided the most severe scenario presented in the Bank’s April Monetary Policy Report (MPR), and the central bank may carry out a wait-and-see approach over the coming months as “the Bank expects the economy to resume growth in the third quarter.”

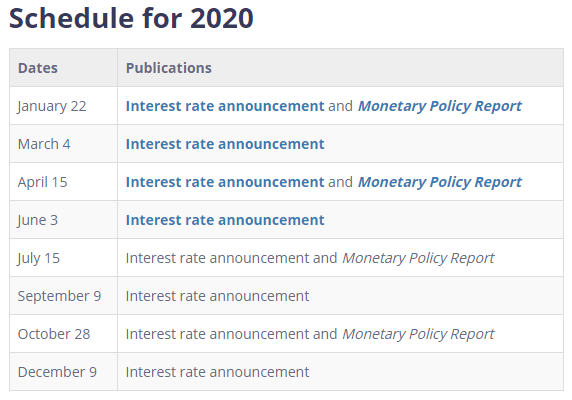

Source: BoC

In turn, the update to the MPR may undermine speculation for additional monetary support as “the Bank is reducing the frequency of its term repo operations to once per week, and its program to purchase bankers’ acceptances to bi-weekly operations,” and an adjustment in the forward guidance for monetary policy may trigger a bullish reaction in the Canadian Dollar if the BoC shows a greater willingness to wind down its asset purchases throughout the second half of 2020.

However, more of the same from the BoC may drag on the Canadian Dollar as Governor Tiff Macklem rules out a V-shape recovery, and the central bank may largely emphasize its “commitment to continue large-scale asset purchases until the economic recovery is well underway” as officials warn that “the global recovery likely will be protracted and uneven.”

Until then, USD/CAD may continue to consolidate as it snaps the ascending channel formation carried over from the previous month, with the June range on the radar as the exchange rate remains little changed from the start of the month.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

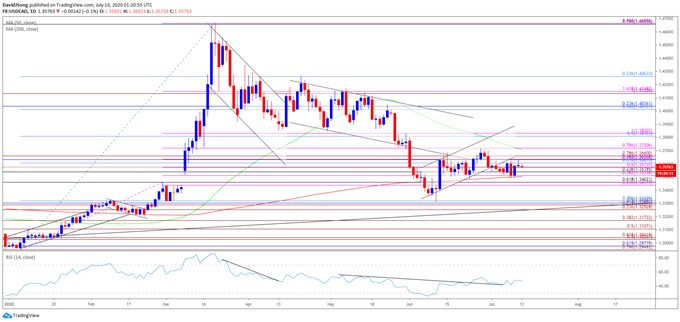

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, the USD/CAD correction from the 2020 high (1.4667) managed to fill the price gap from March, with the pullback in the exchange rate pushing the Relative Strength Index (RSI) into oversold territory for the first time since the start of the year.

- However, the RSI has failed to retain the downward trend from May as USD/CAD reversed from the March low (1.3315), with the development highlighting a potential shift in market behavior as the exchange rate continues to track the June range.

- In turn, USD/CAD may continue to consolidateas it snaps the ascending channel formation following the failed attempt to test the June high (1.3801), with lack of momentum to break/close above the 1.3610 (61.8% retracement) to 1.3660 (78.6% expansion) pushing the exchange rate back towards the Fibonacci overlap around 1.3510 (38.2% expansion) to 1.3540 (23.6% retracement).

- The June range remains on the radar for USD/CAD, but need a break/close below the 1.3510 (38.2% expansion) to 1.3540 (23.6% retracement) region to open up the overlap around 1.3440 (23.6% expansion) to 1.3460 (61.8% retracement),with the next area of interest coming in around 1.3290 (61.8% expansion) to 1.3320 (78.6% retracement), which lines up with the June low (1.3315).

- At the same time, a break/close above the Fibonacci overlap around 1.3610 (61.8% retracement) to 1.3660 (78.6% expansion) opens up the 1.3720 (78.6% expansion) region, with the next area of interest coming in around 1.3810 (50% retracement) to 1.3830 (100% expansion), which largely lines up with the June high (1.3801).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong