Canadian Dollar Talking Points

USD/CAD approaches the June high (1.3801) ahead of the monthly update to Canada’s Gross Domestic Product (GDP) report, and the reversal from the March low (1.3315) may continue to evolve going into July as the Relative Strength Index (RSI) breaks out of the bearish formation carried over from the previous month.

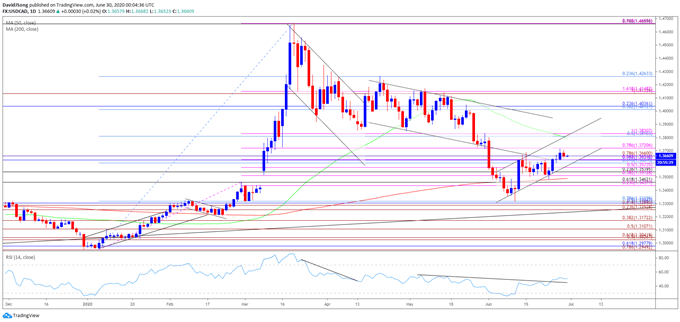

USD/CAD Reversal from March Low in Focus as RSI Breaks Bearish Trend

USD/CAD extends the advance from the June low (1.3315) as Fitch Ratings downgrades Canada’s Long-Term Foreign Currency Issuer Default Rating (IDR) to ‘AA+’ from ‘AAA,’ and the exchange rate may continue to trade within an ascending channel as Canada’s GDP report is anticipated to show the growth rate contracting 12.2% in April following the 7.2% decline the month prior.

In response, the Bank of Canada (BoC) may continue to rule out a V-shape recovery as Governor Tiff Macklem warns that “the quick rebound of the reopening phase of the recovery will give way to a more gradual recuperation phase,” and the central bank may come under pressure to implement more non-standard measures as “the recovery will likely be prolonged and bumpy, with the potential for setbacks along the way.”

It seems as though the BoC will rely on its balance sheet to support the Canadian economy as “the policy rate is now at its effective lower bound,” but it remains to be seen if the central bank will deploy more unconventional tools after unveiling the Corporate Bond Purchase Program in April as “any further policy actions would be calibrated to provide the necessary degree of monetary policy accommodation required to achieve the inflation target.”

In turn, the BoC may stick to the sidelines in the second half of 2020 as Governor Macklem pledges to carry out “large-scale asset purchases until the economic recovery is well underway,” but the central bank appears to be in no rush to drop the dovish forward guidance as “the pandemic is likely to inflict some lasting damage to demand and supply.”

With that said, the BoC may stick to same script at the next interest rate decision on July 15 as officials “expect growth to resume in the third quarter,” butthe update to the Monetary Policy Report (MPR) may reveal a shift in the forward guidance for monetary policy as “the Bank is reducing the frequency of its term repo operations to once per week, and its program to purchase bankers’ acceptances to bi-weekly operations.”

Until then, the reversal from the March low (1.3315) may continue to evolve as USD/CAD trades within an ascending channel, while the Relative Strength Index (RSI) breaks out of the bearish formation carried over from the previous month.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, the USD/CAD rally at the start of 2020 emerged following the failed attempt to break/close belowthe Fibonacci overlap around 1.2950 (78.6% expansion) to 1.2980 (61.8% retracement), with the yearly opening range highlighting a similar dynamic as the exchange rate failed to test the 2019 low (1.2952) during the first full week of January.

- The shift in USD/CAD behavior may persist in 2020 as the exchange rate breaks out of the range bound price action from the fourth quarter of 2019 and clears the October high (1.3383).

- With that said, the pullback from the yearly high (1.4667) unravels after filling the price gap from March, and the reversal from the March low (1.3315) may continue to evolve as USD/CAD carves an ascending channel, while the Relative Strength Index (RSI) breaks out of the bearish formation carried over from the previous month.

- Need a break/close above 1.3720 (78.6% expansion) to open up the Fibonacci overlap around 1.3810 (50% retracement) to 1.3830 (100% expansion), which largely lines up with the June high (1.3801), with the next area of interest coming in around 1.4010 (38.2% retracement) to 1.4040 (23.6% retracement).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong