EUR/USD Rate Talking Points

EUR/USDpares the decline from earlier this month as Germany and France push for a EUR500 billion recovery fund, but the exchange rate may trade within a more defined range if the recent rebound fails to trigger a test of the May high (1.1020).

EUR/USD Rate Forecast: Test of May High Looks Imminent

EUR/USD appears to have reversed course ahead of the April low (1.0727) even though the European Central Bank (ECB) “stands ready to adjust all of its instruments” as President Christine Lagarde insists that “the Franco-German proposals are ambitious, targeted and, of course, welcome.”

In a recent interview, President Lagarde emphasized that “the ECB has to ensure as much accommodation as needed to stabilise inflation and the economy,” but went onto say that the EUR540 billion stimulus package passed in April “is clearly insufficient to get the euro area economy going again” as the economic shock from COVID-19 pushes the monetary union into recession.

In turn, President Lagarde argues that the solution is “a European programme of rapid and robust fiscal stimulus to restore symmetry between the countries when they exit from the crisis,” and the comments suggest the Governing Council is in no rush to deploy more non-standard measures after unveiling the Pandemic Emergency Longer-Term Refinancing Operations (PELTROs) in April.

In turn, the ECB may merely buy time at its next meeting on June 4, but President Lagarde and Co. are likely to reiterate that “the Governing Council stands ready to adjust all of its instruments” as the pandemic pushes the central bank further away from achieving its one and only mandate for price stability.

With that said, the ECB’s dovish forward guidance for monetary policy may present headwinds for the Euro throughout 2020, but EUR/USD may trade within a more defined range in May if the recent rebound fails to trigger a test of the monthly high (1.1020).

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

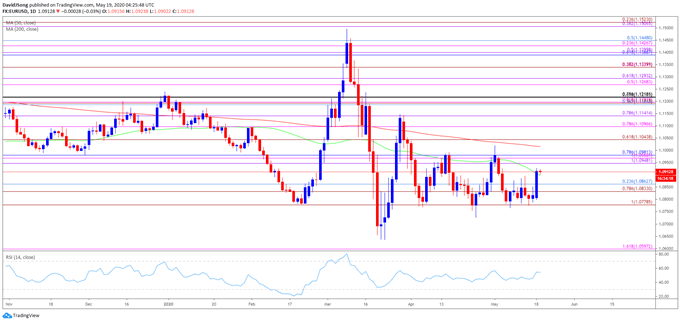

EUR/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the monthly opening range has been a key dynamic for EUR/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 1, with the high for November occurring during the first full week of the month, while the low for December happened on the first day of the month.

- The opening range for 2020 showed a similar scenario as EUR/USD marked the high of the month on January 2, with the exchange rate carving the February high during the first trading day of the month.

- However, the opening range for March was less relevant amid the pickup in volatility, with the pullback from the yearly high (1.1495) producing a break of the February low (1.0778) as the exchange rate slipped to a fresh 2020 low (1.0636).

- Nevertheless, EUR/USD may trade within a more defined range as the advance from the April low (1.0727) failed to produce a test of the April high (1.1039), and a similar scenario may take shape in May if the recent rebound fails to trigger a test of the monthly high (1.1020).

- Need a break/close above the Fibonacci overlap around 1.0950 (100% expansion) to 1.0980 (78.6% retracement) to bring the May high (1.1020) on the radar, with the next area of interest coming in around 1.1040 (61.8% expansion), which lines up with the April high (1.1039),

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong