Australian Dollar Talking Points

AUD/USD clears the April high (0.6570) following the limited reaction to the Reserve Bank of Australia (RBA) Minutes, and the exchange rate may attempt to test the March high (0.6685) as it carves a series of higher highs and lows.

AUD/USD Forecast: Break of May Range Brings March High on the Radar

AUD/USD extends the advance from earlier this week to tag a fresh monthly high (0.6585), and the Australian Dollar may continue to appreciate against its US counterpart as the RBA tames speculation for additional monetary support.

The RBA warns that “Australian GDP was expected to contract by around 10 per cent over the first half of 2020,” but went onto say that “under the baseline scenario, the economy was expected to begin recovering gradually over the second half of 2020.”

The RBA insists that “a recovery could be expected to start later in 2020, supported by both the large fiscal packages and the monetary policy response,” with the meeting minutes revealing that “members agreed that the Bank's policy package was working broadly as expected” as the central bank scales back its bond purchases.

In turn, “members assessed that the best course of action was to maintain the current policy settings and monitor economic and financial outcomes closely,” and the comments suggest the RBA will endorse a wait-and-see approach over the coming months as governments across Australia roll back the lockdown laws.

As a result, Governor Philip Lowe and Co. may continue to alter the forward guidance at the next meeting on June 2, but it remains to be seen if the unprecedented response by monetary and fiscal authorities will foster a V-shaped recovery as the stimulus programs like the Jobkeeper Payment is set to expire on September 27.

With that said, the threat of a protracted recovery may put pressure on the RBA to further support the Australian economy, and the Australia Dollar is likely to face headwinds if Governor Lowe and Co. revert back to a dovish forward guidance in the months ahead.

Nevertheless, the break above the April high (0.6570) may push AUD/USD towards the March high (0.6685) as it carves a series of higher highs and lows, but the exchange rate faces a key test as it approaches the former support zone around 0.6600 (50% expansion) to 0.6650 (61.8% expansion).

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

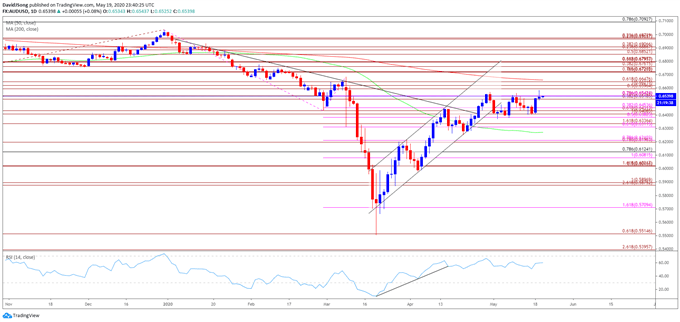

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the monthly opening range was a key dynamic for AUD/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 2, with the high for November occurring during the first full week of the month, while the low for December materialized on the first day of the month.

- The opening range for 2020 showed a similar scenario as AUD/USD marked the high of the month on January 2, with the exchange rate carving the February high during the first week of the month.

- However, the opening range for March was less relevant, with the high of the month occurring on the 9th, the same day as the flash crash.

- Nevertheless, the advance from the yearly low (0.5506) appears to have stalled ahead of the March high (0.6685) as AUD/USD finally snaps the upward trending channel, but the break above the April high (0.6570) may keep the exchange rate afloat as it carves a series of higher highs and lows.

- In turn, the March high (0.6685) is back on the radar amid the string of failed attempt break/close below the 0.6380 (50% expansion) to 0.6450 (38.2% expansion) region, but AUD/USD faces a key test as it approaches the former support zone around 0.6600 (50% expansion) to 0.6650 (61.8% expansion), which largely lines up with the 200-Day SMA (0.6661).

- Need a break/close above the 0.6600 (50% expansion) to 0.6650 (61.8% expansion) region to open up the Fibonacci overlap around 0.6720 (78.6% expansion) to 0.6800 (61.8% expansion), with the next area of interest coming in around 0.6850 (50% expansion) to 0.6910 (38.2% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong