Australian Dollar Talking Points

AUD/USD extends the rebound from earlier this week amid the wave of new measures announced by the Federal Reserve, and the exchange rate looks poised for a larger recovery as the Relative Strength Index (RSI) displays a textbook buy signal.

AUD/USD Rate Rebound in Focus as RSI Displays Buy Signal

AUD/USD extends the rebound from the yearly low (0.5506) as the Federal Open Market Committee (FOMC) launches three new credit facilities along with plans to purchase commercial mortgage-backed securities (CMBS), and the extraordinary efforts may generate a near-term correction in the exchange rate as Chairman Jerome Powell and Co. plan toestablish“a Main Street Business Lending Program to support lending to eligible small-and-medium sized businesses.”

The unprecedented response by the FOMC appears to be shoring up investor confidence as the S&P 500 notched its largest single day gain on a percentage basis since October 2008, and the wave of monetary/fiscal stimulus may continue to curb the flight to safety as major central banks keep the door open to deploy more unconventional tools to combat the weakening outlook for growth.

In turn, it remains to be seen if the Reserve Bank of Australia (RBA) will continue to push monetary policy into uncharted territory amid the growing number of COVID-19 cases, and a further depreciation in the Australian Dollar may force Governor Philip Lowe and Co. to intervene in the currency market as the central bank stands ready to “to support smooth market functioning when liquidity conditions are highly stressed.”

Nevertheless, the recent rebound in AUD/USD may encourage the RBA to retain the current policy at the next meeting on May 5, and the exchange rate may stage a larger rebound over the remainder of the month as the Relative Strength Index (RSI) displays a textbook buy signal.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

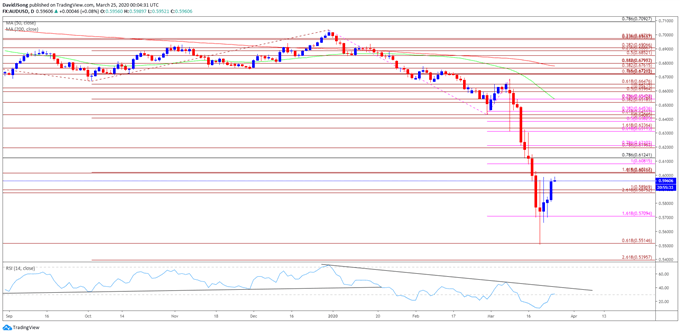

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the monthly opening range has been a key dynamic for AUD/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 2, with the high for November occurring during the first full week of the month, while the low for December materialized on the first day of the month.

- The opening range for 2020 showed a similar scenario as AUD/USD marked the high of the month on January 2, with the exchange rate carving the February high during the first week of the month.

- However, the opening range for March was less relevant, with the high of the month occurring on the 9th, the same day as the flash crash.

- With that said, recent price action raises the scope for a near-term rebound in AUD/USD starts to carve a series of higher highs and lows, with the Relative Strength Index (RSI) highlighting a similar dynamic as the oscillator bounces back from oversold territory and displays a textbook buy signal.

- Will keep a close eye on the RSI as it continues to track the downward trend from earlier this year, with a break of the bearish formation likely to be accompanied by a larger correction in AUD/USD.

- The close above the Fibonacci overlap around 0.5880 (261.8% expansion) to 0.5900 (100% expansion) brings the 0.6020 (61.8% expansion) region on the radar, with the next area of interest coming in around 0.6080 (100% expansion) to 0.6120 (78.6% retracement).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong