Australian Dollar Talking Points

AUD/USD extends the rebound from the yearly low (0.6434) even though the Reserve Bank of Australia (RBA) cuts the official cash rate (OCR) to a fresh record low of 0.50%, and the exchange rate may stage a larger rebound over the coming days as the bearish momentum abates.

AUD/USD Rate Rebound Pulls RSI Out of Oversold Territory

AUD/USD retraces the decline from the previous month after trading at its lowest level since 2009, and reaction to the RBA rate cut suggests the 25bp reduction was not enough for market participants to dump the Australian Dollar as the central bank states that the “Australian Government has also indicated that it will assist areas of the economy most affected by the coronavirus.”

It seems as though the RBA is in no rush to push the official cash rate (OCR) to the effective lower bound (ELB) of 0.25% even though the “Board is prepared to ease monetary policy further to support the Australian economy,” and it remains to be seen if Governor Philip Lowe and Co. will implement another rate cut at the next meeting on April 7 as “the Australian economy is expected to return to an improving trend” once COVID-19 is contained.

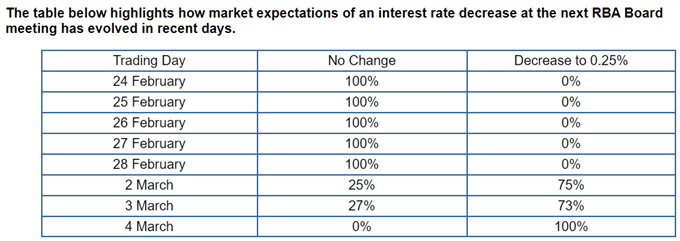

Expectations for a fiscal stimulus package may push the RBA to the sidelines as Treasurer Josh Frydenberg insists that the program “is going to have a 'b' in front of it,” but the ASX 30 Day Interbank Cash Rate Futures reflect a 100% probability for another 25bp rate cut as the central bank warns “GDP growth in the March quarter is likely to be noticeably weaker than earlier expected.”

With that said, the Australian Dollar may face headwinds ahead of the next RBA meeting, but recent price action raises the scope for a larger rebound in AUD/USD as the Relative Strength Index (RSI) bounces back from oversold territory and breaks out of the bearish formation from earlier this year.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

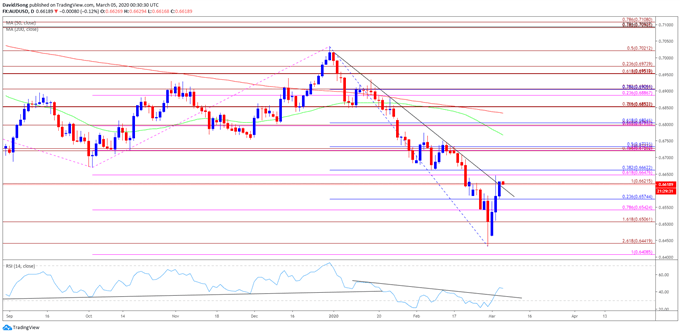

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the monthly opening range has been a key dynamic for AUD/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 2, with the high for November occurring during the first full week of the month, while the low for December materialized on the first day of the month.

- The opening range for 2020 showed a similar scenario as AUD/USD marked the high of the month on January 2, with the exchange rate carving the February high during the first week of the month.

- With that said, the opening range for March remains in focus, and the bearish momentum may continue to abate over the coming days as the Relative Strength Index (RSI) bounces back from oversold territory and snaps the bearish formation from earlier this month.

- The failed attempt to break/close below the 0.6410 (100% expansion) to 0.6440 (261.8% expansion) region has pushed AUD/USD back above the Fibonacci overlap around 0.6510 (161.8% expansion) to 0.6570 (23.6% retracement), but need a move above the 0.6620 (100% expansion) to 0.6660 (38.2% retracement) region to open up the overlap around 0.6720 (78.6% expansion) to 0.6730 (50% retracement).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong