Canadian Dollar Talking Points

USD/CAD struggles to retain the rebound from earlier this week as the Federal Reserve delivers an emergency 50bp rate cut ahead of its interest rate decision on March 18, but the exchange rate may continue to retrace the decline from the May high (1.3565) as a bull flag formation unfolds.

USD/CAD Levels to Watch Ahead of Bank of Canada (BoC) Meeting

The recent pullback in USD/CADmay prove to be short live amid the limited reaction to the Fed rate cut, and the exchange rate continue to exhibit a bullish behavior as the Bank of Canada (BoC) comes under pressure to reverse the rate hikes from 2018.

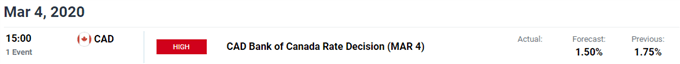

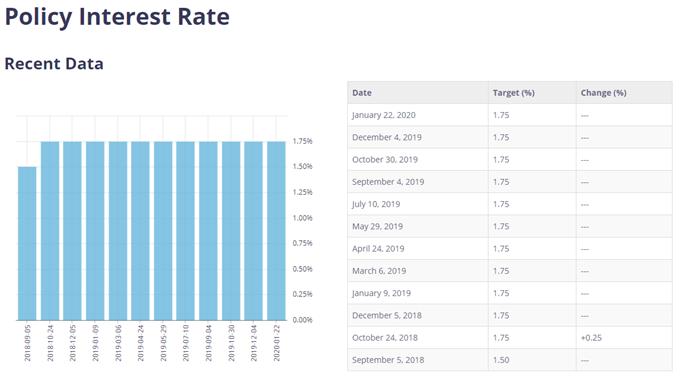

The BoC may follow its US counterpart and reduce the benchmark interest rate from its current level of 1.75% in an effort to insulate the Canadian economy from the coronavirus. At the same time, Governor Stephen Poloz and Co. may reveal a material change in the forward guidance for monetary policy as the outbreak continues to pose a threat to the global supply chain.

In turn, the BoC may embark on a rate easing cycle to combat the weakening outlook for growth, and a rate cut along with a batch of dovish rhetoric may produce headwinds for the Canadian Dollar as the central bank alters the course for monetary policy.

With that said, a broader shift in USD/CAD behavior may materialize over the near-term if the BoC shows a greater willingness to implement lower interest rates throughout 2020, and the exchange rate may continue to extend the advance from the 2020 low (1.2957) as a bull flag formation unfolds.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

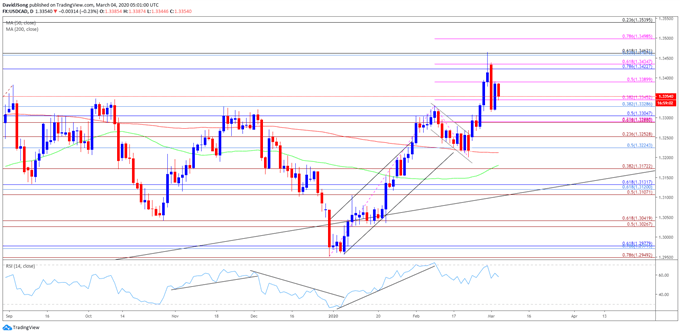

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, the near-term strength in USD/CAD emerged following the failed attempt to break/close belowthe Fibonacci overlap around 1.2950 (78.6% expansion) to 1.2980 (61.8% retracement), with the yearly opening range highlighting a similar dynamic as the exchange rate failed to test the 2019 low (1.2952) during the first full week of January.

- There appears to be shift in USD/CAD behavior as the exchange rate breaks out of the range from the fourth quarter of 2019 and clears the October high (1.3383).

- In turn, USD/CAD may continue to retrace the decline from the May high (1.3565) as the bull flag formation unfolds, but the bullish momentum appears to be abating as the Relative Strength Index (RSI) deviates with price and reverses course ahead of overbought territory.

- Lack of momentum to close above the Fibonacci overlap around 1.3420 (78.6% retracement) to 1.3430 (61.8% expansion) has pushed USD/CAD back below the 1.3390 (50% expansion) region, with the exchange rate stuck in a narrow range following the failed attempt to test the 1.3290 (61.8% expansion) to 1.3310 (50% retracement) region.

- Need a break/close above the Fibonacci overlap around 1.3420 (78.6% retracement) to 1.3430 (61.8% expansion) to bring the yearly high (1.3465) on the radar, which coincides with the 1.3460 (61.8% retracement) hurdle, with the next area of interest coming in around the 1.3500 (78.6% expansion) handle.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong