Australian Dollar Talking Points

AUD/USD bounces back from the yearly low (0.6434) ahead of the Reserve Bank of Australia (RBA) interest rate decision, but the weakening outlook for global growth may continue to drag on the exchange rate as COVID-19 poses a greater threat to the world economy.

AUD/USD Rate Rebound Vulnerable to Hints of Looming RBA Rate Cut

AUD/USD appears to have halted the decline from the start of the year as the RBA is expected to retain the current policy in March, and the exchange rate may stage a larger rebound over the coming days if the central bank tames speculation for lower interest rates.

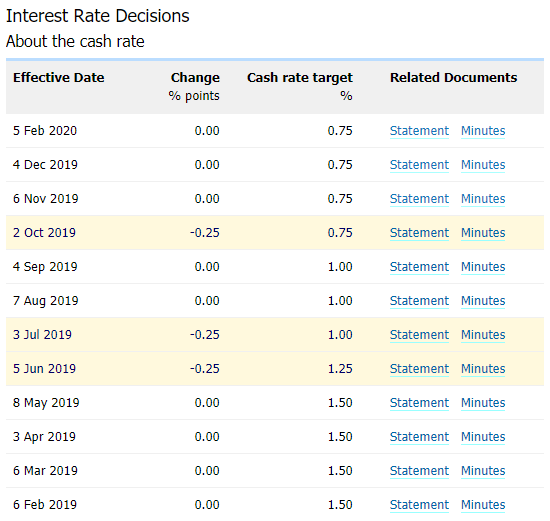

The RBA is seen keeping the official cash rate (OCR) at the record-low of 0.75% on March 3, while the update to the Gross Domestic Product (GDP) report is anticipated to show the Australian economy growing 2.0% during the last three months of 2019 after expanding 1.7% in the third quarter.

More of the same from the RBA along with an upbeat GDP print may fuel a larger rebound in AUD/USD as the central bank appears to be in no rush to revisit its rate easing cycle, and Governor Philip Lowe and Co. may merely attempt to buy time until its next meeting on April 7 amid “signs that the slowdown in global growth was coming to an end.”

However, the threat posed by the coronavirus may put pressure on the RBA to insulate the economy as data prints coming out of China, Australia’s largest trading partner, cast a dour outlook for the Asia/Pacific region.

China’s Manufacturing Purchasing Managers Index (PMI) tumbled to 35.7 from 50.0 in January to mark the lowest reading since the data series began in 2005, and the marked downturn in business sentiment may trigger a response by the RBA as the board remains “prepared to ease monetary policy further if needed.”

In turn, the RBA may show a greater willingness to implement lower interest rates in 2020, and hints of a looming rate cut may undermine the recent rebound in AUD/USD as the central bank prepares to abandon the wait-and-see approach as for monetary policy.

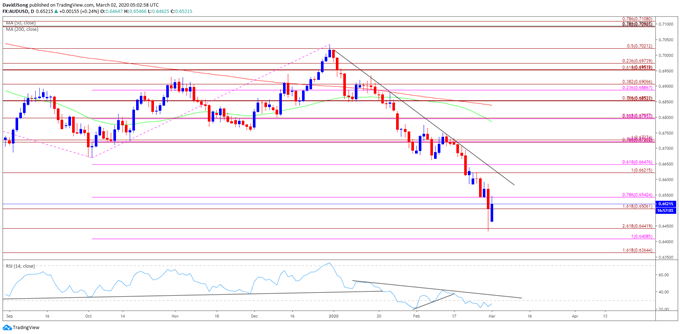

With that said, AUD/USD may continue to give back the correction from the 2008 low (0.6006), and the bearish momentum may gather pace over the coming days as the Relative Strength Index (RSI) sits in oversold territory.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the monthly opening range has been a key dynamic for AUD/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 2, with the high for November occurring during the first full week of the month, while the low for December materialized on the first day of the month.

- The opening range for 2020 showed a similar scenario as AUD/USD marked the high of the month on January 2, with the exchange rate carving the February high during the first week of the month.

- With that said, the opening range for March remains in focus, but the bearish momentum may gather pace over the coming days as Relative Strength Index (RSI) tracks the downward trend from earlier this year and sits in oversold territory.

- As a result, AUD/USD maycontinue to give back the correction from the 2008 low (0.6006), but need a break/close below the 0.6510 (161.8% expansion) to 0.6540 (78.6% expansion) region to open up the Fibonacci overlap around 0.6410 (100% expansion) to 0.6440 (261.8% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong