Canadian Dollar Talking Points

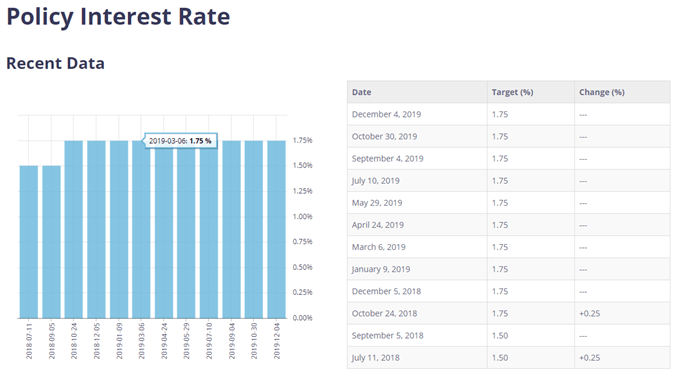

USD/CAD tracks the range bound price action from the previous week, but the Bank of Canada (BoC) interest rate decision may influence the exchange rate as the central bank remains reluctant to roll back the rate hikes from 2018.

USD/CAD Rate to Take Cues from Bank of Canada (BoC) Forward Guidance

USD/CAD is little changed from the previous week even though the BoC Business Outlook Survey (BOS)“continued to edge up after falling below zero in early 2019,” and the exchange rate may continue to consolidate as the BoC is widely expected to retain the current policy at its first meeting for 2020.

The improvement in business sentiment along with the 35.2K expansion in Canada Employment may encourage the BoC to retain a wait-and-see approach for monetary policy as Governor Stephen Poloz emphasizes that the “labour market has shown a healthy trend over the past year.”

In turn, the BoC may merely attempt to buy time on January 22 as officials “are watching for signs that adverse impacts of trade disputes are being felt beyond the export sectors,” but Governor Poloz and Co. may continue to tame speculation for lower interest rates as US lawmakers finally pass the United States-Mexico-Canada Agreement (USMCA).

Little to no indications of a looming rate cut may spark a bullish reaction in the Canadian Dollar as the BoC remains reluctant to reverse the rate hikes from 2018.

With that said, USD/CAD may exhibit a more bearish behavior this year as the exchange rate snaps the range bound price action from the second half of 2019.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

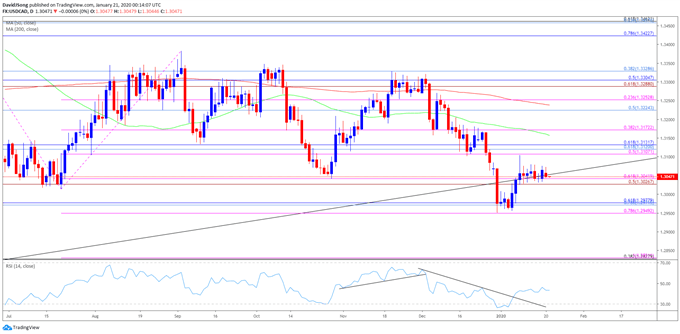

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, the USD/CAD rebound from the July low (1.3016) has failed to generate a test of the Fibonacci overlap around 1.3420 (78.6% retracement) to 1.3460 (61.8% retracement), with the exchange rate snapping the range bound price action from the second half of 2019.

- However, lack of momentum to break/close below the Fibonacci overlap around 1.2950 (78.6% expansion) to 1.2980 (61.8% retracement) has spurred a near-term rebound in USD/CAD, with the monthly opening range raising the scope for a larger recovery in USD/CAD as it fails to test the 2019 low (1.2952) during the first full week of January.

- The Relative Strength Index (RSI) highlights a similar dynamic as the oscillator bounces back from oversold territory and breaks out of the bearish formation carried over from the previous month.

- The move above the former support zone around 1.3030 (50% expansion) to 1.3040 (61.8% expansion) has pushed USD/CAD back towards the overlap around 1.3110 (50% expansion) to 1.3130 (61.8% retracement), but the exchange rate may continue to face range bound conditions as it fills the gap from late December.

- Need a break/close below the Fibonacci overlap around 1.3030 (50% expansion) to 1.3040 (61.8% expansion) to bring the 1.2950 (78.6% expansion) to 1.2980 (61.8% retracement) area back on the radar, with the next region of interest coming in around 1.2830 (38.2% retracement).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong