Australian Dollar Talking Points

AUD/USD continues to pare the rebound from the November low (0.6754), with the exchange rate carving a fresh series of lower highs and lows as the Trump administration appears to be on track to raise China tariffs on December 15.

AUD/USD Vulnerable to No Change in Fed Interest Rate Dot-Plot

AUD/USD extends the decline from earlier this week as the Director of the United States National Economic Council, Larry Kudlow, tames hopes for an imminent trade deal and warns that “the reality is that those tariffs are still on the table.”

It seems as though the US and China, Australia’s largest trading partner, will struggle to strike a deal ahead of 2020 as Commerce Secretary Wilbur Ross insists that as “every day that goes by, we are in a better negotiating position.”

The ongoing shift in US trade policy may continue to sway financial markets as the Trump administration remains reluctant to rollback tariffs, and it remains to be seen if the Federal Reserve will respond to the weakening outlook for global growth as the central bank is widely expected to retain the current policy at its last interest rate decision for 2019.

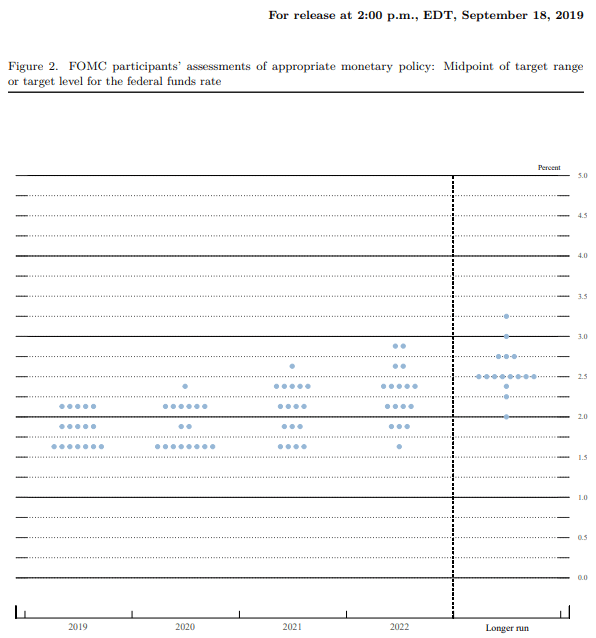

In turn, market participants are likely to pay increased attention to the forward guidance for monetary policy as Fed officials update the Summary of Economic Projections (SEP), and a downward revision in the interest rate dot-plot may produce a bearish reaction in the US Dollar as the central bank shows a greater willingness to reestablish its rate easing cycle in 2020.

However, the Federal Open Market Committee (FOMC) may merely attempt to buy time amid “tentative signs that trade tensions were easing,” and little to no changes in the SEP may keep AUD/USD under pressure as Chairman Jerome Powell and Co. appear to be in no rush to implement lower interest rates.

In turn, the Reserve Bank of Australia (RBA) may find it difficult to sit on the sidelines and the central bank may continue to strike a dovish tone at its next meeting on February 4 amid waning hopes for a US-China trade deal.

In response, Governor Philip Lowe and Co. may prepare Australian households and businesses for lower interest rates in 2020, and the diverging paths for monetary policy may drag on AUD/USD as the RBA remains “prepared to ease monetary policy further if needed.”

With that said, the Australian Dollar may underperform its US counterpart over the coming months, and the recent rebound in AUD/USD may prove to be short lived as the exchange rate carves a fresh string of lower highs and lows.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

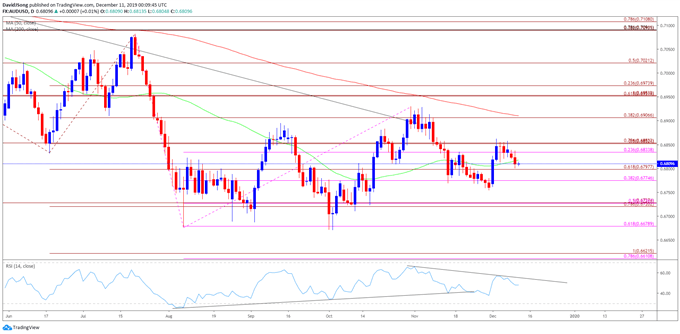

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the AUD/USD rebound following the currency market flash-crash has been capped by the 200-Day SMA (0.6911), with the exchange rate marking another failed attempt to break/close above the moving average in July.

- A similar scenario appears to have taken shape in November as the correction from the yearly low (0.6671) failed to trigger a test of the simple moving average, which largely lines up with the Fibonacci overlap around 0.6950 (61.8% expansion) to 0.6970 (23.6% expansion).

- The Relative Strength Index (RSI) highlights a similar dynamic as the oscillator snaps the upward trend from August and starts to carve a bearish formation.

- In turn, the reboundfrom the November low (0.6754) may prove to be short lived as AUD/USD initiates a fresh series of lower highs and lows.

- Lack of momentum to hold above the Fibonacci overlap around 0.6830 (23.6% expansion) to 0.6850 (78.6% expansion) brings the 0.6780 (38.2% expansion) to 0.6800 (61.8% expansion) region on the radar, with the next area of interest coming in around 0.6720 (78.6% expansion) to 0.6730 (50% expansion).

- Next downside hurdle comes in around 0.6680 (61.8% expansion), which lines up with the yearly low (0.6671).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.