EUR/USD Rate Talking Points

EUR/USD struggles to hold its ground ahead of the update to the US Consumer Price Index (CPI), and the exchange rate may continue to give back the rebound from the yearly-low (1.0879) as the Relative Strength Index (RSI) offers a bearish signal.

EUR/USD Analysis: RSI Offers Bearish Signal Ahead of Powell Testimony

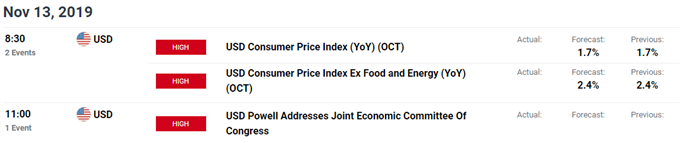

EUR/USD extends the decline from earlier this week, with the exchange rate at risk of exhibiting a more bearish behavior as consumer price growth in the US is anticipated to hold steady at 1.7% for the third consecutive month.

At the same time, the core CPI is anticipated to show a similar dynamic as the reading is projected to print at 2.4% in September. Signs of sticky price growth may spark a bullish reaction in the US Dollar as a growing number of Federal Reserve officials tame speculation for another rate cut in 2019.

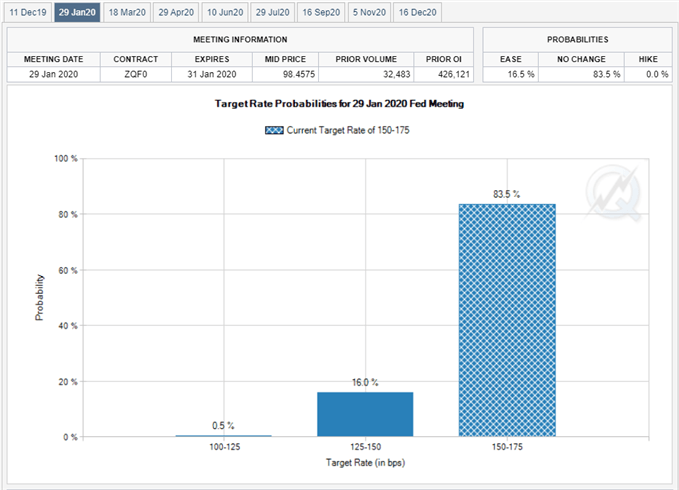

In fact, Philadelphia Fed President Patrick Harker, a Federal Open Market Committee (FOMC) voting-member in 2020, insists that the central bank should “stay put for now and see how things work out” after delivering three consecutive rate cuts this year. Mr. Harker went on to say that the current stance for monetary policy “might be slightly accommodative” even though US President Donald Trump argues that the Fed’s approach “puts us at a competitive disadvantage to other countries.”

The remarks suggest the Fed will keep the benchmark interest rate in its current threshold of 1.50% to 1.75% throughout the remainder of the year, withFed Fund futures reflecting a greater than 80% probability that the FOMC will stick to the sidelines at its first rate decision for 2020.

In turn, Chairman Jerome Powell may strike a similar tone in front of US lawmakers as the central bank head is scheduled to testify in front of the congressional Joint Economic Committee. A batch of less dovish comments may heighten the appeal of the US Dollar as the central bank moves away from its rate easing cycle.

With that said, EUR/USD may exhibit a more bearish behavior over the near-term especially as the European Central Bank (ECB) reestablishes its asset purchase program.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

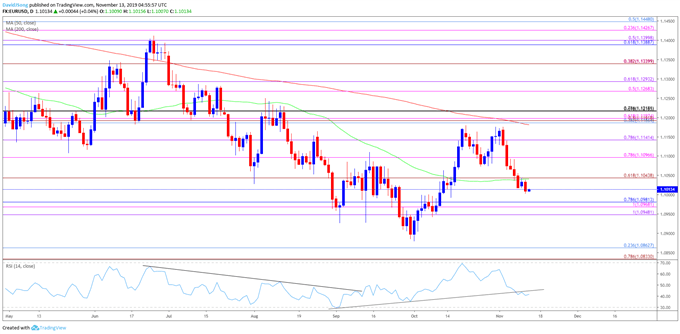

EUR/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the broader outlook for EUR/USD remains tilted to the downside as the exchange rate clears the May-low (1.1107) following the Federal Reserve rate cut in July, with Euro Dollar trading to a fresh yearly-low (1.0879) in October.

- The recent correction in EUR/USD appears to have run its course as the advance from the yearly-low (1.0879) fails to produce a test of the Fibonacci overlap around 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement)

- At the same time, the monthly opening range fosters a bearish outlook for EUR/USD amid the lack of momentum to test the October-high (1.1180).

- As a result, the break/close below 1.1040 (61.8% expansion) brings the 1.0950 (100% expansion) to 1.0980 (78.6% retracement) region on the radar, with the next area of interest coming in around 1.0830 (78.6% expansion) to 1.0860 (23.6% retracement).

- Moreover, the Relative Strength Index (RSI) offers a bearish signal as the oscillator snaps the upward trend from September.

For more in-depth analysis, check out the 4Q 2019 Forecast for Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other markets the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.