Gold Price Talking Points

The price of gold attempts to break out of the range-bound price action from the previous month, with the Relative Strength Index (RSI) highlighting a similar dynamic as data prints coming out of the US point to a slowing economy.

Gold Price Forecast: Bull Flag Takes Shape as RSI Breaks Out

The reaction to the 128K rise in US Non-Farm Payrolls was short lived, with the price of gold climbing to a session-high of $1516 as the ISM Manufacturing survey crossed the wires at 48.3 versus expectations for a 48.9 print.

The ongoing weakness in business sentiment may continue to heighten the appeal of gold as it puts pressure on the Federal Reserve to further insulate the economy. In response, the Federal Open Market Committee (FOMC) may continue to reverse the four rate hikes from 2018 as the central bank reiterates that “weakness in global growth and trade developments have weighed on the economy and pose ongoing risks.”

It remains to be seen if “phase one” of the US-China trade deal will be signed over the coming days asChile no longer plans to host the Asia-Pacific Economic Cooperation (APEC) meeting scheduled for November 15-16, and the FOMC may prepare US households and businesses for lower interest rates as Chairman Jerome Powell pledges to “respond accordingly” to the economic outlook.

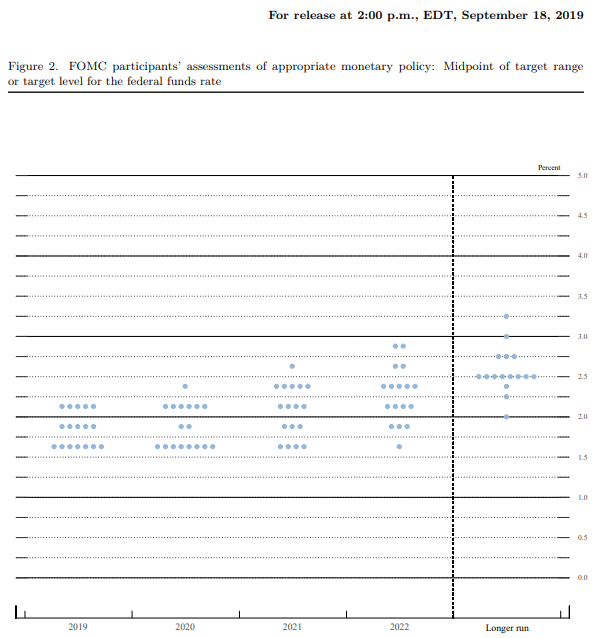

In turn, a growing number of Fed officials may project a lower trajectory for the benchmark interest rate when they update the Summary of Economic Projections (SEP) in December.

However, the dissent within the FOMC may fuel fears of a policy error as Kansas City Fed President Esther George and Boston Fed President Eric Rosengren preferred to keep the benchmark interest rate at 1.75% to 2.00% in October, while US President Donald Trump tweets that “the Fed has called it wrong from the beginning.”

As a result, falling interest rates along with signs of a global recession may heighten the appeal of gold as market participants look to hedge against fiat currencies.

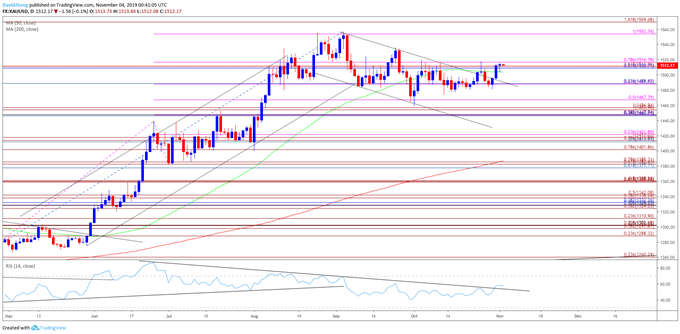

Keep in mind, the near-term outlook for gold remains mired by a Head-and-Shoulders formation, but a bullish Flag appears to be taking shape as the precious metal attempts to break out of the range bound price action carried over from the previous month..

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

Gold Price Daily Chart

Source: Trading View

- The broader outlook for gold prices remain constructive as both price and the Relative Strength Index (RSI) clear the bearish trends from earlier this year, with the precious metal trading to a fresh yearly-high ($1557) in September.

- At the same time, recent developments in the RSI suggest the near-term correction in gold is coming to an end as the oscillator finally breaks out of the downward trend carried over from June.

- A bull Flag formation has materialized amid the lack of momentum to test the Fibonacci overlap around $1447 (38.2% expansion) to $1457 (100% expansion), but need a break/close above the $1509 (61.8% retracement) to $1517 (78.6% expansion) region to bring the topside targets on the radar.

- First topside hurdle comes in around $1554 (100% expansion), which largely lines up with the yearly-high ($1557), followed by the $1570 (161.8% expansion) region.

For more in-depth analysis, check out the 4Q 2019 Forecast for Gold

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.