EUR/USD Rate Talking Points

EUR/USD struggles to hold its ground as attention turns to the European Central Bank (ECB) meeting on October 24, and recent price action raises the risk for a larger pullback as the exchange rate carves a fresh series of lower highs and lows.

EUR/USD Rate Initiates Lower Highs and Lows Ahead of ECB Meeting

EUR/USD pulls back from the monthly-high (1.1180) as the ECB’s most recent bank lending survey points out that “net demand for loans to enterprises remained broadly unchanged in the third quarter of 2019, in spite of expectations of an increase in the previous round.”

The update suggests economic activity in Europe may continue to fall short of the ECB’s projection as “incoming information since the Governing Council’s July monetary policy meeting indicated a more protracted weakness in the euro area economy than previously expected.”

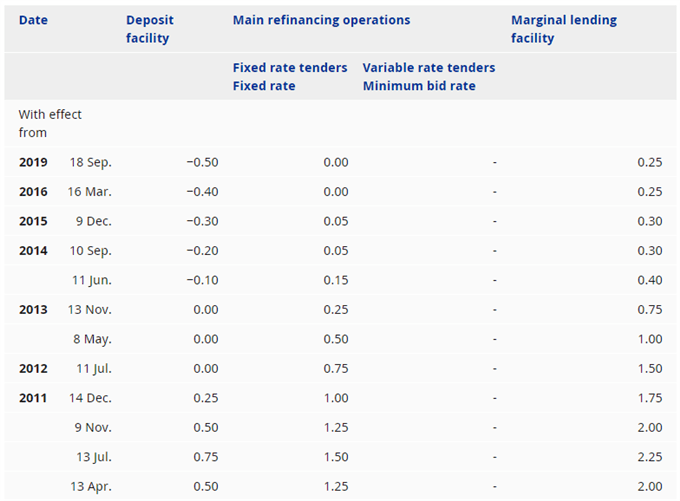

In turn, the ECB is likely to reiterate that the Governing Council stands ready to “adjust all of its instruments” at the last meeting with President Mario Draghi, but the central bank may lay out a greater case for European policymakers to shore up the monetary union as board member Francois Villeroy de Galhau argues that “all available instruments need to be mobilized, including fiscal policy, as a complement to monetary policy.”

With that said, the ECB is likely to emphasize that “governments with fiscal space should act in an effective and timely manner,” but it remains to be seen if the dovish forward guidance will influence the near-term outlook for EUR/USD as the central bank is widely expected to retain the current policy.

In fact, the ECB may merely attempt to buy more time as the central bank plans to reestablish its asset-purchase program in November, and the divide at the ECB may force incoming President Christine Lagarde to endorse a wait-and-see approach for monetary policy as the account of the September meeting reveals a range of different views within the Governing Council.

As a result, more of the same from the ECB may generate a limited reaction in EUR/USD, but the advance from the yearly-low (1.0879) may continue to unravel amid the failed attempt to test the August-high (1.1250).

At the same time, the bullish momentum appears to be abating as the Relative Strength Index (RSI) fails to push above 70, with the oscillator turning around ahead of overbought territory.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

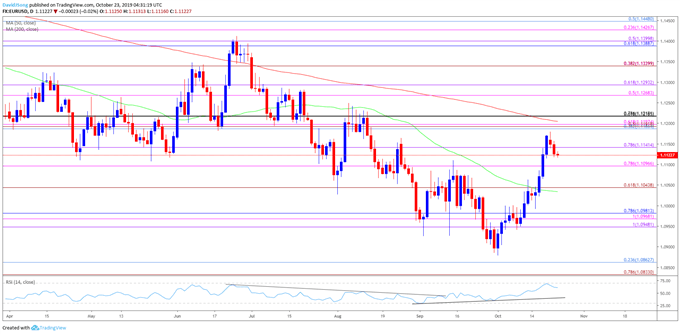

EUR/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the broader outlook for EUR/USD remains tilted to the downside as the exchange rate clears the May-low (1.1107) following the Federal Reserve rate cut in July, with Euro Dollar trading to a fresh yearly-low (1.0879) in October.

- The recent correction in EUR/USD appears to be losing steam as the advance from the start of the month fails to produce a test of the August-high (1.1250), with recent price action bringing the downside targets back on the radar as the exchange rate carves a fresh series of lower highs and lows.

- Lack of momentum to break/close above the Fibonacci overlap around 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement) may spur a move back towards the 1.1100 (78.6% expansion) handle, with the next area of interest coming in around 1.1040 (61.8% expansion).

- Will keep a close eye on the Relative Strength Index (RSI) as it continues to track the upward trend carried over from the previous month, but a break of trendline support may offer a bearish signal as the oscillator fails to push into overbought territory.

For more in-depth analysis, check out the 4Q 2019 Forecast for Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other markets the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.