EUR/USD Rate Talking Points

EUR/USD trades near the monthly-high (1.1063) despite the divide at the European Central Bank (ECB), and the exchange rate may make a run at the September-high (1.1110) as the Governing Council pushes for fiscal support.

EUR/USD Rate Eyes September High as ECB Pushes for Fiscal Support

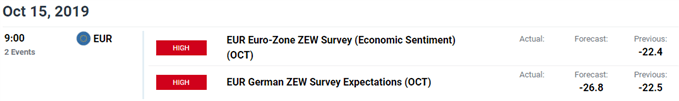

EUR/USD holds a narrow range ahead of the Euro-Zone ZEW survey, with the gauge for economic sentiment expected to fall to -26.4 from -22.5 in September.

It remains to be seen if the Governing Council will take additional steps to insulate the monetary union as the account of the September meeting reveals a range of different views, with several members arguing that “the baseline scenario in the latest ECB staff projections was still too optimistic,” while “a number of members assessed the case for renewed net asset purchases as not sufficiently strong.”

The mixed rhetoric suggests the ECB will move to the sidelines at the next meeting on October 24, and the central bank may largely endorse a wait-and-see approach after delivering the monetary stimulus package in September as Governing Council officials emphasize that “governments with fiscal space should act in an effective and timely manner.”

The comments largely align with a recent speech by President Mario Draghi, where the central bank head insists that “other policy areas could help us to do our job more quickly and effectively.”

It seems as though the ECB will call on European lawmakers to do more to support the Euro area economy, but the Governing Council may continue to endorse a dovish forward guidance as officials reiterate that the central bank “continues to stand ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner.”

In turn, the ECB’s reliance on non-standard measures casts a bearish outlook for the Euro, but EUR/USD appears to be on track to test the September-high (1.1110) as the Relative Strength Index (RSI) preserves the bullish formation carried over from the previous month.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

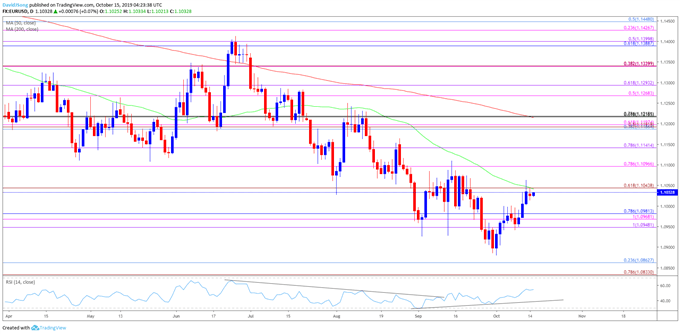

EUR/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the broader outlook for EUR/USD remains tilted to the downside as the exchange rate clears the May-low (1.1107) following the Federal Reserve rate cut in July, with Euro Dollar trading to a fresh yearly-low (1.0879) in October.

- However, recent price action warns of a larger correction as EUR/USD breaks out of the monthly opening range, with the close above the Fibonacci overlap around 1.0950 (100% expansion) to 1.0980 (78.6% retracement) keeping the topside targets on the radar.

- Need a break/close above 1.1040 (61.8% expansion) to bring the 1.1100 (78.6% expansion) handle on the radar, with a move above the September-high (1.1110) opening up the 1.1140 (78.6% expansion) region.

For more in-depth analysis, check out the 4Q 2019 Forecast for Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other markets the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.