British Pound Talking Points

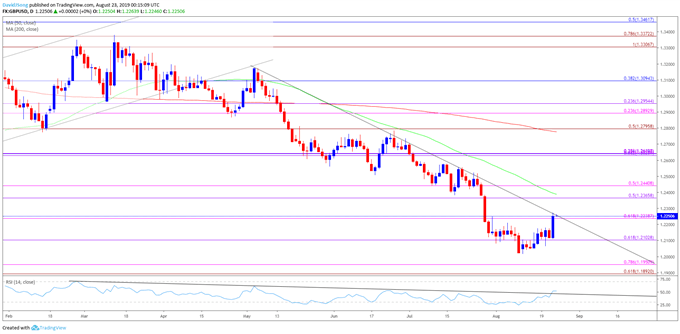

GBPUSD breaks out of the range-bound price action from earlier this month, with recent developments in the Relative Strength Index (RSI) foreshadowing a larger correction in the exchange rate as the oscillator snaps the bearish trend from earlier this year.

GBPUSD Rate Forecast: RSI Offers Bullish Signal for British Pound

GBPUSD rallies to a fresh monthly-high (1.2273) as UK Prime Minister Boris Johnson meets with French President Emmanuel Macron as well as German Chancellor Angela Merkel to renegotiate the Brexit deal, but it remains to be seen if a compromise will be reached with less than 70 days until the October 31 deadline.

The lingering threat of a no-deal Brexit may become a growing concern for the Bank of England (BoE) as the central bank has 1 meeting left before the UK departs the European Union (EU), and the central bank may come under pressure to alter the forward guidance at the next interest rate decision on September 19 as “increased uncertainty about the nature of EU withdrawal means that the economy could follow a wide range of paths over coming years.”

In turn, the Monetary Policy Committee (MPC) may draw up a contingency plan to a no-deal Brexit as “underlying growth appears to have slowed since 2018 to a rate below potential,” and a batch of dovish comments is likely to produce headwinds for the British Pound as it fuels speculation for lower interest rates.

On the other hand, more of the same from the BoE may heighten the appeal of the British Pound asGovernor Mark Carney and Co. still insist that “increases in interest rates, at a gradual pace and to a limited extent, would be appropriate to return inflation sustainably to the 2% target,” but retail positions remains skewed going into the last full week of August even though GBPUSD continues to track the bearish trend from earlier this year.

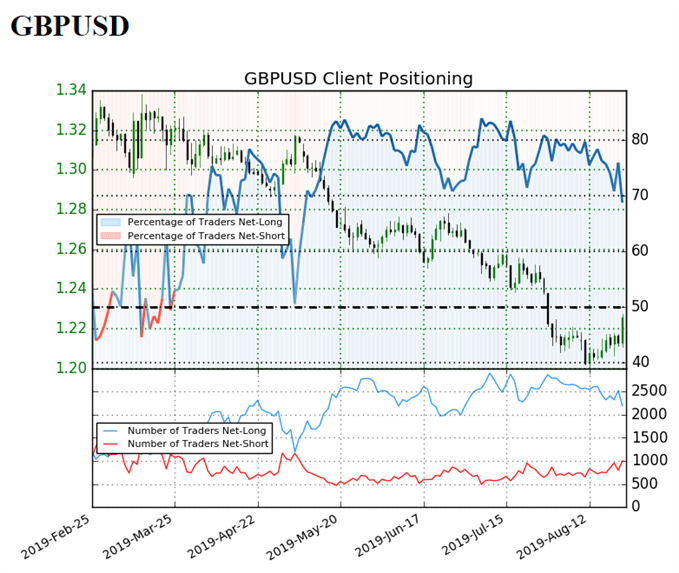

The IG Client Sentiment Report shows 68.7% of traders are still net-long GBPUSD compared to 74.3% earlier this week, with the ratio of traders long to short at 2.2 to 1.

In fact, traders have remained net-long since May 6 when GBPUSD traded near the 1.3100 handle even though price has moved 6.5% lower since then.The number of traders net-long is 12.7% lower than yesterday and 11.9% lower from last week, while the number of traders net-short is 12.1% higher than yesterday and 22.0% higher from last week.

The ongoing drop in net-long position is indicative of profit-taking behavior amid the recent rebound in GBPUSD, but the persistent tilt in retail interest offers a contrarian view to crowd sentiment as the exchange rate continues to track the bearish trend from earlier this year.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

GBP/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the broader outlook for GBP/USD is no longer constructive as the exchange rate snaps the upward trend from late last year after failing to close above the Fibonacci overlap around 1.3310 (100% expansion) to 1.3370 (78.6% expansion).

- However, recent developments in the Relative Strength Index (RSI) foreshadows a larger correction in GBPUSD as the oscillator bounces back from oversold territory and breaks out of the bearish formation from earlier this year.

- In turn, GBPUSD may highlight a similar dynamic as it comes up against trendline resistance, with the move above break/close above the 1.2240 (61.8% expansion) region bringing the former support zone around 1.2370 (50% expansion) to 1.2440 (50% expansion) on the radar.

- Next area of interest comes in around 1.2630 (38.2% expansion) to 1.2640 (38.2% expansion) followed by the 1.2800 (50% expansion) handle.

For more in-depth analysis, check out the 3Q 2019 Forecast for the British Pound

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.