Australian Dollar Talking Points

AUDUSD trades in a narrow range following the Reserve Bank of Australia (RBA) Minutes, and the exchange rate may continue to consolidate over the remainder of the week as attention turns to the Kansas City Fed Economic Symposium in Jackson Hole, Wyoming.

AUDUSD Monthly Range on Radar Ahead of Fed Economic Symposium

The RBA Minutes failed to generated a meaningful reaction in AUDUSD even though the central bank keeps the door open to implement lower interest rates, and it seems as though the central bank will continue to endorse a dovish forward guidance as “members would consider a further easing of monetary policy if the accumulation of additional evidence suggested this was needed to support sustainable growth in the economy.”

In contrast, recent remarks from Boston Fed President Eric Rosengren, a 2019-voting member on the Federal Open Market Committee (FOMC), suggest the Federal Reserve is in no rush to embark on a rate easing cycle as the official insists that the central bank needs “to be careful not to ease too much when we don’t have significant problems.”

At the same time, San Francisco Fed President Mary Daly asserts that there’s little evidence of a looming recession as “the labor market is strong, consumer confidence is high, and consumer spending is healthy,” but the ongoing shift in US trade policy may spur a growing rift within the FOMC as the committee comes under pressure to reverse the four rate hikes from 2018.

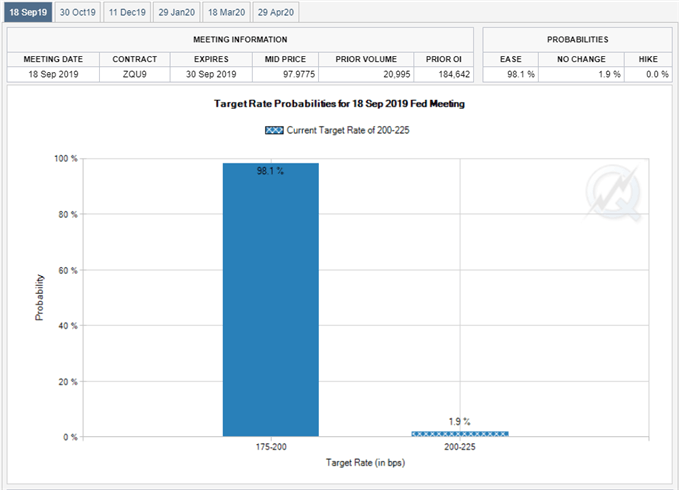

In fact, Fed Fund futures still highlight nearly a 100% probability for a 25bp reduction on September 18, and it remains to be seen if FOMC officials will make a major announcement ahead of the next meeting as Chairman Jerome Powell is scheduled to speak at the economic symposium.

In turn, the monthly range sits on the radar for AUDUSD, but the Australian dollar remains at risk of facing additional headwinds ahead of the next RBA meeting on September 3 as Governor Philip Lowe & Co. stand ready to further insulate the economy.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

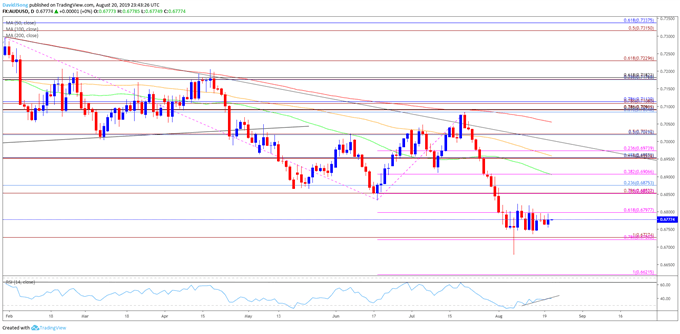

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the AUDUSD rebound following the currency market flash-crash has been capped by the 200-Day SMA (0.7055), with the exchange rate marking another failed attempt to break/close above the moving average in July.

- With that said, the broader outlook for AUDUSD remains tilted to the downsideas both price and the Relative Strength Index (RSI) continue to track the bearish formations from late last year.

- However, the string of failed attempts to close below the Fibonacci overlap around 0.6720 (78.6% expansion) to 0.6730 (100% expansion) raises the risk for a larger rebound especially as the RSI bounces back from oversold territory.

- Need a break/close above the 0.6800 (61.8% expansion) handle to bring the former-support zone around 0.6850 (78.6% expansion) to 0.6880 (23.6% retracement) on the radar, with the next area of interest coming in around 0.6910 (38.2% expansion).

- Will keep a close eye on the RSI as the oscillator starts to threaten the bullish formation carried over from the previous week.

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.