EUR/USD Rate Talking Points

EURUSD snaps the range bound price action from earlier this week even though US President Donald Trump tweets that the Federal Reserve is “too slow to cut,” and the exchange rate may continue to consolidate over the coming days as the Federal Open Market Committee (FOMC) tames speculation for a rate easing cycle.

EURUSD Rebound Unravels as Fed Tames Bets for Rate Easing Cycle

Fresh data prints coming out of the euro-area generated a limited reaction in EURUSD, but the updates to the Gross Domestic Product (GDP) report should keep the European Central Bank (ECB) on the sidelines as the growth rate climbs 0.2% q/q in the second quarter of 2019.

In contrast, the Federal Reserve may come under increased pressure to implement lower interest rates as President Trump insists that “the Fed is holding us back,” and it remains to be seen if the FOMC will reverse the four rate hikes from 2018 as the commander in chief goes on to say that “our economy is strong.”

However, fresh remarks from St. Louis Fed President James Bullard, a 2019 voting member on the FOMC, suggests the central bank is in no rush to implement a rate easing cycle as “macroeconomic outcomes are quite good for the United States.”

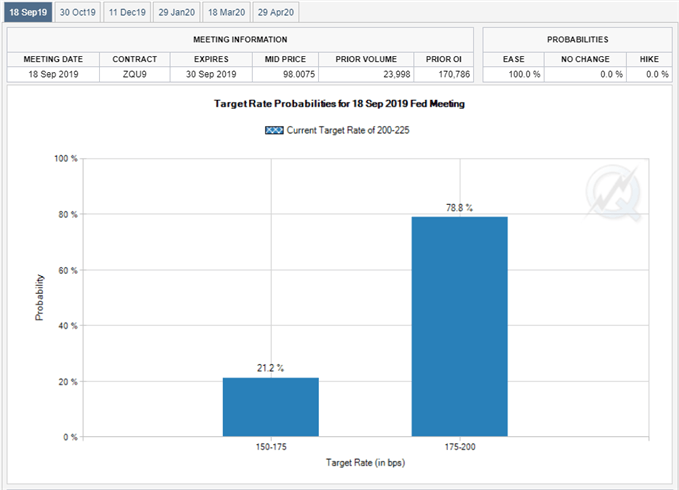

Keep in mind, Fed Fund futures still reflect a 100% probability for at least a 25bp reduction on September 18, but Fed officials may continue to tame bets for a rate easing cycle as “the economy’s not in recession.”

In turn, the FOMC may attempt to buy more time as the Trump administration delays a portion of the next tranche of China tariffs to December 15, and the central bank may largely endorse a wait-and-see approach ahead of the next meeting as Mr. Bullard argues that “it’s actually a good time to do strategic thinking for the future.”

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

EUR/USD Rate Daily Chart

- The broader outlook for EURUSD is clouded with mixed signals as the exchange rate clears the May-low (1.1107) following the FOMC rate cut in July, with the 1.1100 (78.6% expansion) handle no longer offering support.

- The Relative Strength Index (RSI) highlights a similar dynamic as the oscillator fails to retain the bullish formation from earlier this year.

- At the same time, the rebound from the monthly-low (1.1027) appears to have stalled following the string of failed attempts to close above the Fibonacci overlap around 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement).

- Lack of momentum to hold above the 1.1140 (78.6% expansion) region raises the risk for a move towards the 1.1100 (78.6% expansion) handle, with the next area of interest coming in around 1.1040 (61.8% expansion).

For more in-depth analysis, check out the 3Q 2019 Forecast for Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other markets the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.