Australian Dollar Talking Points

AUDUSD holds a narrow range ahead of the semi-annual testimony with Federal Reserve Chairman Jerome Powell, but the monthly opening range undermines the recent rebound in the exchange rate as the advance from the June-low (0.6832) fails to spur a test of the May-high (0.7061).

AUDUSD Rate Outlook Mired by Failed Attempt to Test May High

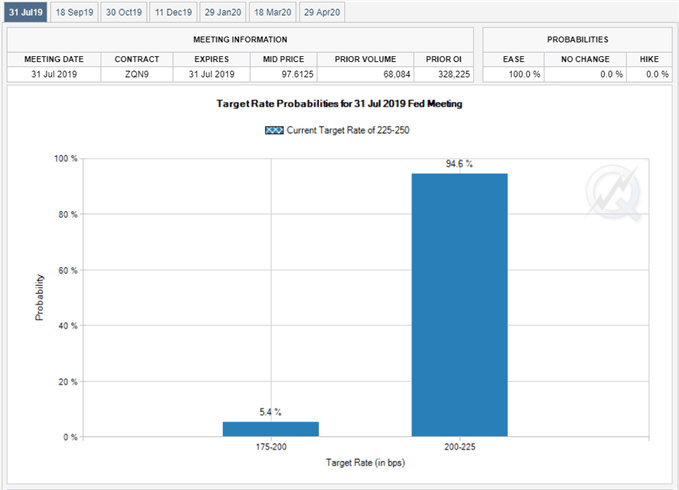

AUDUSD consolidates following the US Non-Farm Payrolls (NFP) report as the above-forecast print suggests the Federal Reserve will deliver an “insurance cut” at the next interest rate decision on July 31.

The Federal Open Market Committee (FOMC) is widely expected to insulate the US economy as the “apparent progress on trade turned to greater uncertainty,” but the central bank appears to be in no rush to implement a rate easing cycle as “many labor market indicators remain strong.”

In turn, Chairman Powell may strike a more balanced tone in front of US lawmakers as the economy shows little signs of a looming recession, and a batch of less dovish comments may keep AUDUSD under pressure as Fed Fund futures reflect narrowing bets for a 50bp rate cut.

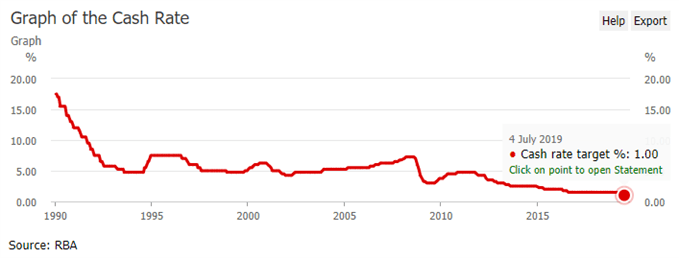

In contrast, fresh data prints coming out of Australia may do little to influence the monetary policy outlook as the Reserve Bank of Australia (RBA) keeps the door open to further support the economy and pledges to “adjust monetary policy if needed.”

In turn, AUDUSD may show a limited reaction to the NAB Business Confidence survey as Governor Philip Lowe and Co. endorse a dovish forward guidance, and the RBA may continue to push the official cash rate to fresh record lows in 2019 as the US and China, Australia’s largest trading partner, struggle to reach a deal.

With that said, current market conditions may drag on AUDUSD, and the exchange rate stands at risk of exhibiting a more bearish behavior over the coming days as the advance from the June-low (0.6832) sputters ahead of the May-high (0.7061).

Keep in mind, the AUDUSD rebound following the currency market flash-crash has been capped by the 200-Day SMA (0.7094), with the exchange rate marking another failed attempt to break/close above the moving average in April.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

AUD/USD Rate Daily Chart

- The broader outlook for AUDUSD remains tilted to the downside, with the exchange rate still at risk of giving back the rebound from the 2019-low (0.6745) as the wedge/triangle formation in both price and the Relative Strength Index (RSI) unravels.

- More recently, the advance from June-low (0.6832) appears to have stalled ahead of the May-high (0.7061), with a break/close below the 0.6950 (61.8% expansion) to 0.6960 (38.2% retracement) region bringing the downside targets back on the radar.

- First area of interest comes in around 0.6850 (78.6% expansion) to 0.6880 (23.6% retracement) followed by the 0.6730 (100% expansion) region.

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.