Euro Rate Talking Points

EUR/USD fails to break the monthly opening range despite the growing threat of a US-China trade war, and the exchange rate may continue to consolidate over the coming days as it carves a fresh series of lower highs & lows.

EURUSD Carves Bearish Series Amid Failure to Break May Opening Range

EUR/USD pares the advance from the monthly-low (1.1135) even though the shift in U.S. trade policy undermines the outlook for global growth, and the greenback may continue to appreciate over the coming days as Federal Reserve officials show little to no interest in adjusting the forward-guidance for monetary policy.

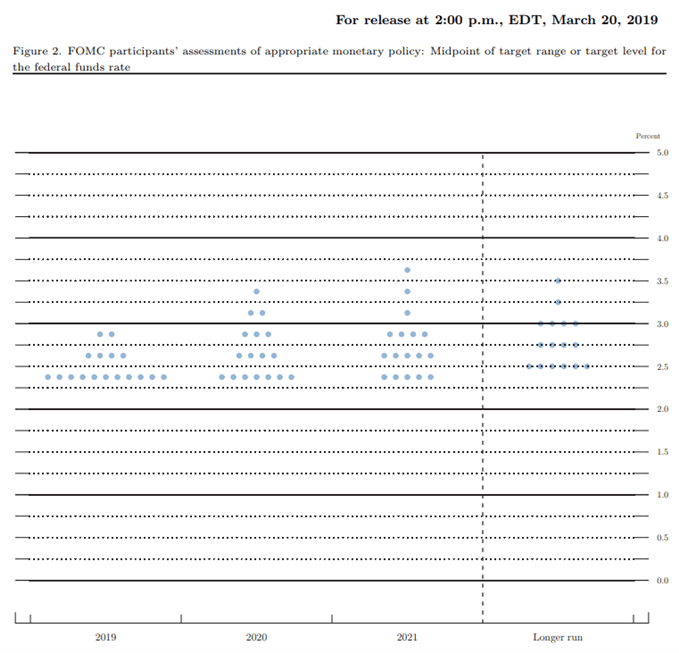

Recent remarks from Kansas City Fed President Esther George, a 2019-voting member on the Federal Open Market Committee (FOMC), suggest the central bank will stick to the sidelines as ‘thecurrent benign inflation outlook gives us the opportunity to test our assumptions about the degree of slack in the economy,’ and Chairman Jerome Powell & Co. may largely endorse a wait-and-see approach at the next interest rate decision on June 19 as the U.S. economy sits at full-employment.

It seems as though the FOMC will continue to tolerate below-target inflation as the central bank plans to wind down the $50B/month in quantitative tightening (QT) over the coming months, and the committee appears to be in no rush to alter the outlook for monetary policy especially as the Trump administration struggles to reach a trade deal with China. With that said, it remains to be seen if Fed officials will continue to project a longer-run interest rate of 2.50% to 2.75% as the central bank is slated to update the Summary of Economic Projections (SEP), and more of the same from Chairman Powell & Co. may ultimately heighten the appeal of the U.S. dollar as it undermines speculation for a change in regime.

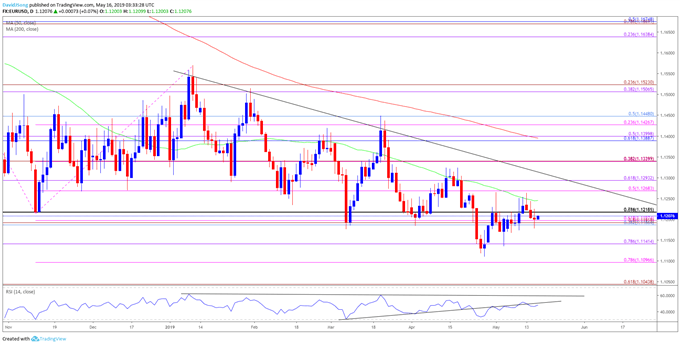

Keep in mind, the broader outlook for EUR/USD remains tilted to the downside as both price and the Relative Strength Index (RSI) continue to track the bearish formations from earlier this year, with the near-term outlook mired by the failed attempt to break out of the monthly opening range.

EUR/USD Rate Daily Chart

- The failed attempt to push back above the Fibonacci overlap around 1.1270 (50% expansion) to 1.1290 (61.8% expansion) may keep EUR/USD under pressure, with the monthly opening range on the radar as the exchange rate struggles to hold above the 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement) region.

- The fresh series of lower highs & lows may spur a move towards 1.1140 (78.6% expansion), with the next area of interest coming in around the 1.1100 (78.6% expansion) handle followed by the 1.1040 (61.8% expansion) region.

Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss key market themes along with potential trade setups.

For more in-depth analysis, check out the 2Q 2019 Forecast for EUR/USD

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.