Australian Dollar Talking Points

AUD/USD holds a narrow range following the Reserve Bank of Australia (RBA) meeting, but key developments surrounding the Asia/Pacific region may influence the near-term outlook for the aussie-dollar exchange rate as the U.S. and China, Australia’s largest trading partner, struggle to reach a trade agreement.

AUDUSD Rate Outlook Mired by Monthly Opening Range, Dovish RBA

AUD/USD extends the range-bound price action from the previous week, with the RBA interest rate decision doing little to alter the near-term outlook for the Australian dollar as the central bank sticks to the sidelines ahead of the Federal election on May 18.

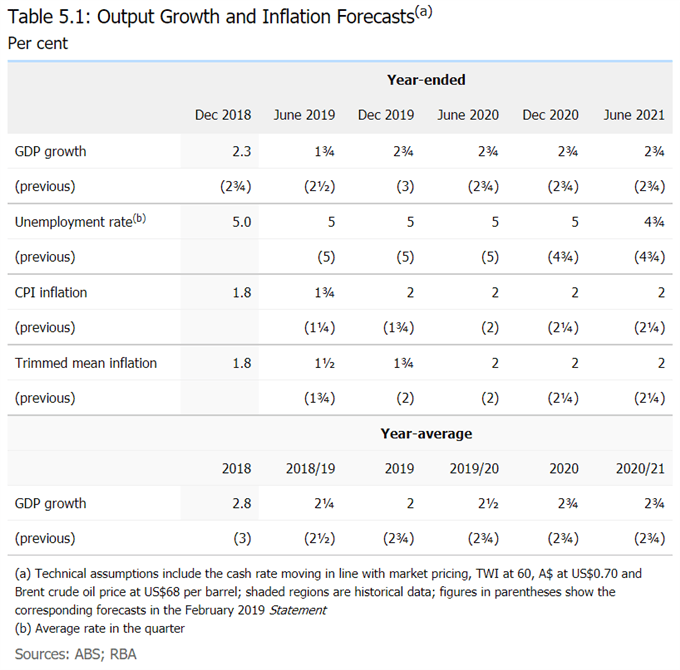

However, recent comments coming out of the RBA suggest the central bank will take additional steps to insulate the region as ‘inflation data for the March quarter were noticeably lower than expected and suggest subdued inflationary pressures across much of the economy.’

In turn, Governor Philip Lowe & Co. may prepare Australian households and businesses for an imminent rate-cut as ‘a further improvement in the labour market was likely to be needed for inflation to be consistent with the target,’ and the threat of below-target price growth may push the RBA to reestablish its easing-cycle as ‘the ongoing subdued rate of inflation suggests that a lower rate of unemployment is achievable.’

With that said, updates to Australia’s Employment report may impact the near-term outlook for AUD/USD as the economy is anticipated to add 15.0K jobs in April, while the Unemployment Rate is expected to hold steady at 5.0% for the second month. A positive development should prop up the Australian dollar as it dampens bets for an RBA rate-cut, but a batch of lackluster data prints may drag on AUD/USD as it boosts speculation for lower interest rates.

It remains to be seen if a reduction in the official cash rate (OCR) will spur a further improvement in the labor market as the jobless rate sits at its lowest level since 2012, but AUD/USD stands at risk of facing a more bearish fate following the RBA meeting as the dovish-hold fails to spur a break of the monthly opening range.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

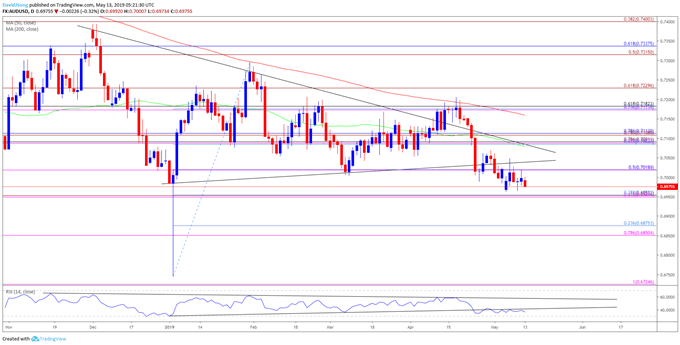

AUD/USD Rate Daily Chart

- Keep in mind, the AUD/USD rebound following the currency market flash-crash has been capped by the 200-Day SMA (0.7160), with the exchange rate marking another failed attempt to break/close above the moving average in April.

- In turn, AUD/USD may continue to give back the rebound from the 2019-low (0.6745) as the wedge/triangle formation in both price and the Relative Strength Index (RSI) unravels, with the monthly opening range in focus as the exchange struggles to push back above the 0.7020 (50% expansion) pivot.

- Need a break/close below 0.6850 (78.6% expansion) to open up the Fibonacci overlap around 0.6850 (78.6% expansion) to 0.6880 (23.6% retracement), with the next area of interest coming in around 0.6730 (100% expansion).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.