Canadian Dollar Talking Points

USD/CAD extends the decline from earlier this week even though U.S. Durable Goods Orders unexpectedly climb 0.4% in January, and recent price action keeps the downside targets on the radar as the exchange rate continues to carve a string of lower highs & lows.

USD/CAD Extends Bearish Series, RSI Comes Up Against Trendline Support

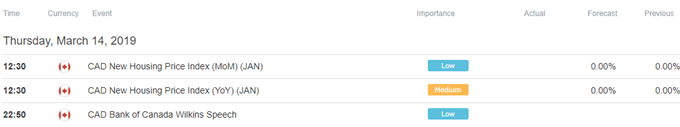

The USD/CAD rally following the Bank of Canada (BoC) meeting continues to unravel as recent data prints coming out of the U.S. economy do little to alter the monetary policy outlook, and recent pullback in the exchange rate may continue to unfold over the next 24-hours of trade as the economic docket remains fairly light for the remainder of the week.

In turn, USD/CAD may continue to consolidate ahead of the Federal Reserve interest rate decision on March 20 as the central bank is widely expected to keep the benchmark interest rate in its current range of 2.25% to 2.50%, and the wait-and-see approach by both the BoC and the Federal Open Market Committee (FOMC) may foster range-bound conditions for the dollar-loonie exchange rate amid the shift in forward-guidance.

Recent comments from BoC Governor Lynn Patterson suggest the central bank will continue to change its tune at the next meeting on April 24 as ‘it now appears the economy will be weaker in the first half of 2019 than we had projected in January,’ and Governor Stephen Poloz & Co. may ultimately follow its U.S. counterpart and look to abandon the hiking-cycle as ‘it will take time to gauge the persistence of below-potential growth.’ With that said, similar comments from Senior Deputy Governor Carolyn Wilkins may rattle the recent strength in the Canadian dollar, and the broader outlook for USD/CAD remains constructive following the break of the June-high (1.3386) as the exchange rate stages a near-term breakout after bouncing along the 200-Day SMA (1.3137).

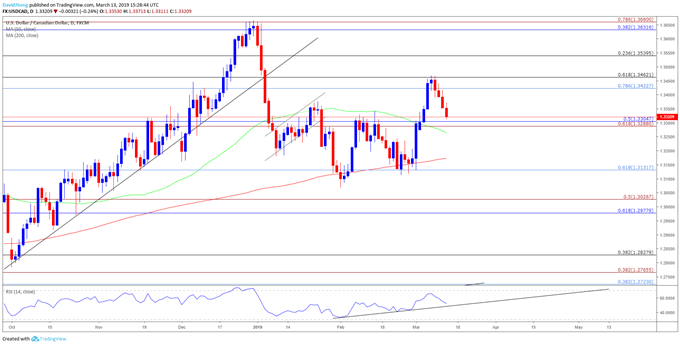

However, recent price action raises the risk for a larger pullback as USD/CAD extends the string of lower highs & lows from earlier this week, with the Relative Strength Index (RSI) at risk of flashing a bearish trigger as it comes up against trendline support. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

USD/CAD Daily Chart

- The USD/CAD advance from the monthly-low (1.3130) may continue to unravel amid the failed attempt to close above the Fibonacci overlap around 1.3420 (78.6% retracement) to 1.3460 (61.8% retracement).

- In turn, a break/close below the 1.3290 (61.8% expansion) to 1.3310 (50% retracement) region raises the risk for a move back towards 1.3130 (61.8% retracement), with the 2019-low (1.3068) up next on the radar.

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.