Japanese Yen Talking Points

USD/JPY extends the advance following the U.S. Gross Domestic Product (GDP) report, with the exchange rate climbing to a fresh 2019-high (111.98), and the correction following the currency market flash-crash may continue to evolve as the exchange rate carves a fresh series of higher highs & lows.

USD/JPY Carves Bullish Series Even as ISM Manufacturing Disappoints

USD/JPY remains bid even though the ISM Manufacturing survey falls short of expectations in February, with the index narrowing to 54.2 from 56.6 the month prior, and the dollar may continue to benefit from signs of sticky price growth as the core Personal Consumption Expenditure (PCE), the Federal Reserve’s preferred gauge for inflation, holds steady at 1.9% per annum for the second consecutive month.

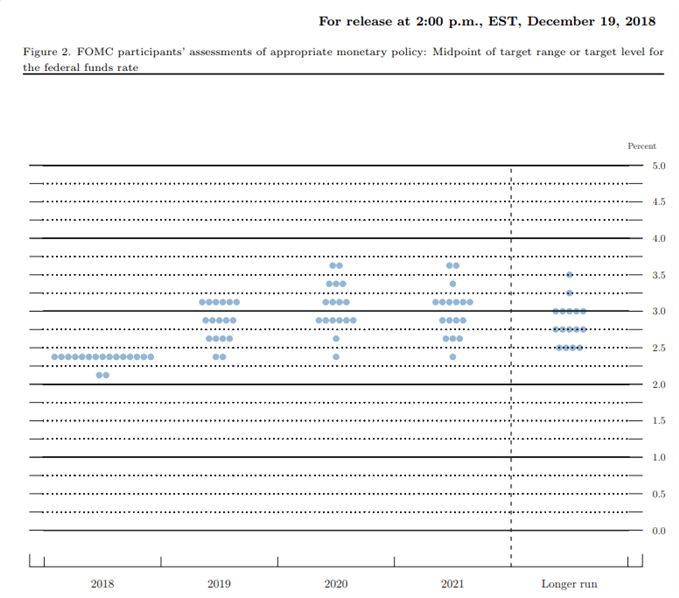

Keep in mind, recent remarks from Chairman Jerome Powell suggest the Federal Open Market Committee (FOMC) will retain the current policy at the next interest rate decision on March 20 as ‘crosscurrents and conflicting signals’ cloud the economic outlook, and the central bank appears to be on track to taper the $50B/month in quantitative tightening (QT) over the coming months as the central bank head indicates that ‘the Committee can now evaluate the appropriate timing and approach for the end of balance sheet runoff.’

With that said, it remains to be seen if Fed officials will adjust the Summary of Economic Projections (SEP) as Chairman Powell warns of ‘muted’ inflation pressures, but the FOMC may have a difficult time in defending the shift in forward-guidance as the central bank pledges to be ‘data dependent.’ In turn, positive data prints coming out of the U.S. economy may keep USD/JPY afloat as it puts pressure on the Fed to further embark on its hiking-cycle, and the fresh updates to the Non-Farm Payrolls (NFP) report may influence foreign exchange markets over the coming days as employment is anticipated to increase another 188K in February.

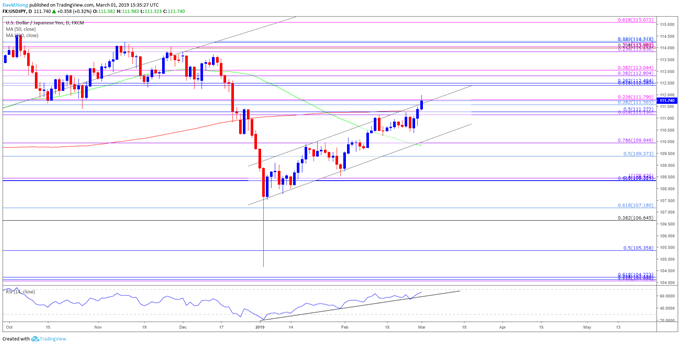

Until then, recent price action keeps the topside targets on the radar for USD/JPY as it clears the 200-Day SMA (111.32), and the Relative Strength Index (RSI) appears to be extending the bullish formation from earlier this year as the oscillator now approaches overbought territory. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

USD/JPY Daily Chart

- Topside targets remain on the radar for USD/JPY as both price and the RSI continue to track the upward trends from earlier this year, with the break above the 200-Day SMA (111.32) raising the risk for a further appreciation in the exchange rate as it carves a fresh series of higher highs & lows.

- However, need a close above the Fibonacci overlap around 111.10 (61.8% expansion) to 111.80 (23.6% expansion) to see the flash-crash rebound gather pace, with the next region of interest coming in around 112.40 (61.8% retracement) to 113.00 (38.2% expansion).

For more in-depth analysis, check out the Q1 2019 Forecast for the Japanese Yen

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.