Canadian Dollar Talking Points

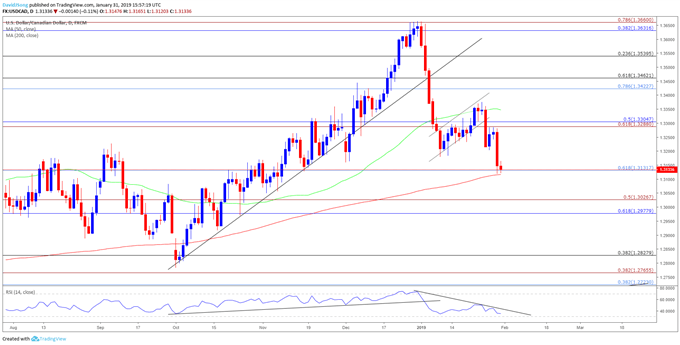

USD/CAD trades to a freshly monthly-low (1.3119) as the Federal Reserve removes the hawkish forward-guidance for monetary policy, and the exchange rate stands at risk for a larger correction as a bear-flag formation unfolds.

USD/CAD Bear-Flag Continues to Unfold as Fed Drops Hawkish Guidance

Fresh remarks from the Federal Open Market Committee (FOMC) suggest the benchmark interest rate will sit at its current range of 2.25% to 2.50% even though U.S. New Home Sales jumps 16.9% in November, and the Fed may start to taper the $50B/month in quantitative tightening (QT) as officials note that ‘the normalization of the size of the portfolio will be completed sooner, and with a larger balance sheet, than in previous estimates.’

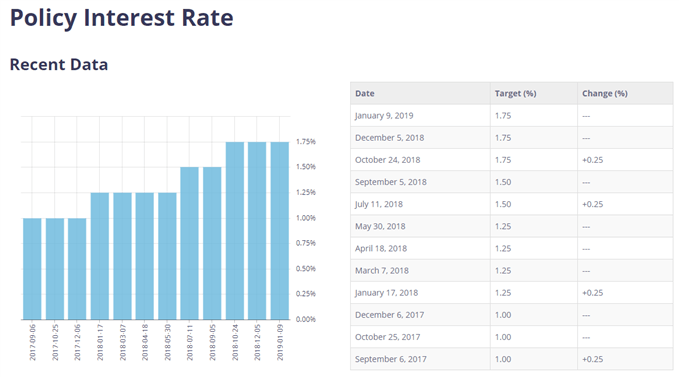

The Bank of Canada (BoC) may follow a similar path to its U.S. counterpart amid the weakening outlook for the global economy, and the central bank may larger endorse a wait-and-see approach the next meeting on March 6 as the central bank’s ‘revised forecast reflects a temporary slowing in the fourth quarter of 2018 and the first quarter of 2019.’

Governor Stephen Poloz may sound less-hawkish over the coming months as ‘CPI inflation is projected to edge further down and be below 2 per cent through much of 2019,’ but it remains to be seen if the BoC will remove the hawkish forward-guidance as the ‘Governing Council continues to judge that the policy interest rate will need to rise over time.’ With that said, the current environment may foster a larger correction in USD/CAD as the BoC continues to prepare Canadian households and businesses for higher borrowing-costs, and recent price action raises the risk for a further depreciation in the exchange rate as bear-flag formation unfolds. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

USD/CAD Daily Chart

- Keep in mind, broader outlook for USD/CAD remains constructive following the break of the June-high (1.3386), but the failed attempts to close above the 1.3630 (38.2% retracement) to 1.3660 (78.6% expansion) region raises the risk for a larger correction as both price & the RSI snap the bullish formations from October.

- The recent decline appears to be stalling ahead of the 200-Day SMA (1.3117), but a close below 1.3130 (61.8% retracement) opens up the Fibonacci overlap around 1.2980 (61.8% retracement) to 1.3030 (50% expansion), with the next area of interest coming in around 1.2830 (38.2% retracement).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.