Australian Dollar Talking Points

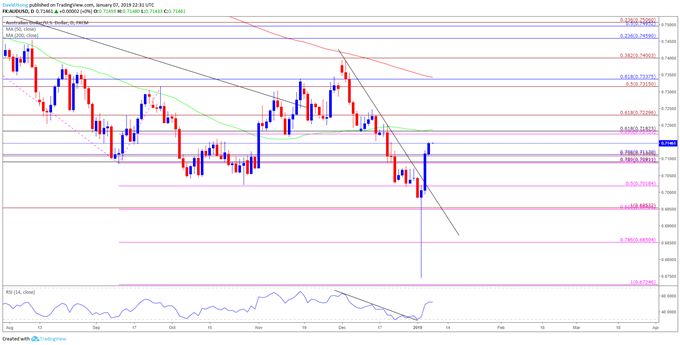

AUD/USD carves a fresh series of higher highs & lows following the currency market flash-crash, and the opening range for 2019 raises the risk for a larger rebound as both price and the Relative Strength Index (RSI) break out of the bearish formations from December.

AUD/USD 2019 Open Range Raises Risk for Larger Flash-Crash Rebound

AUD/USD extends the rebound from a 10-year low as Federal Reserve Chairman Jerome Powell adopts a less-hawkish tone, and the exchange rate may continue to catch a bid ahead of the Federal Open Market Committee (FOMC) Minutes as a growing number of central bank officials endorse a wait-and-see approach for monetary policy.

It seems as though the FOMC will retain the current policy at the next interest rate decision on January 30 especially as the deadlock in Congress clouds the economic outlook, and waning expectations for a Fed rate-hike may fuel a larger correction in AUD/USD as the central bank appears to be approaching the end of the hiking-cycle.

However, the contraction in the Federal Reserve’s balance sheet seems to be swaying risk-taking behavior as global equity prices remain battered, and the quantitative tightening (QT) may continue to rattle the broader outlook for the aussie-dollar exchange rate as the Reserve Bank of Australia (RBA) remains in no rush to lift the official cash rate (OCR) off of the record-low.

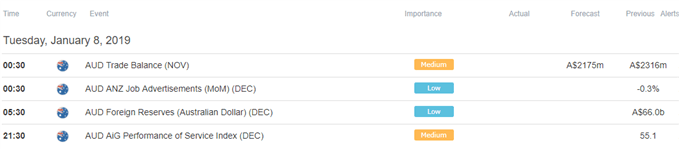

At the same time, updates to Australia’s Balance of Payments (BoP) should keep the RBA on the sidelines at the next meeting on February 5 as the trade surplus is expected to narrow to A$2175M from A$2316M in October, and the ongoing threat of a U.S.-China trade war may curb the appeal of the Australian dollar amid the weakening outlook for the Asia/Pacific region.

Nevertheless, the sharp rebound during the opening week of 2019 keeps the topside targets, and the recent pickup in AUD/USD has triggered a material change in retail interest, with traders already attempting to fade the advance from the monthly-low (0.6745).

The IG Client Sentiment Report shows 61.4% of traders are now net-long AUD/USD compared to 77.0% last week, with the ratio of traders long to short at 1.59 to 1.The number of traders net-long is 9.7% higher than yesterday and 24.5% lower from last week, while the number of traders net-short is 21.0% higher than yesterday and 60.7% higher from last week.

Keep in mind, the persistent tilt in retail interest offers a contrarian view to crowd sentiment especially as the RBA seems to be bracing for a weaker exchange rate, but the surge in net-short interest comes as AUD/USD carves a fresh series of higher highs & lows, with both price and the Relative Strength Index (RSI) breaking out of the bearish formations from December. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

AUD/USD Daily Chart

- AUD/USD may stage a larger rebound as it carves a bullish series, with the 0.7170 (23.6% expansion) to 0.7180 (61.8% retracement) region on the radar as it lines up with the 50-Day Simple Moving Average (SMA) (0.7185).

- Break/close above the stated region raises the risk for a move towards 0.7230 (61.8% expansion), with the next region of interest coming in around 0.7320 (50% expansion) to 0.7340 (61.8% retracement) followed by the 0.7400 (38.2% expansion) handle, which lines up with the December-high (0.7394).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.