Australian Dollar Talking Points

AUD/USD struggles to retain the advance from earlier this month as the Reserve Bank of Australia’s (RBA) quarter Statement on Monetary Policy (SMP) highlights a diverging path with the Federal Reserve, and the rebound from the 2018-low (0.7021) may continue to unravel as the exchange rate carves a fresh series of lower highs & lows.

AUD/USD Carves Bearish Sequence Following Failed Run at September-High

It seems as though the RBA will stick to the same script at its last 2018-meeting on December 4 as ‘the Board does not see a strong case to adjust the cash rate in the near term,’ and the central bank may continue to tame bets for higher interest rates amid the ‘uncertainty about the outlook for household income growth as well as uncertainty about how households may respond to significant housing price declines.’

In turn, Governor Philip Lowe & Co. may stick to a wait-and-see approach throughout the first-half of 2019 as ‘there continues to be uncertainty about how quickly the unemployment rate will decline and how quickly that will feed into wage pressures and inflation,’ and the ongoing disparity with the Federal Reserve instills a long-term bearish outlook for AUD/USD especially as Chairman Jerome Powell & Co. show no interest in abandoning the hiking-cycle.

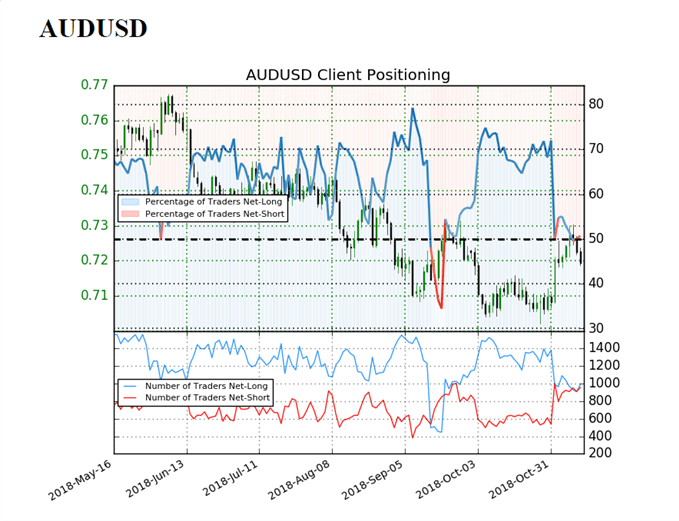

With that said, the failed attempt to test the September-high (0.7315) may bring the downside targets back on the radar as Fed Fund Futures continue to highlight bets for a 25bp rate-hike in December, and it appears as though the retail crowd is attempting to take advantage of the range-bound price action carried over from late-September as traders now appear to be fading the recent strength in AUD/USD.

The IG Client Sentiment Report shows 50.7% of traders are net-long AUD/USD compared to 70.5% at the end of October, with the ratio of traders long to short at 1.03 to 1.The number of traders net-long is 8.6% higher than yesterday and 8.2% lower from last week, while the number of traders net-short is 0.1% lower than yesterday and 5.1% higher from last week.

The ongoing expansion in net-short interest continues to warrant attention as the advance from the 2018-low (0.7021) unravels, but a further accumulation in net-short interest may ultimately provide a contrarian view to crowd sentiment as the Relative Strength Index (RSI) clings to the bullish formation carried over from the previous month. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

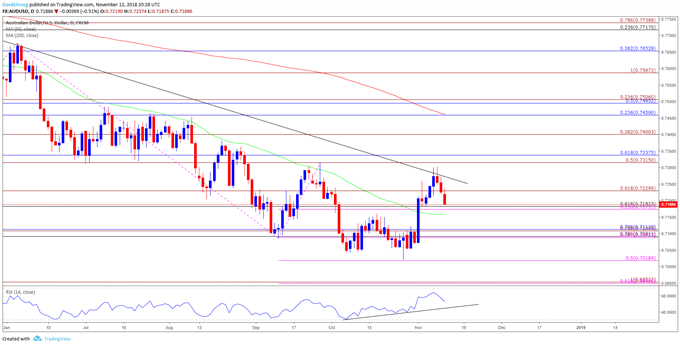

AUD/USD Daily Chart

- AUD/USD appears to be responding to trendline resistance amid the failed attempt to test the September-high (0.7315), with the recent series of lower highs & lows raising the risk for further losses.

- In turn, a break/close below the 0.7170 (23.6% expansion) to 0.7180 (61.8% retracement) region raises the risk for a move back towards the 0.7090 (78.6% retracement) to 0.7110 (78.6% retracement) area, with the next downside hurdle coming in around 0.7020 (50% expansion, which largely lines up with the 2018-low (0.7021).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.