Euro Talking Points

The near-term rebound in EUR/USD appears to have stalled even though the European Central Bank (ECB) remains upbeat on the economy, and fresh comments coming out of the Federal Reserve may undermine the recent advance in the exchange rate should the central bank prepare U.S. households and businesses for four rate-hikes in 2018.

EUR/USD Bullish Sequence Snaps Despite Less-Dovish ECB Rhetoric

The ECB’s account of the July meeting suggests the central bank will stay on its current course to wind down the quantitative easing (QE) program as ‘members broadly shared the view that uncertainties surrounding the inflation outlook had been receding.’

Signs of ‘solid and broad-based growth’ may push President Mario Draghi & Co. to further adjust the forward-guidance as ‘the strength of the economy was assessed to confirm the Governing Council’s confidence that the convergence of inflation to levels below, but close to, 2%,’ but it seems as though the central bank is in no rush to move away from its easing-cycle as ‘significant monetary policy stimulus was considered to be still needed to support the further build-up of domestic price pressures and headline inflation over the medium term.’ In turn, the ECB may stick to the sidelines at the next meeting on September 13, and more of the same from the central bank may produce headwinds for the Euro as ‘the Governing Council expected the key ECB interest rates to remain at their present levels at least through the summer of 2019.’

However, comments from Bundesbank President Jens Weidmann, who’s seen as the frontrunner to replace Draghi in 2019, warns of an imminent shift in the monetary policy outlook as the ECB board member argues that it’s ‘time to begin exiting the very expansionary monetary policy and the non-standard measures, especially considering their possible side effects,’ and a growing number of Governing Council officials may change their over the coming months as ‘the economic upturn contrasts with the monetary policy stance remaining exceptionally expansionary.’

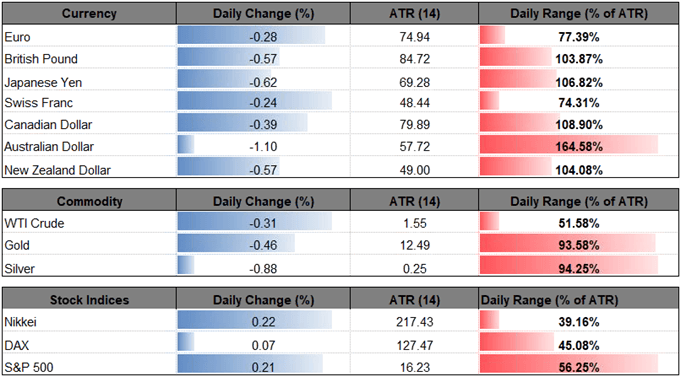

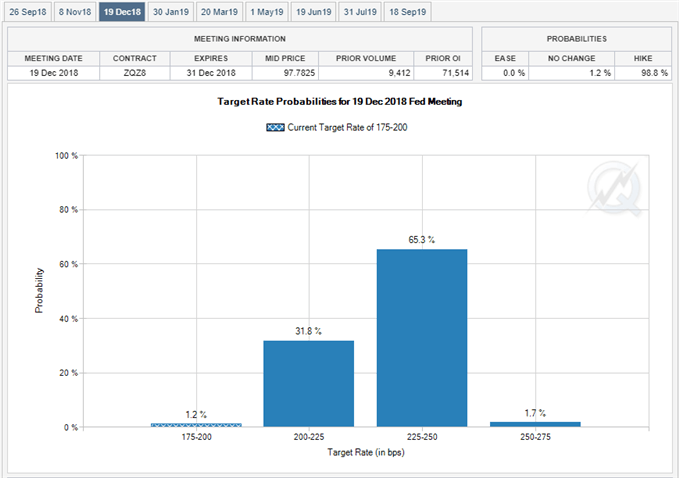

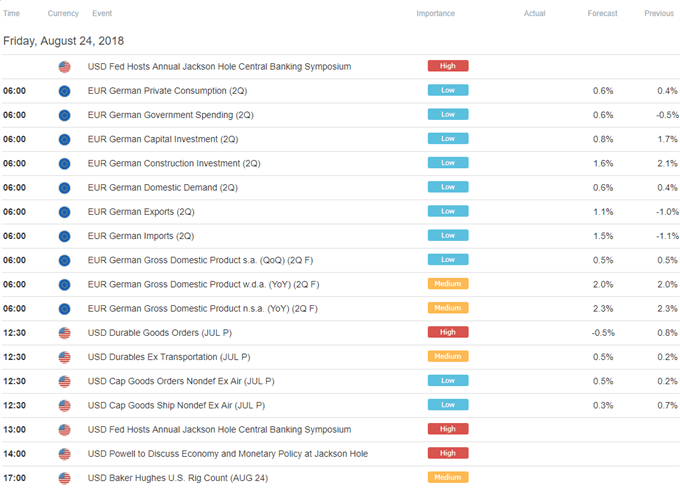

Until then, the ECB’s preset course for monetary policy does little to boost the longer-term outlook for EUR/USD, with the exchange rate at risk of exhibiting a more bearish behavior over the coming days as market attention turns to the Fed Economic Symposium in Jackson Hole, Wyoming. All eye are on Chairman Jerome Powell as the central bank head is scheduled to speak on Friday, and a batch of hawkish rhetoric may ultimately produce a bullish reaction in the U.S. dollar as Fed Fund Futures continue to reflect expectations for four rate-hikes in 2018.

With that said, the rebound in EUR/USD may continue to unravel as the Federal Open Market Committee (FOMC) shows little to no intentions of deviating from its hiking-cycle, and the lack of momentum to extend the recent series of higher highs & lows may bring the downside targets back on the radar amid the deviating paths for monetary policy. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

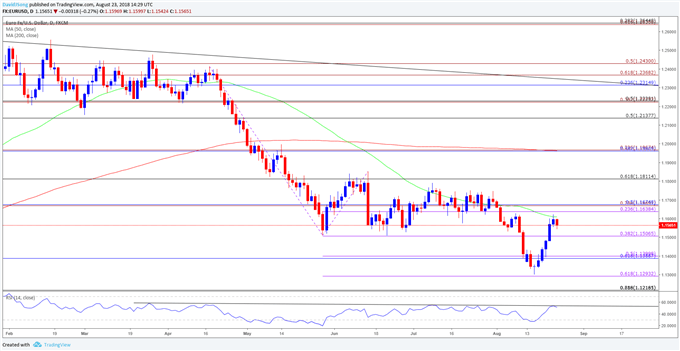

EUR/USD Daily Chart

- The rebound from the 2018-low (1.1301) appears to be tapering off as EUR/USD snaps the bullish sequence, with failure to break/close above the 1.1640 (23.6% expansion) to 1.1680 (50% retracement) region raising the risk for range-bound conditions.

- In turn, the downside targets may come back on the radar, with a move below 1.1510 (38.2% expansion) raising the risk for a move back towards 1.1390 (61.8% retracement) to 1.1400 (50% expansion), with near-term support coming in around 1.1290 (61.8% expansion).

For more in-depth analysis, check out the Q3 Forecast for the Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 201 8.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.