Japanese Yen Talking Points

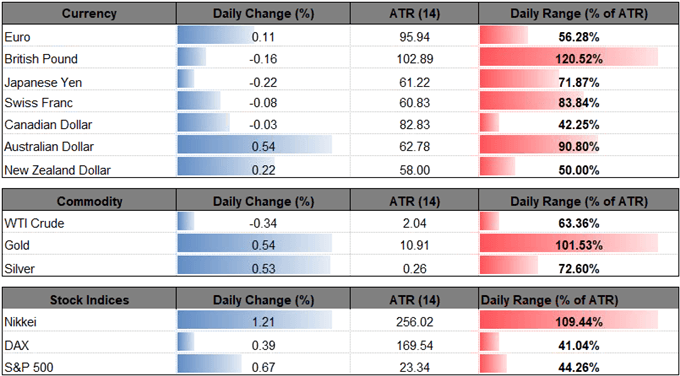

USD/JPY holds a narrow range following the lackluster U.S. Non-Farm Payrolls (NFP) report, but fresh comments from Federal Reserve officials may sway the near-term outlook for the dollar-yen exchange rate as the central bank appears to be on course to further normalize monetary policy over the coming months.

USD/JPY Outlook Hinges on Fed Chairman Powell Testimony

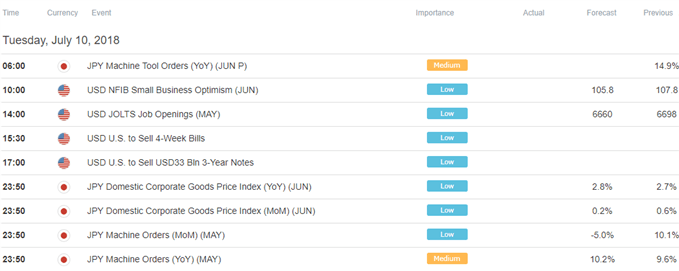

Even though New York Fed President John Williams and Atlanta Fed President Raphael Bostic, both voting members on the 2018-FOMC, are scheduled to speak over the coming days, the semi-annual Humphrey-Hawkins testimony may sway the near-term outlook for USD/JPY as Chairman Jerome Powell is slated to appear in front of Congress.

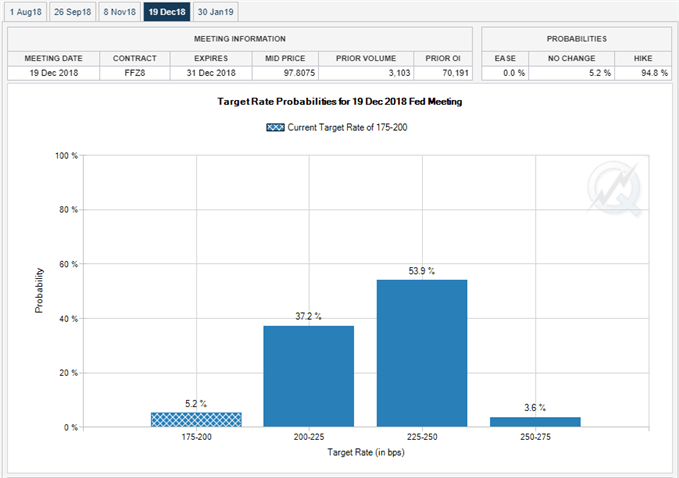

Chairman Powell may continue to strike a hawkish tone as Fed officials‘generally judged that, with the economy already very strong and inflation expected to run at 2 percent on a sustained basis over the medium term, it would likely be appropriate to continue gradually raising the target range for the federal funds rate to a setting that was at or somewhat above their estimates of its longer-run level by 2019 or 2020,’ and the central bank head may prepare U.S. lawmakers for a less accommodative stance as ‘incoming data suggested that GDP growth strengthened in the second quarter of this year.’

In turn, indications of higher borrowing-costs may prop up USD/JPY as Fed Fund Futures highlight budding expectations for four rate-hikes in 2018, but a batch of cautious remarks may dampen the appeal of the dollar as Chairman Powell & Co. warn thatthe ‘uncertainty and risks associated with trade policy had intensified and were concerned that such uncertainty and risks eventually could have negative effects on business sentiment and investment spending.’

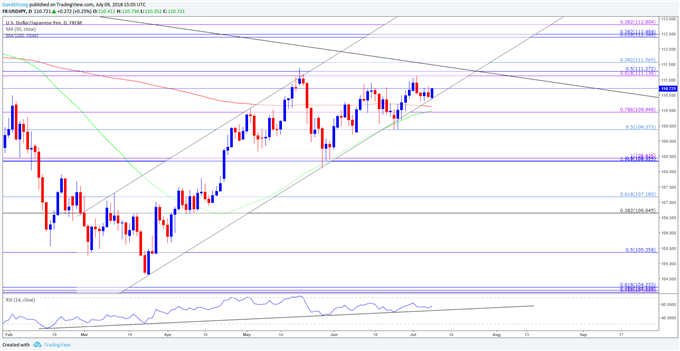

USD/JPY Daily Chart

- Broader outlook for USD/JPY remains constructive as both price and the Relative Strength Index (RSI) track the bullish formations from earlier this year, but the pair may continue to face range-bound conditions following the failed attempt to teste the May-high (111.40).

- Need a break/close above the Fibonacci overlap around 111.10 (61.8% expansion) to 111.60 (38.2% retracement) to bring the topside targets back on the radar, with the next hurdle coming in around 112.40 (61.8% retracement) to 112.80 (38.2% expansion).

- Failure to preserve the monthly opening range raises the risk for a move back towards 109.40 (50% retracement) to 110.00 (78.6% expansion), with near-term support coming in around 108.30 (61.8% retracement) to 108.40 (100% expansion), which sits just above the May-low (108.11).

For more in-depth analysis, check out the Q3 Forecast for the Japanese Yen

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.