Japanese Yen Talking Points

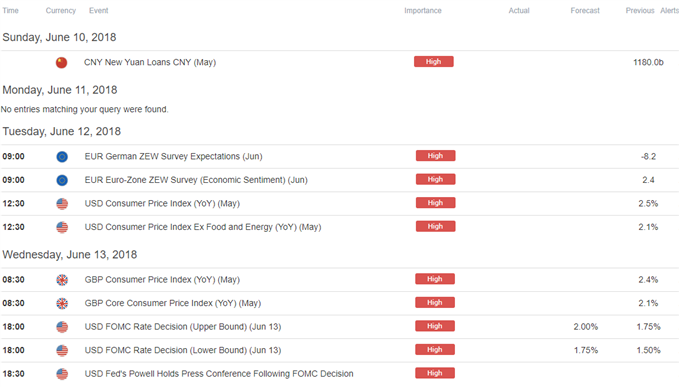

USD/JPY remains under pressure, with the Yen largely unfazed by the mixed data prints coming out of Japan, and the exchange rate may continue to consolidate ahead of the Federal Open Market Committee (FOMC) interest rate decision on June 13 as it initiates a fresh series of lower highs & lows.

USD/JPY Rate Vulnerable to Further Losses as Bearish Series Develops

Updates to Japan’s Gross Domestic Product (GDP) report should keep the Bank of Japan (BoJ) on track to further expand its balance sheet as the final reading shows a 0.6% contraction in the growth rate, and Governor Haruhiko Kuroda and Co. may carry the Quantitative/Qualitative Easing (QQE) Program with Yield-Curve Control into the year ahead as inflation continues to run below the 2% target,

However, the limited reaction to the fresh figures suggest USD/JPY will continue to take cues from Fed policy as the recent pullback coincides with the weakness in U.S. Treasury Yields, and the fresh updates from the Federal Open Market Committee (FOMC) is likely to impact the near-term outlook for dollar-yen as especially as Chairman Jerome Powell and Co. pledge to phase out the forward-guidance for monetary policy.

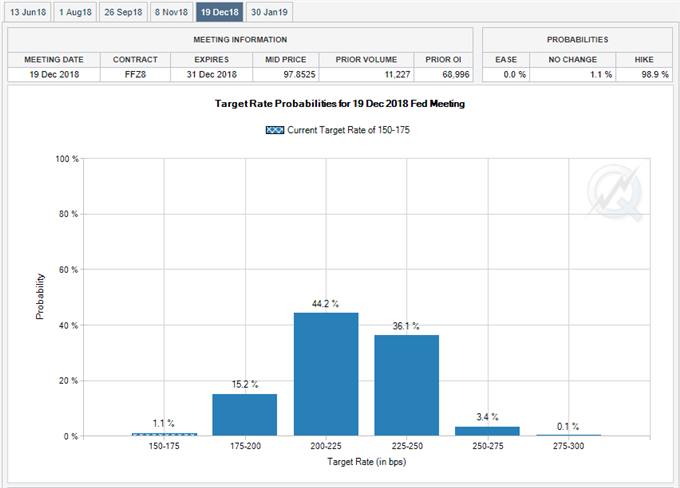

Keep in mind, Fed Fund Futures are now showing narrowing expectations for four rate-hikes in 2018, with the benchmark interest rate seen ending the year around the 2.00% to 2.25% threshold, and more the same from the FOMC may keep USD/JPY under pressure as market participants scale back bets for a more aggressive hiking-cycle.

With that said, little to no changes in the longer-run interest rate forecast (dot-plot) may dampen the appeal of the greenback, with USD/JPY at risk of exhibiting a more bearish behavior over the near-term especially as both price and the Relative Strength Index (RSI) fail to preserve the bullish formations from earlier this year.

USD/JPY DAILY CHART

- USD/JPY stands at risk for further losses as it carves a fresh series of lower highs & lows after failing to make a run at the May-high (111.40).

- Waiting for a close below the 109.40 (50% retracement) to 110.00 (78.6% expansion) region to favor a move back towards 108.30 (61.8% retracement) to 108.40 (100% expansion), with the next downside region of interest comes in around 106.70 (38.2% retracement) to 107.20 (61.8% retracement).

For more in-depth analysis, check out the Q2 Forecast for the Japanese Yen

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

Additional Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.