NEW ZEALAND DOLLAR TALKING POINTS

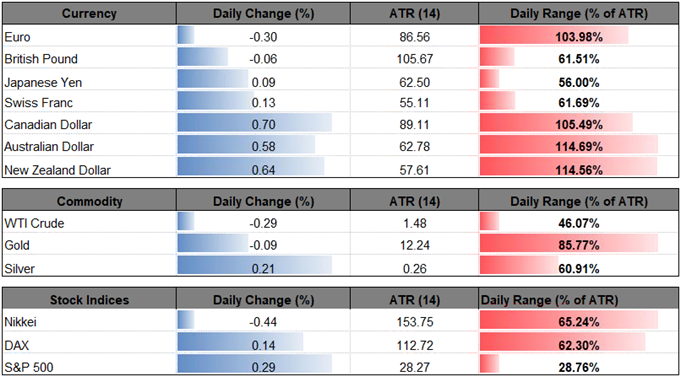

The New Zealand dollar trades on a firmer footing ahead of the annual budget statement, but recent price action in NZD/USD keeps the near-term outlook tilted to the downside as the pair continues to carve a series of lower highs & lows. The updates from Finance Minister Grant Robertson may do little to alter the near-term outlook for kiwi-dollar as the government led by Prime Minister Jacinda Ardernplan to further develop the Living Standards Framework (LSF), but updates to the Producer Price Index (PPI) may rattle the recent rebound in the exchange rate should the print dampen the outlook for inflation.

NZD/USD PRESERVES BEARISH SEQUENCE AHEAD OF NEW ZEALAND PRODUCER PRICE INDEX (PPI), 2018 BUDGET STATEMENT

Like the Consumer Price Index (CPI), a slowdown in factory-gate prices may produce headwinds for the New Zealand dollar as it encourages the Reserve Bank of New Zealand (RBNZ) to keep the official cash rate (OCR) at the record-low throughout 2018. In turn, Governor Adrian Orr may stick to the current script at the next meeting on June 27, and the central bank may continue to tame expectations for a rate-hike as officials ‘expect to keep the OCR at this expansionary level for a considerable period of time.’

With that said, the New Zealand dollar may continue to weaken against its U.S. counterpart as the Federal Reserve is widely expected to deliver a rate-hike in June, and recent price action raises the risk for a further decline in the exchange rate as NZD/USD preserves the bearish sequence carried over from the previous week.

NZD/USD DAILY CHART

- The November-low (0.6780) remains on the radar as NZD/USD continues to carve lower highs & lows, but need to see a break/close below the 0.6820 (23.6% retracement) to 0.6870 (78.6% expansion) region to open up the next area of interest around 0.6780 (100% expansion).

- However, recent developments in the Relative Strength Index (RSI) clouds the near-term outlook as the oscillator bounces back from an extreme reading and is on the cusp of flashing a textbook buy-signal as it appears to be climbing back above 30.

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

ADDITIONAL TRADING RESOURCES

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.