FX Talking Points:

- AUD/USD Rebound Fizzles as Reserve Bank of Australia (RBA) Governor Philip Lowe Curbs Bets for Imminent Rate-Hike. Near-Term Outlook Clouded with Mixed Signals.

- USD/CAD Resilience to Persist as Bank of Canada (BoC) Sticks to Wait-and-See Approach. Canada Employment Report in Focus.

The near-term rebound in AUD/USD fizzles as Reserve Bank of Australia (RBA) Governor Philip Lowe tames expectations for an imminent rate-hike, and the pair may continue to consolidate over the next 24-hours of trade as market attention turns to the key developments coming out of the U.S. economy.

Even though Governor Lowe reiterates that ‘it is likely that the next move in interest rates in Australia will be up, not down,’ the fresh batch of cautious remarks suggest the central bank remains in no rush to lift the cash rate off of the record-low as‘the expected progress in reducing unemployment and having inflation return to target is likely to be only gradual.’ As a result, the RBA appears to be on track to retain the current policy throughout the first-half of 2018, and the wait-and-see approach may keep AUD/USD confined within a wide range especially as the Federal Open Market Committee (FOMC) appears to be on course to deliver a 25bp rate-hike later this month.

Moreover, the 235K expansion in the ADP Employment report may pave the way for an above-forecast Non-Farm Payrolls (NFP) print, with a group of positive developments likely to heighten the appeal of the U.S. dollar as it fuels speculation for four Fed rate-hikes in 2018. Keep in mind, the near-term outlook AUD/USD has perked up as the pair breaks out of a narrow range, with the Relative Strength Index (RSI) snapping the bearish formation carried over from the previous month, but the lack of momentum to extend the recent series of higher highs & lows may lead to range-bound conditions as market participants weigh the outlook for monetary policy.

AUD/USD Daily Chart

- May see AUD/USD stage a larger recovery as the 0.7720 (23.6% retracement) to 0.7770 (61.8% expansion) area offers near-term support, while the RSI flashes a bullish trigger.

- Need a break/close above 0.7850 (38.2% retracement) to 0.7860 (61.8% expansion) to open up the topside targets, with the next hurdle coming in around 0.7930 (50% retracement) to 0.7940 (61.8% retracement) followed by the 0.8030 (38.2% expansion) region.

USD/CAD remains bid as the Bank of Canada (BoC) keeps the benchmark interest rate at 1.25%, and the near-term resilience in the dollar-loonie exchange rate may persist over the remainder of the week as the bullish momentum appears to be gathering pace.

Recent comments from the BoC suggest the central bank is in no rush to implement higher borrowing-costs after implementing a dovish rate-hike at the start of the year, and Governor Stephen Poloz and Co. may stick to the sidelines for the foreseeable future as ‘trade policy developments are an important and growing source of uncertainty for the global and Canadian outlooks.’ Even though the ‘the economic outlook is expected to warrant higher interest rates over time,’ the BoC may attempt to buy more time at its next meeting on April 18 as ‘some continued monetary policy accommodation will likely be needed to keep the economy operating close to potential and inflation on target.’

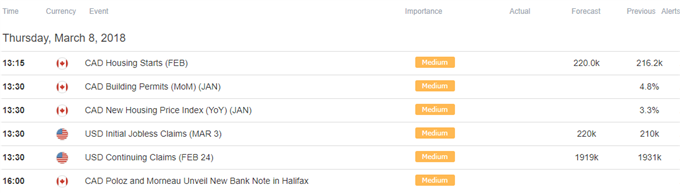

With that said, market participants may pay increased attention to Canada’s employment report as job growth is expected to rebound 22.0K in February, but another below-forecast print may fuel fresh yearly highs in USD/CAD as it discourages bets for another BoC rate-hike in 2018.

USD/CAD Daily Chart

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

- Near-term outlook for USD/CAD remains tilted to the topside as the potential bull-flag appears to be taking shape, while the Relative Strength Index (RSI) appears to be extending the bullish formation carried over from the previous month as it pushes off of trendline support.

- Still need a break/close above the 1.3290 (61.8% expansion) to 1.3310 (50% retracement) to favor a further advance in the dollar-loonie exchange rate, with the next region of interest coming in around 1.3130 (61.8% retracement).

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.