FX Talking Points:

- EUR/USD Remains Bid Following FOMC; Outlook Hinges on NFP.

- AUD/USD Rally Unravels Ahead of Reserve Bank of Australia (RBA) Meeting.

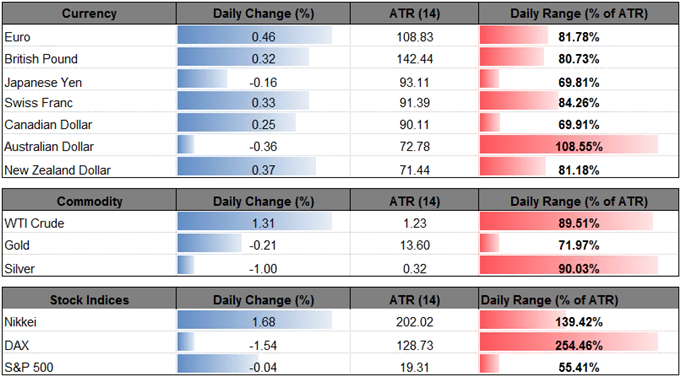

EUR/USD remains bid even as the Federal Open Market Committee (FOMC) reiterates that ‘economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate,’ and the pair may continue to exhibit a bullish behavior as the Relative Strength Index (RSI) sits in overbought territory.

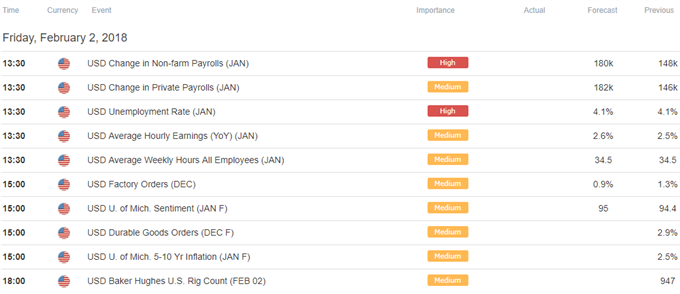

The fresh remarks from the FOMC suggests the central bank is on track to deliver three rate-hikes in 2018 as ‘market-based measures of inflation compensation have increased in recent months,’ and the U.S. Non-Farm Payrolls (NFP) report may fuel bets for an imminent Fed rate-hike as both job and wage growth are expected to pick up in January. A positive development may rattle EUR/USD as it encourages Fed officials to implement higher borrowing-costs at its next meeting in March, but another bag of mixed data prints may keep the euro-dollar exchange rate afloat as the FOMC struggles to achieve the 2% target for inflation.

With that said, recent price action keeps the near-term outlook tilted to the topside as bullish momentum persists, with EUR/USD at risk of making fresh yearly highs as long as the RSI holds above 70. Want more insight? Sign up and join DailyFX Strategist Michael Boutros & David Song LIVE to cover the U.S. NFP report.

EUR/USD Daily Chart

Interested in trading? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

- Near-term outlook for EUR/USD remains constructive as price and the RSI extend the bullish formations from late-2017, with a close above the 1.2430 (50% expansion) hurdle opening up the next region of interest around 1.2640 (61.8% expansion) to 1.2650 (38.2% retracement).

- However, another failed attempt to close above 1.2430 (50% expansion) raises the risk for a near-term pullback as the bullish momentum appears to be abating, with the first downside area of interest coming in around 1.2230 (50% retracement) followed by the 1.2130 (50% retracement) region.

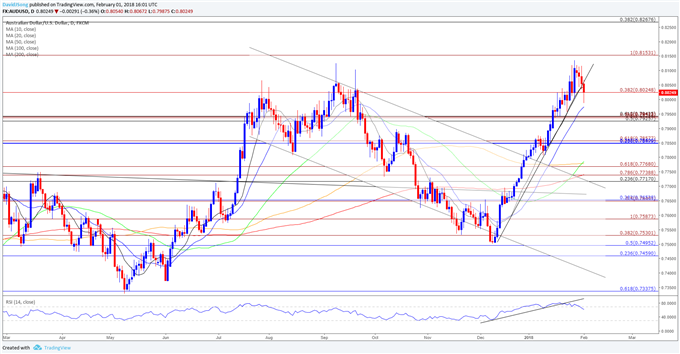

The near-term rally in AUD/USD unravels just ahead of the Reserve Bank of Australia (RBA) meeting on February 6, with the pair at risk for further losses as it snaps the upward trend from the December-low (0.7501).

The RBA is likely to stay on hold at its first interest rate decision for 2018 amid the below-forecast data prints coming out of the real economy, and the central bank may merely attempt to jawbone the local currency as ‘an appreciating exchange rate would be expected to result in a slower pick-up in domestic economic activity and inflation than currently forecast.’Even though Governor Philip Lowe notes that ‘it is more likely that the next move in interest rates will be up, rather than down,’ the RBA appears to be in no rush to lift the cash rate off of the record-low as ‘the outlook for household consumption continued to be a significant risk, given that household incomes were growing slowly and debt levels were high.’

In turn, more of the same from Governor Lowe & Co. may produce headwinds for the Australian dollar as market participants scale back bets for an RBA rate-hike in 2018. Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

AUD/USD Daily Chart

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

- Downside targets are coming back on the radar for AUD/USD as the pair snaps the upward trend after failing to push above the 0.8150 (100% expansion) hurdle, with the pair starting to carve a fresh series of lower highs & lows.

- The Relative Strength Index (RSI) highlights similar dynamic as the oscillator finally falls back from overbought territory and flashes a textbook sell-signal.

- First downside area of interest comes in around 0.7930 (50% retracement) to 0.7940 (61.8% retracement) followed by the 0.7850 (38.2% retracement) to 0.7860 (61.8% expansion) region.

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.