FX Talking Points:

- AUD/USD Rate Outlook Hinges on Australia 4Q Consumer Price Index (CPI).

- USD/JPY Bearish Momentum Gathers Pace Ahead of FOMC Meeting.

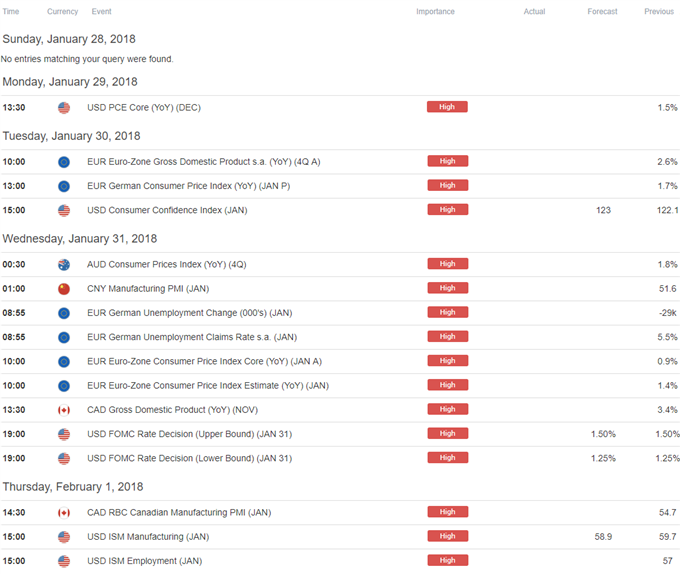

AUD/USD remains bid going into the end of January, with the pair at risk of extending the advance from late last year as Australia’s Consumer Price Index (CPI) is expected to show a pickup in both the headline and core rate of inflation.

The updates to Australia CPI may keep AUD/USD afloat as the reading is projected to increase to an annualized 2.0% from 1.8% in the third-quarter of 2017, and signs of stronger price growth may encourage the Reserve Bank of Australia (RBA) to gradually alter the outlook for monetary policy especially as ‘forward-looking indicators of labour demand suggested employment growth would be somewhat above average over the next few quarters.’

Even though Governor Philip Lowe & Co. are widely expected to retain the wait-and-see approach at its next meeting on February 6, a batch of hawkish rhetoric may fuel the broader shift in AUD/USD behavior as the central bank shows a greater willingness to start normalizing monetary policy.

AUD/USD Daily Chart

Interested in trading? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

- Near-term outlook for AUD/USD remains constructive as the pair preserves the upward trend from December, while the Relative Strength Index (RSI) holds above 70 and trades in overbought territory.

- A break of the 2017-high (0.8125) may spark a more meaningful run at the 0.8150 (100% expansion) region, with the next area of interest coming in around 0.8270 (38.2% retracement).

- Need to keep a close eye on the RSI as it appears to be deviating with price and snaps the bullish formation from late last year, with a move below 70 raising the risk for a near-term pullback in AUD/USD; first downside hurdle comes in around 0.7930 (50% retracement) to 0.7940 (61.8% retracement).

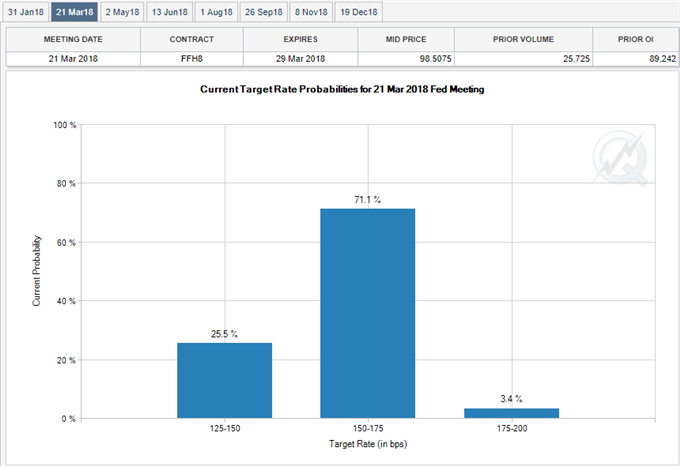

USD/JPY remains under pressure following the lackluster 4Q U.S. Gross Domestic Product (GDP) report, but the Federal Open Market Committee’s (FOMC) first meeting for 2018 may sway the near-term outlook for the dollar-yen exchange rate as the central bank appears to be on course to further normalize monetary policy over the coming months.

The limited reaction to the 2.6% rise in the U.S. growth rate suggests market participants are largely waiting for the January 31 interest rate decision, and the FOMC may utilize Chair Janet Yellen’s last meeting to prepare U.S. households and businesses for higher borrowing-costs as Fed Fund Futures continue to highlight a greater than 70% probability for a March rate-hike.

However, more of the same from the committee may keep USD/JPY under pressure as it dampens bets for an imminent rate-hike, and a growing number of Fed officials may warn that ‘there was a possibility that inflation might stay below the objective for longer than they currently expected’ amid the below-forecast prints coming out of the U.S. economy. Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

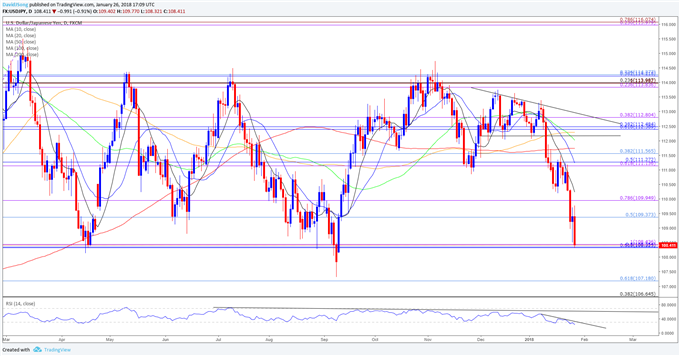

USD/JPY Daily Chart

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

- Downside targets remain on the radar for USD/JPY as the Relative Strength Index (RSI) sits in oversold territory, with the near-term outlook capped by the former-support zone around 111.10 (61.8% expansion) to 111.60 (38.2% retracement).

- Need a break/close below the 108.30 (61.8% retracement) to 108.40 (100% expansion) region to open up the next downside hurdle around 106.70 (38.2% retracement) to 107.20 (61.8% retracement), which sits just beneath the 2017-low (107.32).

- Will also keep a close eye on the RSI as the bearish momentum appears to be gathering pace, with the oscillator highlighting the most extreme reading since 2016.

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.