Talking Points:

- AUD/USD Remains Capped Ahead of NFP Report, RBA Meeting.

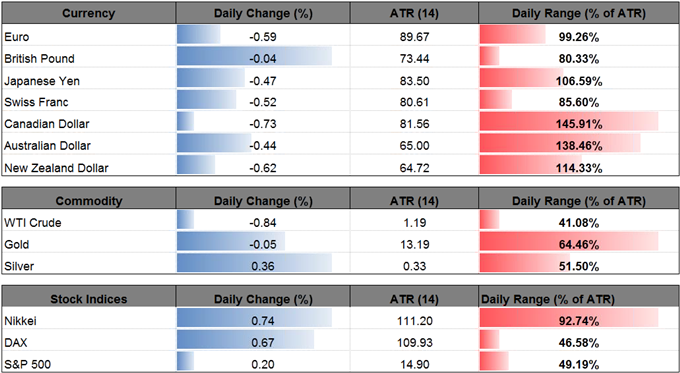

- USD/CAD Fails to Test July-Low, Initiates Bullish Sequence Ahead of Canada GDP Report.

- Percentage of Traders Net-Long USD/CAD is Now Its Highest Since August 09.

| Ticker | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| AUD/USD | 0.7916 | 0.7996 | 0.7906 | 35 | 90 |

AUD/USD gives back the advance from earlier this week follow a batch of positive data prints coming out of the U.S. economy, and the pair may continue to consolidate ahead of the highly anticipated Non-Farm Payrolls (NFP) report as market participants mull the outlook for monetary policy.

With the Reserve Bank of Australia (RBA) widely expected to preserve the record-low cash rate at the September 5 meeting, Governor Philip Lowe and Co. may merely attempt to jawbone the local currency as ‘an appreciating exchange rate would be expected to result in a slower pick-up in economic activity and inflation than currently forecast.’

As a result, market participants may put increased emphasis on U.S. data prints as the Federal Reserve ‘expects to begin implementing its balance sheet normalization program relatively soon.’ The greenback may trade on a firmer footing ahead of the next Federal Open Market Committee (FOMC) interest rate decision on September 20 as the economy is projected to add another 180K jobs in August, and Chair Janet Yellen and Co. may stay on course to deliver three rate-hikes in 2017 as the economy approaches full-employment. However, a Fed officials may project a more shallow path for the benchmark interest rate as inflation continues to run below the 2% target, and the bearish sentiment surrounding the U.S. dollar may persist throughout the remainder of the year as Fed Fund Futures highlight narrowing expectations for a move in December.

AUD/USD Daily Chart

Chart - Created Using Trading View

- AUD/USD may once again threaten the upward trend from May as it struggles to test the monthly opening range, with the near-term outlook largely capped by the 0.8020 (38.2% retracement) hurdle.

- Failure to hold above channel support may spur a move back towards the Fibonacci overlap around 0.7850 (38.2% retracement) to 0.7860 (61.8% expansion), with the next region of interest coming in at 0.7808, the August-low; broader outlook remains supported by the former-resistance zone around 0.7720 (23.6% retracement) to 0.7770 (61.8% expansion).

| Ticker | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| USD/CAD | 1.2605 | 1.2620 | 1.2501 | 93 | 119 |

USD/CAD initiates a series of higher highs & lows after failing to test the July-low (1.2413), and the pair may stage a larger recovery ahead of the Bank of Canada (BoC) meeting on September 6 as Governor Stephen Poloz and Co. are expected to keep the benchmark interest rate at 0.75%.

A more meaningful reversal may start to unfold as the dollar-loonie exchange rate carves a double-bottom going into the end of the summer months, but positive developments coming out of the Canadian economy may fuel the broader shift in USD/CAD behavior as it encourages the BoC further normalize monetary policy in 2017.

Even though the 2Q Gross Domestic Product (GDP) report is anticipated to show the growth rate expanding another 3.7%, a stronger-than-expected print may heighten the appeal of the Canadian dollar as ‘the output gap is now projected to close around the end of 2017, earlier than the Bank anticipated in its April Monetary Policy Report (MPR).’ Nevertheless, anything short of market forecast may encourage Governor Poloz and Co. to adopt a more patient approach, with the Canadian dollar at risk of facing a larger correction as FX traders push back bets for the next BoC rate-hike.

USD/CAD Daily Chart

Chart - Created Using Trading View

- The series of failed attempt to clear the Fibonacci overlap around 1.2410 (100% expansion) to 1.2440 (23.6% expansion) raises the risk for a larger correction in USD/CAD especially as the Relative Strength Index (RSI) snaps back ahead of oversold territory and appears to be trading on a more bullish course.

- First hurdle comes in around 1.2620 (50% retracement) to 1.2640 (61.8% expansion) followed by the 1.2710 (50% region), with near-term resistance sitting around 1.2770 (38.2% expansion) to 1.2780 (38.2% expansion), which largely lines up with the August-high (1.2778).

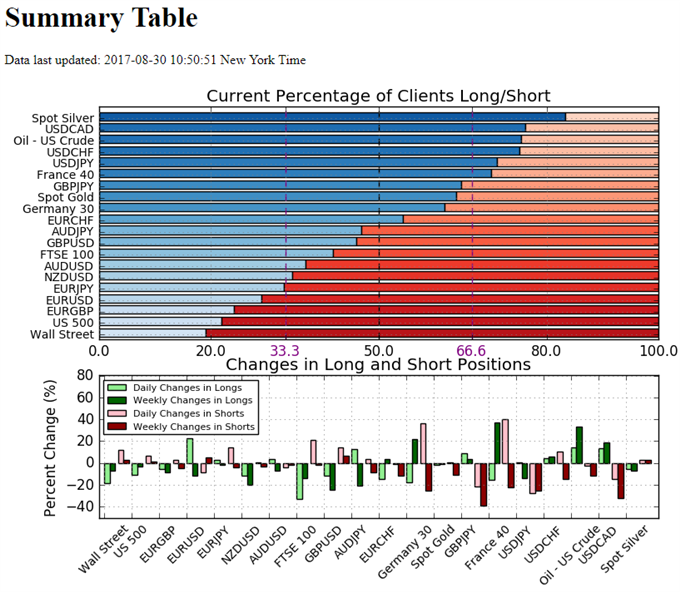

Retail Sentiment

- Retail trader data shows 36.9% of traders are net-long AUD/USD with the ratio of traders short to long at 1.71 to 1. In fact, traders have remained net-short since June 04 when AUD/USD traded near 0.74772; price has moved 5.8% higher since then. The number of traders net-long is 3.5% higher than yesterday and 7.0% lower from last week, while the number of traders net-short is 4.1% lower than yesterday and 1.7% lower from last week.

- Retail trader data shows 76.2% of traders are net-long USD/CAD with the ratio of traders long to short at 3.21 to 1. In fact, traders have remained net-long since June 07 when USD/CAD traded near 1.34832; price has moved 6.5% lower since then. The percentage of traders net-long is now its highest since August 09 when USD/CAD traded near 1.2694. The number of traders net-long is 13.6% higher than yesterday and 19.2% higher from last week, while the number of traders net-short is 14.6% lower than yesterday and 32.2% lower from last week.

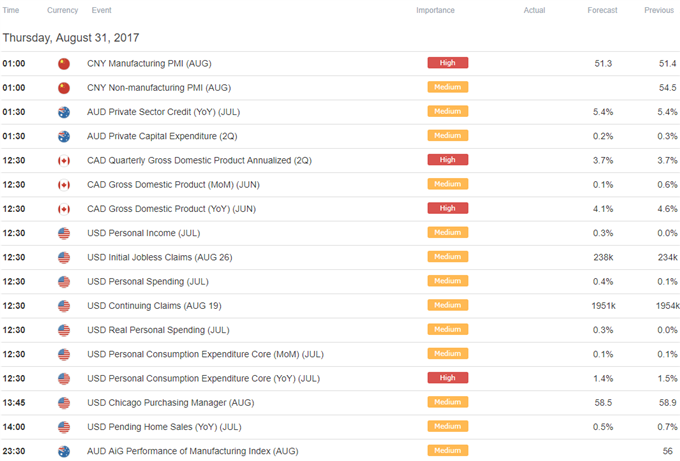

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.