Talking Points:

- EUR/USD Resilience to Recur as ECB Mulls Easing Bias.

- NZD/USD Downside Targets in Focus as Bearish RSI Trigger Unfolds.

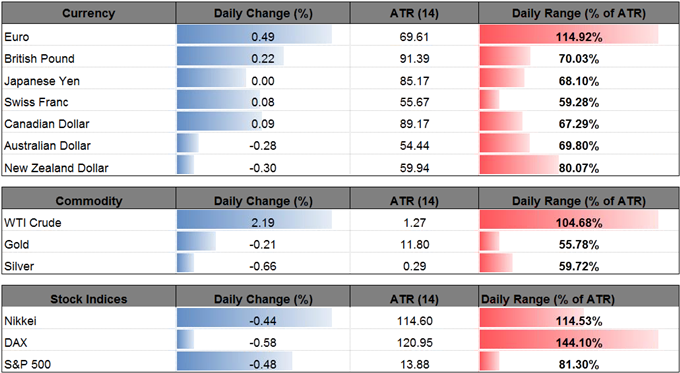

| Ticker | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| EUR/USD | 1.1408 | 1.1410 | 1.1330 | 56 | 80 |

EUR/USD appears to be on its way to test the 2017-high (1.1446) as the European Central Bank (ECB) shows a greater willingness to move away from its easing cycle.

President Mario Draghi and Co. appear to be embracing a less-dovish outlook for monetary policy as officials note the positive developments coming out of the euro-area ‘had to be reflected in the Governing Council’s communication by dropping the reference to the expectation of further rate cuts in its forward guidance on policy rates.’ As the ECB finally puts a floor on interest rates, it seems as though the central bank will continue to revisit ‘the easing bias with respect to the APP purchases’ as the non-standard measure is set to expire in December. As a result, the material shift in EUR/USD behavior may gather pace in the second-half of the year should the Governing Council show a greater willingness to gradually wind down its asset-purchase program over the coming months.

At the same time, Fed Fund Futures are now pricing a less than 60% probability for a December rate-hike as the ADP Employment survey falls short of market expectations, with private-sector jobs increasing 158K in June. In turn, market participants may put increased emphasis on the Non-Farm Payrolls (NFP) report as job and wage growth are projected to pick up going into the second-half of the year, but another batch of mixed data prints may generate a bearish reaction in the U.S. dollar especially as the Federal Open Market Committee (FOMC) remains in no rush to unload the balance sheet.

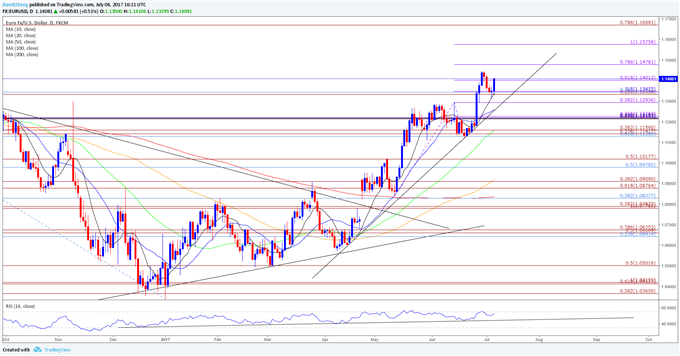

EUR/USD Daily

Chart - Created Using Trading View

- Broader outlook for EUR/USD remains constructive as price & the Relative Strength Index (RSI) retain the upward trends from late-2016, with the pair at risk for a larger advance as a near-term bull flag formation appears to be panning out; will keep a close eye on the recent series of higher highs & lows as the former-resistance zone around 1.1290 (38.2% expansion) appears to be offering support.

- A break of the June-high (1.1446) may spur a more meaningful run at the 1.1480 (78.6% expansion) hurdle, with the next topside area of interest coming in around 1.1580 (100% expansion).

Have a question about the currency markets? Join a Trading Q&A webinar and ask it live!

| Ticker | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| NZD/USD | 0.7268 | 0.7293 | 0.7245 | 22 | 48 |

The New Zealand dollar lags behind its major counterparts, with NZD/USD at risk of exhibiting a more bearish behavior as the pair extends the series of lower highs & lows carried over from the previous week.

Failure to test the February high (0.7376) keeps the broader outlook tilted to the downside, and the rebound from the 2017-low (0.6818) may largely unravel ahead the next Reserve Bank of New Zealand (RBNZ) interest rate decision on August 10 as central bank remains in no rush to lift the cash rate off of the record-low. Even though Governor Graeme Wheeler is schedule to depart in September, the New Zealand Institute of Economic Research (NZIER) noted ‘recent developments add to the case that there is little urgency for the RBNZ to begin lifting interest rates,’ and the wait-and-see approach for monetary policy may continue to dampen the longer-term outlook for NZD/USD as the research group expects the central bank to stay on hold until mid-2018.

NZD/USD Daily

Chart - Created Using Trading View

- Lack of momentum to clear the key resistance zone around 0.7330 (38.2% retracement) to 0.7350 (23.6% expansion) may open up the downside targets as NZD/USD carves a bearish sequence at the start of the month/quarter; a bearish signal has also emerged in the Relative Strength Index (RSI) as the oscillator continues to come off of overbought territory and takes out the upward trend from May.

- Break/close below 0.7240 (61.8% retracement) may spur a move back towards the 0.7200 (38.2% retracement) handle, with the next downside hurdle coming in around 0.7160 (61.8% retracement).

Make Sure to Check Out the DailyFX Guides for Additional Trading Ideas.

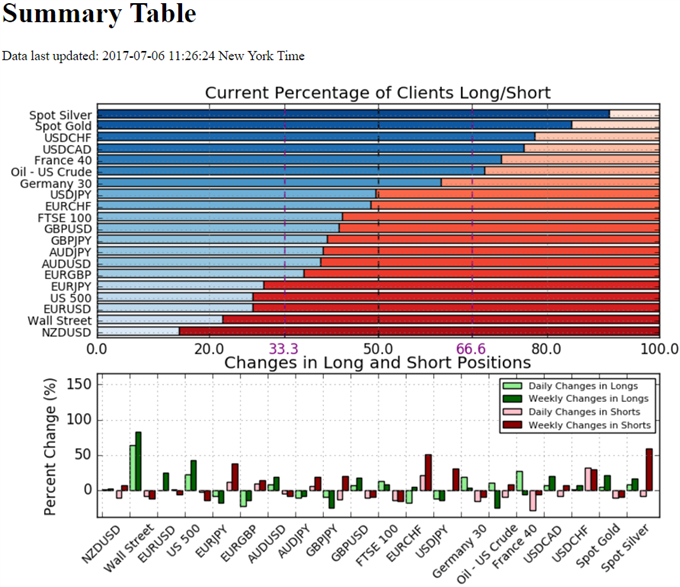

Check Out the New Gauge Developed by DailyFX Based on Trader Positioning

- Retail trader data shows 27.7% of traders are net-long EUR/USD with the ratio of traders short to long at 2.61 to 1. In fact, traders have remained net-short since April 18 when EUR/USD traded near 1.06424; price has moved 7.2% higher since then. The number of traders net-long is 0.1% higher than yesterday and 25.2% higher from last week, while the number of traders net-short is 1.1% higher than yesterday and 6.0% lower from last week.

- Retail trader data shows 14.6% of traders are net-long NZD/USD with the ratio of traders short to long at 5.84 to 1. In fact, traders have remained net-short since May 24 when NZD/USD traded near 0.68944; price has moved 5.2% higher since then. The number of traders net-long is 0.8% higher than yesterday and 2.5% higher from last week, while the number of traders net-short is 11.1% lower than yesterday and 7.1% higher from last week.

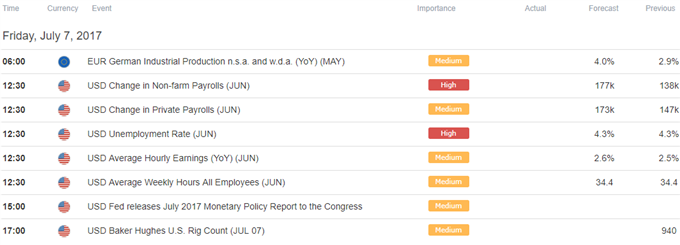

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.