Talking Points:

- USD/JPY Continues to Track Risk Sentiment; Downside in Focus Ahead of U.S. 4Q GDP Report.

- USD/CAD Post-BoC Rally Accompanied by Subdued Oil Prices; Trump to Renegotiate NAFTA.

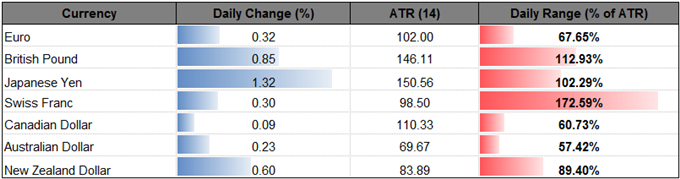

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| USD/JPY | 113.13 | 114.49 | 112.95 | 124 | 154 |

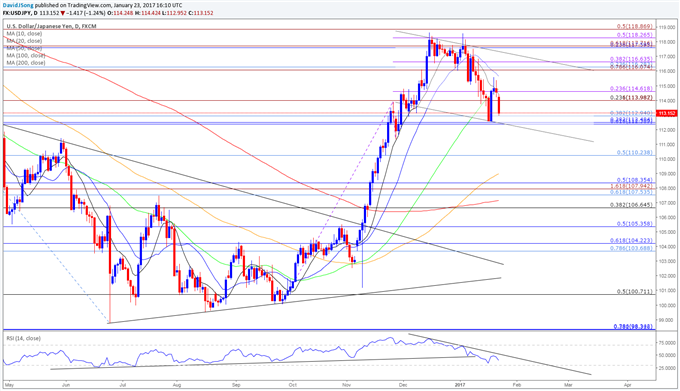

USD/JPY Daily

Chart - Created Using Trading View

- USD/JPY gapped lower to start the last full-week of January, with the pair at risk for a further decline as the Relative Strength Index (RSI) preserves the bearish trend carried over from the previous month; will keep a close eye on the Nikkei 225 as it broadly moves in tandem with the dollar-yen exchange rate, and the downside targets remain in focus for both the dollar-yen and the benchmark equity index as they remain stuck in a double-top formation (measured move highlights the risk for a move back towards the 110.00 handle).

- Japan’s Consumer Price Index (CPI) may fuel speculation for additional monetary support as the core-core rate of inflation, which strips out volatile items such as food and energy costs, is expected to contract an annualized 0.1% in December, but the depreciation in the local currency may encourage the Bank of Japan (BoJ) to retain the status quo at the January 31 interest rate decision as Governor Haruhiko Kuroda remains confident in achieving the 2% target for inflation over the policy horizon; the Federal Reserve also looks poised to preserve its current policy at its February 2 rate decision as the 4Q U.S. Gross Domestic Product (GDP) report is expected to show the growth rate increasing an annualized 2.2.% followed the 3.5% expansion during the three-months through September.

- USD/JPY appears to have made a failed attempt to work its way back towards the monthly opening range as it remains capped by the 20-Day SMA (115.69), with the pair at risk of making another run at near-term support around 112.40 (61.8% retracement) to 112.50 (38.2% retracement) should risk sentiment continue to abate.

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| USD/CAD | 1.3308 | 1.3335 | 1.3268 | 17 | 67 |

USD/CAD Daily

Chart - Created Using Trading View

- The Canadian dollar weakness following the Bank of Canada (BoC) interest rate decision may persist over the near-term especially as U.S. President Donald Trump pledges to renegotiate the North American Free Trade Agreement (NAFTA) and implement a ‘very major border tax;’ will also keep a close eye on crude as it remains capped by the $55 handle, and subdued oil prices may spark bets for additional monetary support as BoC Governor Stephen Poloz endorses a dovish outlook for monetary policy.

- Despite the ongoing expansion in the labor market, the BoC may come under pressure to further insulate the real economy in 2017 as officials warn the ‘new measures of core inflation are all below 2 percent presently, weighed down by excess capacity in the economy,’ and the dollar-loonie may continue to carve a long-term series of higher highs & lows amid the deviating paths for policy.

- Broader outlook for USD/CAD remains supportive as the price & the RSI preserve the bullish formations carried over from the previous year; failed run at the October low (1.3006) keeps the topside targets in focus over the near-term, with a close above 1.3350 (78.6% retracement) opening up the next region of interest around 1.3460 (61.8% retracement).

For More Updates, Join DailyFX Currency Analyst David Song for LIVE Analysis!

Click HERE for the Entire DailyFX Webinar schedule.

Click Here for the DailyFX Calendar

If you’re looking for trading ideas, check out our Trading Guides.

Read More:

S&P 500 Technical Analysis: Short-term Chart Pattern in View

Brexit Briefing: British Pound Gathers Strength, Supreme Court Vote Ahead

Silver Prices: Trading Levels in Play

Gold Off Key Resistance- Trump, US GDP to Determine Depth of Correction

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.