Talking Points:

- Canadian Dollar Strength to Persevere as Crude Oil Rally Gathers Pace.

- USD/JPY Comes Up Against Former-Support, Remains Overbought Ahead of FOMC.

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| USD/CAD | 1.3141 | 1.3181 | 1.3109 | 13 | 72 |

USD/CAD Daily

Chart - Created Using Trading View

- USD/CAD may continue to pare the rebound from the October low(1.3006) and test for channel-support as it extends the recent series of lower highs & lows; will keep a close eye on the Relative Strength Index (RSI) as it comes up against oversold territory, with a break below 30 raising the risk for a further decline in the exchange rate especially as the oscillator preserves the bearish formation carried over from the previous month.

- With the Non-Organization of Petroleum Exporting Countries (OPEC) also agreeing to cut 558K b/d in crude outputs, the ongoing recovery in energy prices may instill an improved outlook for the Canadian economy as the region continues to adjust to the oil-price shock; may see the Bank of Canada (BoC) gradually move away from its easing cycle in 2017 as Governor Stephen Poloz and Co stick to a wait-and-see approach and argue ‘the dynamics of growth are largely as the Bank anticipated.’

- A closing price below 1.3160 (61.8% retracement) keeps the near-term bias tilted to the downside, with the next downside region of interest coming in around 1.3300 (61.8% expansion) to 1.3310 (38.2% retracement), which lines up with channel-support.

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| USD/JPY | 115.16 | 115.28 | 114.02 | 112 | 126 |

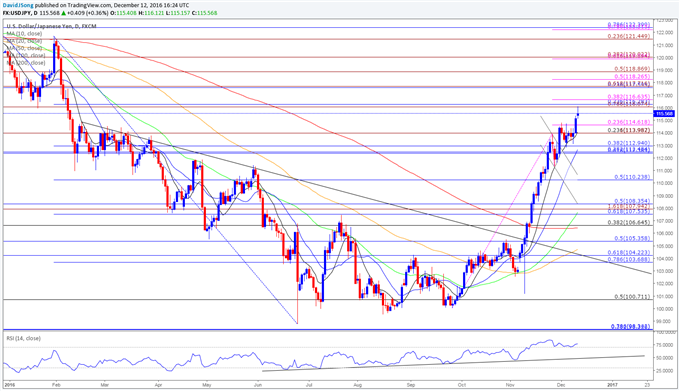

USD/JPY Daily

Chart - Created Using Trading View

- USD/JPY climbs to a fresh monthly high of 116.12, with the pair coming up against a major former-support zone around 116.10 (78.6% expansion) to 116.60 (38.2% expansion); near-term outlook remains constructive as the dollar-yen breaks out of a narrow range, while the RSI stubbornly holds in overbought territory.

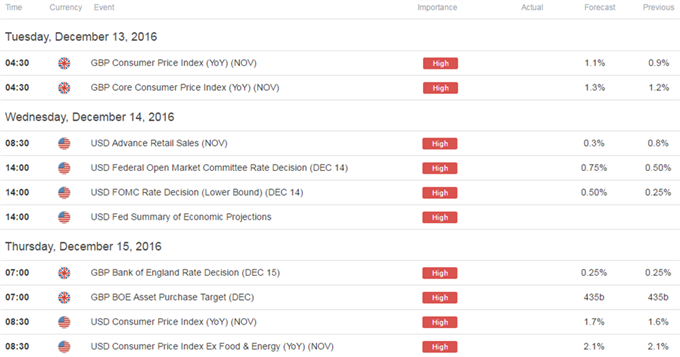

- Risk trends may continue to drive USD/JPY volatility ahead of the Federal Reserve’s last interest rate decision for 2016 as the Nikkei 225 appears to be moving in tandem with the dollar-yen exchange rate; even though the Federal Open Market Committee (FOMC) is widely anticipated to deliver a 25bp rate-hike at the December 14 interest rate decision, the fresh projections from Chair Janet Yellen and Co. may dampen the appeal of the greenback and spark a pullback in USD/JPY should the group of central bank officials adopt a more dovish tone and further scale back their long-run interest rate forecast.

- USD/JPY may attempt to fill the weekly opening gap as it struggles to break/close above the Fibonacci overlap around, but the pickup in risk sentiment may keep USD/JPY float, with the near-term outlook tilted to the upside as long as the pair closes above 114.60 (23.6% expansion), with the next topside region of interest coming in around 117.60 (23.6% retracement) to 117.70 (61.8% expansion).

For More Updates, Join DailyFX Currency Analyst David Song for LIVE Analysis!

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Read More:

AUD/USD Recovery Hinges on RBA, 3Q GDP; Rally at Risk Sub-7600

S&P 500: Will the Market Respect Support This Week?

Technical Focus: Bond Yields - That was Fast!

New Zealand Dollar Clobbered as PM Key Steps Down

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.