Talking Points:

- AUD/USD Carves Near-Term Bullish Formation Ahead of RBA Meeting, 3Q GDP Report.

- NZD/USD Recovery Continues to Dwindle as PM John Key Unexpectedly Resigns; 0.7200 in Focus.

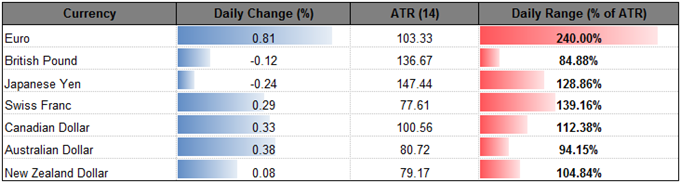

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| AUD/USD | 0.7485 | 0.7489 | 0.7413 | 32 | 76 |

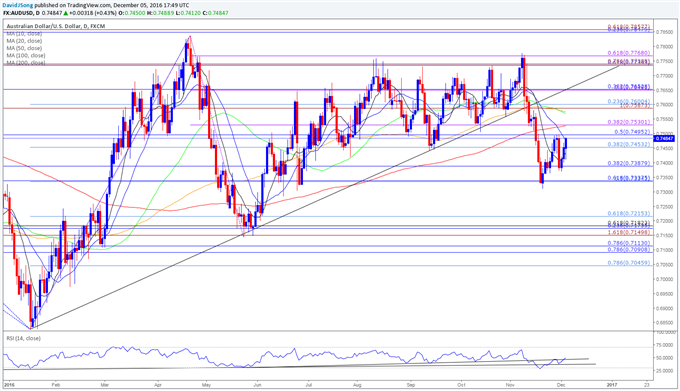

AUD/USD Daily

Chart - Created Using Trading View

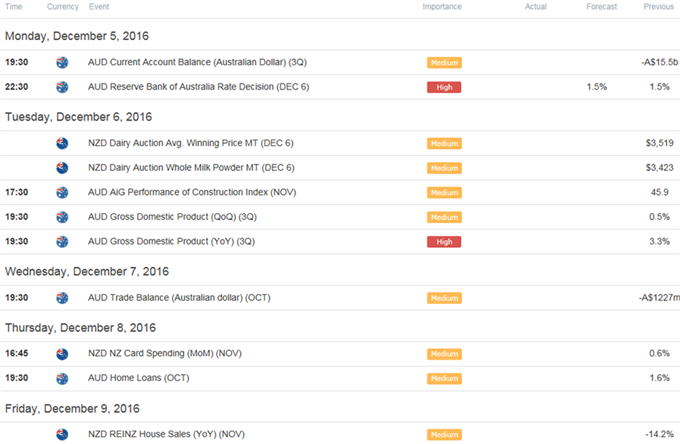

- AUD/USD may extend the recent series of higher highs & lows over the next 24-hours of trade as the Reserve Bank of Australia (RBA) is widely expected to keep the official cash rate at the record-low of 1.50% at the last 2016 interest rate decision; it seems as though Governor Philip Lowe & Co. are on course to conclude the easing-cycle ahead of 2017 as the central bank argues inflation is ‘expected to pick up gradually over the forecast period;’ more of the same from the central bank may spark a bullish reaction in the aussie as market participants scale back bets for additional monetary support.

- Nevertheless, Australia’s 3Q Gross Domestic Product (GDP) report is anticipated to highlight a slower expansion, with the growth rate projected to increase an annualized 2.5% following the 3.3% expansion during the three-months through June, and a lackluster print may keep the exchange rate capped especially as the aussie-dollar fails to preserve the upward trend from earlier this year.

- May see another test of the former-support zone around 0.7500 (50% retracement) to 0.7530 (38.2% retracement) as the Relative Strength Index (RSI) continues to come off of oversold territory, with the next topside hurdle coming in around 0.7590 (100% expansion) to 0.7600 (23.6% retracement).

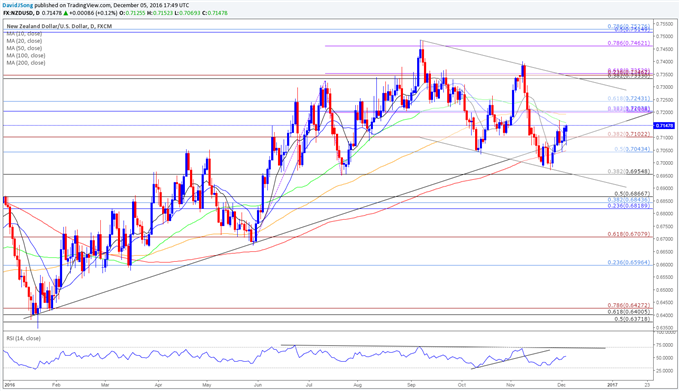

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| NZD/USD | 0.7147 | 0.7153 | 0.707 | 12 | 83 |

NZD/USD Daily

Chart - Created Using Trading View

- NZD/USD pares the advance from the previous week as Prime Minister John Key unexpectedly steps down as the leader of the National Party and paves the way for Finance Minister Bill English to take the helm; even though the broader outlook remains tilted to the downside, the kiwi-dollar may stage a larger rebound going through the first full-week of December as long as it holds above near-term support around 0.7040.

- The shift in leadership may encourage the Reserve Bank of New Zealand (RBNZ) to further support the real economy ahead of the 2017-general election, but it seems as though Governor Graeme Wheeler will endorse a wait-and-see approach while appearing before Parliament’s Finance and Expenditure Committee on December 7 as the central bank argues ‘current projections and assumptions indicate that policy settings, including today’s easing, will see growth strong enough to have inflation settle near the middle of the target range;’ failure to preserve the upward trend from earlier this year highlights a broader shift in market behavior, with a break/close below 0.6950 (38.2% retracement) negating the risk for a longer-term bull-flag formation.

- Until then, the near-term outlook remains supportive, with the pair at risk for a more meaningful run at 0.7200 (38.2% retracement), with the next topside objective coming in around 0.7240 (61.8% retracement).

For More Updates, Join DailyFX Currency Analyst David Song for LIVE Analysis!

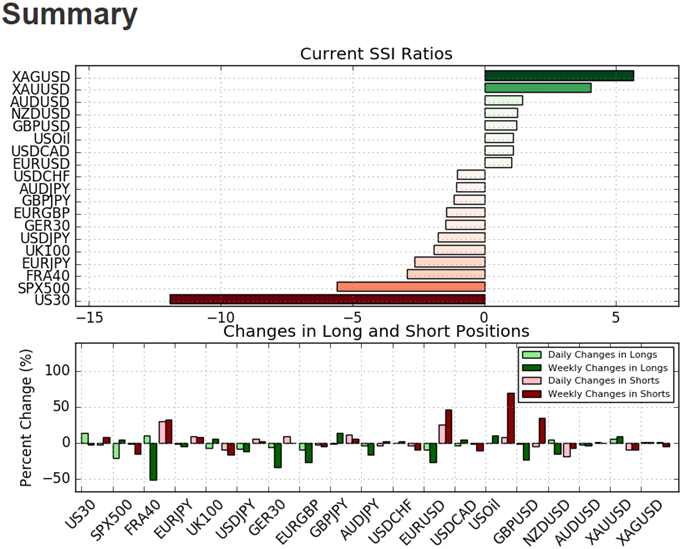

- The DailyFX Speculative Sentiment Index (SSI) shows the retail crowd flipped net-long NZD/USD just ahead of December, with the ratio hitting a 2016-extreme reading of +1.78 during the previous month, while traders have been net-long AUD/USD since November 9.

- NZD/USD SSI sits at +1.26 as 56% of traders are long, with long positions 12.4% lower from the previous week as open interest stands 11.3% below the monthly average.

- AUD/USD SSI sits at +1.45 as 59% of traders are long, with long positions 4.3% lower from the previous week, while open interest stands 0.2% below the monthly average.

- Market participation across the commodity bloc. currencies have narrowed coming into December, while Japanese Yen crosses have bucked the trend as open interest for USD/JPY stands 5.1% above the 30-day average.

Why and how do we use the SSI in trading? View our video and download the free indicator here

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Read More:

S&P 500: Will the Market Respect Support This Week?

Euro Rallying as Italian Referendum Dashes MS5 Hopes

Technical Focus: Bond Yields - That was Fast!

New Zealand Dollar Clobbered as PM Key Steps Down

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.