Talking Points:

- AUD/USD Advance at Risk on Slowing China GDP; Retail Crowd Remains Net-Short.

- USDOLLAR Range Vulnerable to Waning Retail Sales, Subdued Core Consumer Price Index (CPI).

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

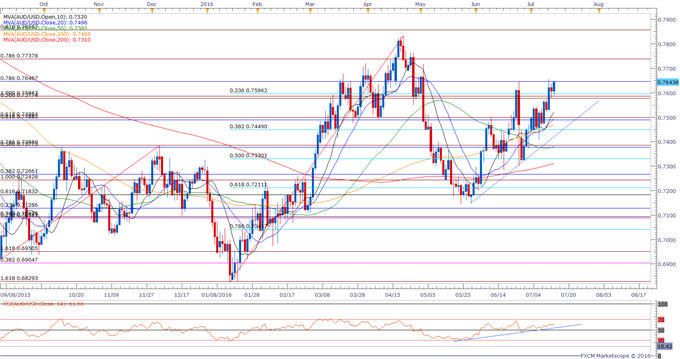

Chart - Created by David Song

- Even though AUD/USD benefits from the ongoing expansion in Australia Employment, the near-term advance may come under pressure as China, Australia’s largest trading partner, is expected to face a slowing recovery, with the 2Q Gross Domestic Product (GDP) report anticipated to show the growth rate climbing an annualized 6.6% following the 6.7% expansion during the first three-months of 2016.

- Weakening outlook for global growth may encourage the Reserve Bank of Australia (RBA) to adopt a more dovish tone at the next policy meeting on August 2, but Governor Glenn Stevens may continue to endorse a wait-and-see approach in the months ahead as the rate-cut from earlier this year continues to work its way through the real economy.

- Will retain a constructive outlook for AUD/USD as price & the Relative Strength Index (RSI) preserve the bullish formation carried over from the previous month, but the failed attempts to close above 0.7650 (78.6% retracement) may highlight a near-term exhaustion, with the first downside area of interest coming in around 0.7490 (61.8% retracement) to 0.7500 (61.8% expansion).

- The DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-short AUD/USD since July 8, with the ratio approaching the lowest level seen since April as it works its way back towards the -2.00 mark.

- The ratio currently sits at -1.24 as 45% of traders are long, with short positions 12.2% higher from the previous week, while open interest stands 11.1% above the monthly average.

Why and how do we use the SSI in trading? View our video and download the free indicator here

USDOLLAR(Ticker: USDollar):

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| US Dollar Index | 11988.73 | 12020.05 | 11965.44 | -0.22 | 76.65% |

Chart - Created by David Song

- The USDOLLAR may preserve the near-term range going into the weekend amid the limited market reaction to the data prints, but a slowdown in U.S. Retail Sales accompanied by another 2.2% print for the core Consumer Price Index (CPI) may drag on the greenback as it provides the Federal Open Market Committee (FOMC) with greater scope to retain its current policy at the July 27 interest-rate decision.

- Even though Fed Funds Futures continue to reflect limited expectations for a 2016 rate-hike, fresh comments from Atlanta Fed President Dennis Lockhart, Kansas City Fed President Esther George, Dallas Fed President Robert Kaplan, San Francisco Fed President John Williams, Minneapolis Fed President Neel Kashkari and St. Louis Fed President James Bullard may spark increased volatility in the greenback as market participants continue to weigh the outlook for monetary policy.

- Dismal developments coming out of the U.S. economy may drag on the USDOLLAR, with a break/close below 11,951 (38.2% expansion) to 11,965 (23.6% retracement) raising the risk for a move back towards 11,898 (50% retracement) to 11,914 (38.2% retracement).

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Read More:

Technical Focus: Copper Base Still a Work in Progress

Silver Prices: Spiral Higher Triggers Historical Momentum Readings

USD/CAD Technical Analysis: Looking Ready To Claw-Back H1 Losses

USD/JPY Technical Analysis: The Proverbial Falling Knife

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.