Talking Points:

- USD/CAD Retail Crowd Remains Net-Long Ahead of Bank of Canada (BoC) Meeting.

- USDOLLAR Preserves Monthly Range Amid More of Same Fed Rhetoric.

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

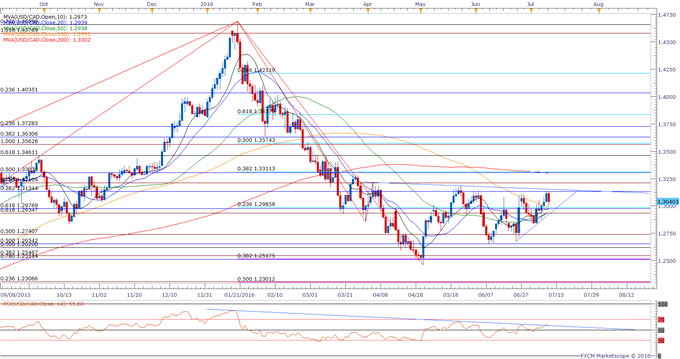

Chart - Created by David Song

- USD/CAD may face a major move over the coming days as the pair approaches the apex of the wedge/triangle formation, while the Relative Strength Index (RSI) appears to be threatening the bearish formation carried over from earlier this year.

- Even though the Bank of Canada (BoC) is widely anticipated to retain its current policy in July, the fresh batch of central bank rhetoric may spark a larger pullback in USD/CAD should Governor Stephen Poloz and Co. sound increasingly upbeat on the economy and show a greater willingness to gradually move away from the easing cycle.

- Failure to break/close above 1.3130 (38.2% retracement) may open up the downside targets, with the first hurdle coming in around 1.2930 (61.8% expansion) to 1.2980 (23.6% retracement) followed by 1.2620 (50% retracement) to 1.2650 (50% retracement).

- The DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-long USD/CAD since June 28, with the ratio hitting an extreme back in April at it advanced to +2.25.

- The ratio currently sits at +1.11 as 53% of traders are long, with short positions 8.6% higher from the previous week even as open interest stands 2.2% below the monthly average.

Why and how do we use the SSI in trading? View our video and download the free indicator here

USDOLLAR(Ticker: USDollar):

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| US Dollar Index | 12010.98 | 12033.32 | 11977.34 | -0.16 | 77.16% |

Chart - Created by David Song

- Failure to break the monthly opening range may continue to produce range-bound prices for the USDOLLAR, with the broader outlook tilted to the topside as the greenback breaks out of the bearish formation from earlier this year.

- Nevertheless, the USDOLLAR stands at risk of facing near-term headwinds as Fed Governor Daniel Tarullo and St. Louis Fed President James Bullard offer little guidance for the monetary policy outlook; may see another unanimous vote to retain the current policy at the Federal Open Market Committee (FOMC) interest-rate decision on July 27 as central bank officials appear to be in no rush to implement higher borrowing-costs.

- Waiting for a break of the near-term rangewith support coming in around 11,951 (38.2% expansion) to 11,965 (23.6% retracement), while the topside hurdle stands around 12,049 (78.6% retracement) to 12,064 (61.8% retracement).

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Read More:

Technical Focus: Copper Base Still a Work in Progress

Silver Prices: Spiral Higher Triggers Historical Momentum Readings

USD/CAD Technical Analysis: Looking Ready To Claw-Back H1 Losses

USD/JPY Technical Analysis: The Proverbial Falling Knife

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.