Talking Points:

- USD/JPY Advance Loses Steam Ahead of BoJ Minutes, Balance of Payment (BoP) Report.

- USDOLLAR Continues to Struggle at Near-Term Hurdle; Fed Officials on Tap.

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

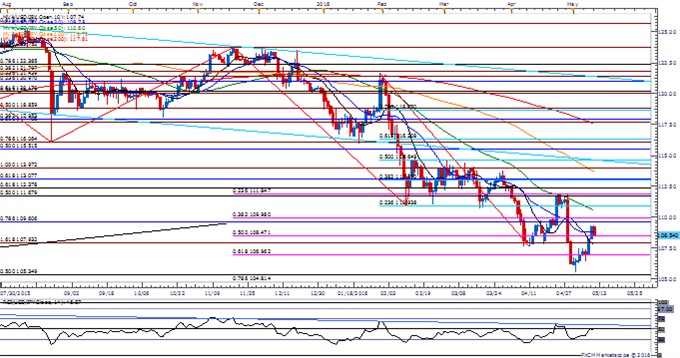

Chart - Created Using FXCM Marketscope 2.0

- USD/JPY may continue to carve a longer-term series of lower highs & lows as the rebound from 105.54 (2016 low) appears to be getting exhausted, while the Relative Strength Index (RSI) preserves the bearish formation carried over from May 2015.

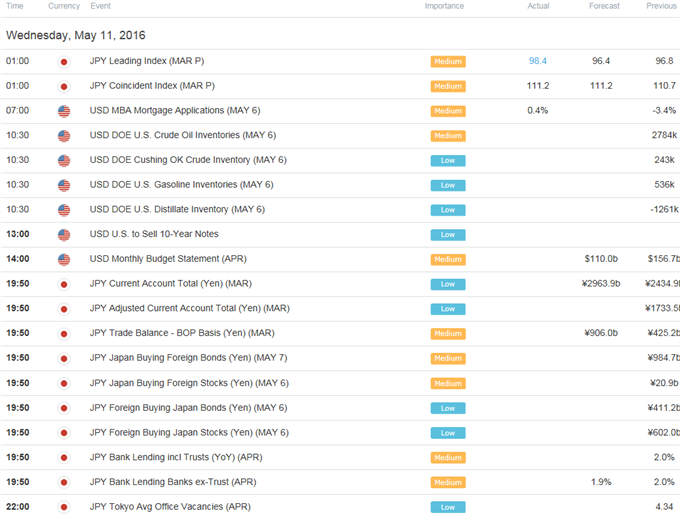

- With Japan’s Balance of Payment (BoP) report anticipated to show a widening current-account surplus in March, a positive development accompanied by more of the same in the Bank of Japan’s (BoJ) Meeting Minutes may heighten the appeal of the Yen as the central bank retains a wait-and-see approach after implementing the negative-interest rate policy (NIRP), while the region returns to its historical role as a net-lender to the global economy.

- Need a break/close above 109.60 (78.6% retracement) to 110.00 (38.2% expansion) to favor a further advance, with near-term support coming in around 104.80 (78.6% expansion) to 105.30 (50% retracement).

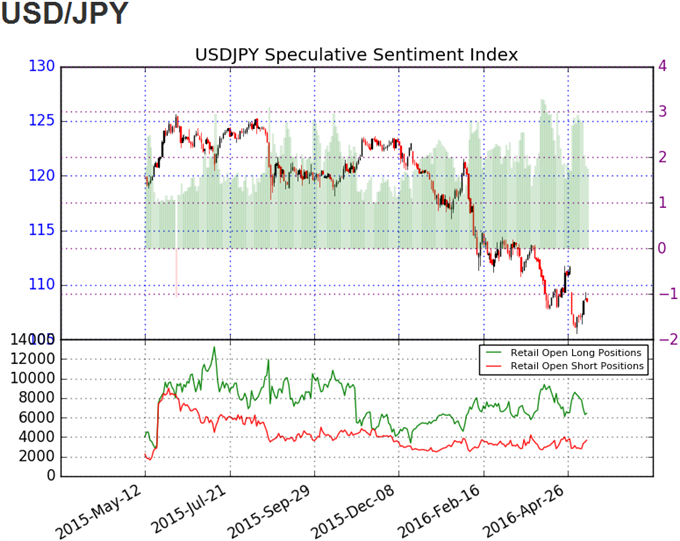

- The DailyFX Speculative Sentiment Index (SSI) shows the FX crowd remains stuck on the wrong side as they remain net-long USD/JPY since the BoJ’s January 29 interest-rate decision.

- The ratio currently sits at +1.87 as 65% of traders remain long, with short positions 16.8% higher from the previous week even as open interest stands 6.0% below the monthly average.

Why and how do we use the SSI in trading? View our video and download the free indicator here

USDOLLAR(Ticker: USDollar):

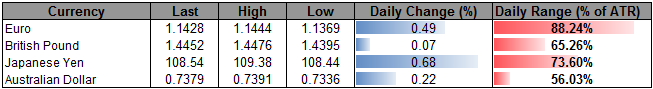

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 11870.38 | 11900.08 | 11863.54 | -0.24 | 63.06% |

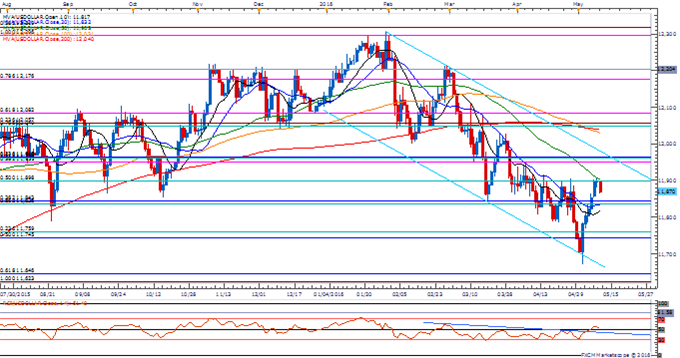

Chart - Created Using FXCM Marketscope 2.0

- The failed attempts to close above 11,898 (50% retracement) may highlight a near-term exhaustion in the USDOLLAR, and the greenback stands at risk of giving back the advance from earlier this month as it largely preserves the downward trending channel carried over from the end of January.

- Comments from Cleveland Fed President Loretta Mester, Boston Fed President Eric Rosengren, Kansas City Fed President Esther George, all voting-members on the 2016 Federal Open Market Committee (FOMC), may produce near-term headwinds for the greenback should the central bank officials show a greater willingness to further delay the normalization cycle.

- Dovish comments from the Fed officials may open up the downside risk, with a break/close below 11,836 (61.8% retracement) to 11,843 (38.2% retracement) raising the risk for a move back towards 11,745 (50% retracement) t0 11,759 (23.6% retracement).

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Read More:

Record Trend Following Long Position in Gold

AUD/CAD Into Key Support- Monthly Opening Range In Focus

US Dollar Bear Trap within an Even Bigger Bull Trap?!

USD/JPY Technical Analysis: Has It Bottomed?

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.