Talking Points:

- GBP/USD to Face Further Losses on Dovish Bank of England (BoE) Testimony.

- USDOLLAR Remains Capped Despite Strong CPI- Fed Speeches in Focus.

For more updates, sign up for David's e-mail distribution list.

Chart - Created Using FXCM Marketscope 2.0

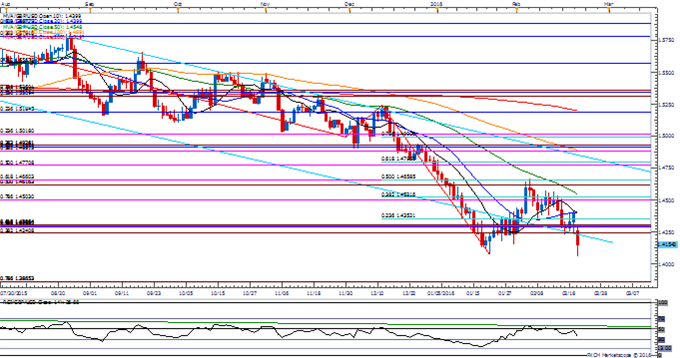

- GBP/USD gapped lower, with the exchange rate tumbling to a fresh 2016 low of 1.4056 as U.K. Prime Minister David Cameron schedules the referendum for June 23; the British Pound stands at risk of facing additional headwinds over the coming weeks/months amid growing support to leave the European Union.

- With the Bank of England (BoE) scheduled to testify in front of the Parliament’s Treasury Select Committee, dovish comments from Governor Mark Carney and Co. may spur a further decline in GBP/USD as market participants push back bets for a rate-hike.

- With the Relative Strength Index (RSI) largely preserving the bearish formation carried over from 2015, the long-term downward trend in the pound-dollar may continue to assert itself over the coming days as the outlook for monetary & fiscal policy remains clouded with high uncertainty.

- The DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-long GBP/USD since November 19, with the ratio hitting an extreme in January as the figure pushed above the +3.00 mark.

- Despite the gap lower, the ratio remains near extremes as it upticks to +2.15, with 68% of traders now long.

Why and how do we use the SSI in trading? View our video and download the free indicator here

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

USDOLLAR(Ticker: USDollar):

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 12101.94 | 12131.7 | 12076.98 | 0.38 | 82.95% |

Chart - Created Using FXCM Marketscope 2.0

- Despite the mixed data prints coming out of the U.S. economy, the USDOLLAR may mount a larger recovery in the days ahead as Fed officials remain upbeat and suggest the central bank remains on course to further normalize monetary policy over the coming months.

- A downward revision in the preliminary 4Q Gross Domestic Product (GDP) report may produce near-term headwinds for the greenback as it highlights a slowing recovery, but the fresh comments from Fed Vice-Chair Stanley Fisher, Governor Jerome Powell and Governor Lael Brainardmay boost the appeal of the greenback should the voting-members endorse higher borrowing-costs for 2016.

- Will keep a close eye on the RSI as it appears to be threatening the bearish formation from earlier this year, with the topside level of interest coming in around 12,176 (78.6% expansion) to the 12,200 pivot.

Read More:

EUR/USD – Bullish Views Getting Put to the Test

Constructive Copper Pattern adds to AUD/USD Intrigue

USD/JPY Technical Analysis: Best 2-Week Run For JPY Since 1998

Get our top trading opportunities of 2016 HERE

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand