Talking Points:

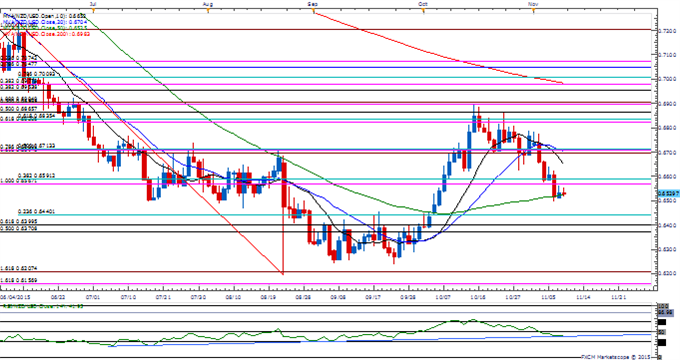

- EUR/USD Breaks Post-NFP Low (1.0704) Ahead of Draghi Comments.

- NZD/USD Holds Tight Range Ahead of RBNZ Report; Waiting for Bearish RSI Trigger.

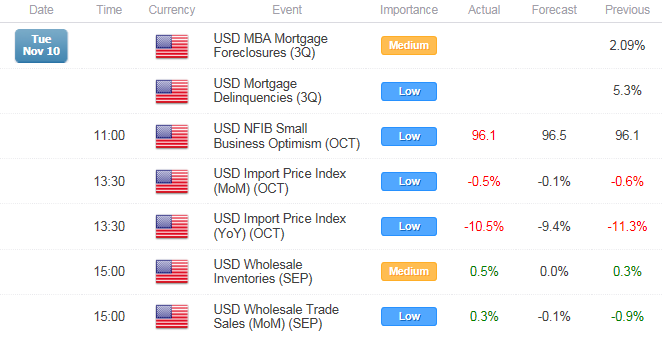

- USDOLLAR Continues to Coil Despite Mixed Data, Overbought Signal.

For more updates, sign up for David's e-mail distribution list.

Chart - Created Using FXCM Marketscope 2.0

- EUR/USD may continue to give back the rebound from April (1.0520) as it extends the decline following U.S. Non-Farm Payrolls (NFP) report; downside risks remains as long as the Relative Strength Index (RSI) slips below 30 for the first time in March.

- With European Central Bank (ECB) President Mario Draghi scheduled to speak over the next 24-hours of trade, the fresh batch of commentary may fuel a further decline in the Euro exchange rate as market participants boost bets for a major policy adjustment at the December 3 interest rate decision.

- The DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long EUR/USD since November 3, with the ratio approaching recent extremes as it climbs to +1.34 as 57% of traders are long.

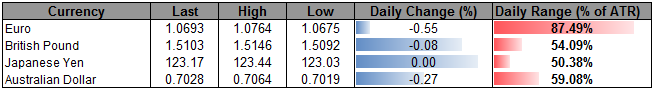

NZD/USD

- NZD/USD holds the tight range from earlier this week, but the pair stands at risk of facing increased volatility as the Reserve Bank of New Zealand (RBNZ) is scheduled to release its Financial Stability Report (FSR).

- Even though the RBNZ largely scales back the verbal intervention on the local currency, dovish comments from Governor Graeme Wheeler may dampen the appeal of the New Zealand dollar as the central bank keeps the door open to implement lower borrowing-costs.

- Will keep a close eye on the RSI as it comes up against trendline support, with a break of the bullish formation opening the door for a move back towards former resistance around 0.6370 (50% retracement) to 0.6400 (61.8% retracement).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: USD/CAD: Second Half of November Is What Really Matters

USD/JPY Technical Analysis: A Hold Above Support Favors Liftoff

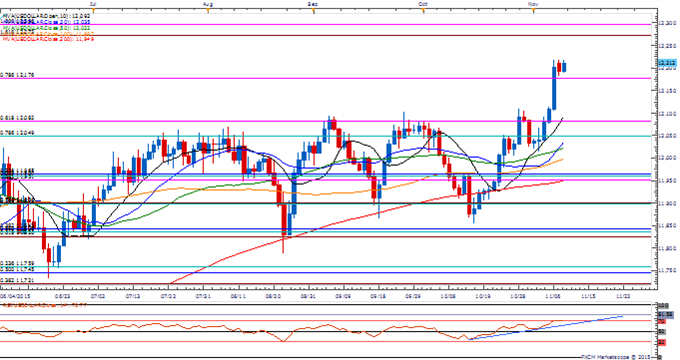

USDOLLAR(Ticker: USDollar):

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 12212.14 | 12220.26 | 12187.98 | 0.14 | 65.92% |

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar appears to be coiling for a move higher amid growing expectations for December Fed rate-hike, while the RSI preserves the bullish formation & kicks into overbought territory.

- Despite rising U.S. interest rate expectations, a marked appreciation in the greenback may become a growing concern for the Federal Open Market Committee (FOMC) as it raises the risk for disinflation.

- With the bullish formations largely in play, will keep a close eye on the next topside region of interest around 12,273 (161.8% expansion) to 12.296 (100% expansion).

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand