Talking Points:

- GBP/USD Holds Range Even as BoE Hints as Growing Dissent.

- AUD/USD Bullish RSI Momentum at Risk on Dovish RBA Minutes.

- USDOLLAR Preserves Range Despite Mixed Data.

For more updates, sign up for David's e-mail distribution list.

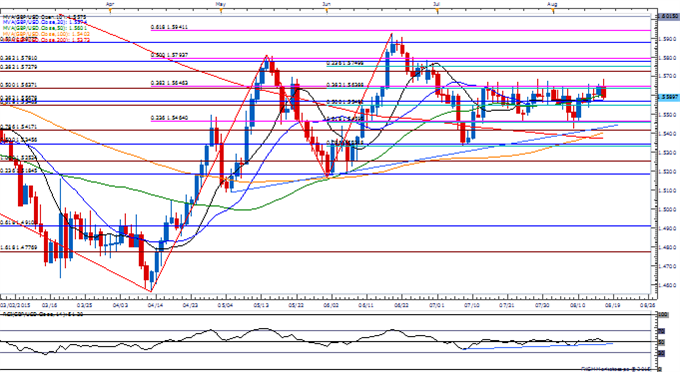

Chart - Created Using FXCM Marketscope 2.0

- GBP/USD looks poised to retain the range-bound price action ahead of the U.K. Consumer Price Index (CPI) amid the ongoing failed attempts to close above 1.5630 (38.2% retracement) to 1.5650 (38.2% expansion) even as recent comments from Bank of England (BoE) board member David Miles & Kristin Forbes suggests there’s a growing dissent within the committee.

- Even though the headline reading for U.K inflation is expected to hold flat for the second consecutive month, stickiness in the core CPI may keep the BoE on course to normalize monetary policy as Governor Mark Carney continues to anticipate stronger price growth over the near to medium-term.

- DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long GBP/USD since July 1, but the ratio remains off of recent extremes as it sits at +1.17, with 54% of traders long.

AUD/USD

- AUD/USD may continue to retrace the decline from May following the failed attempts to close below 0.7240 (100% expansion); will keep a close eye on the topside targets as long as the RSI preserves the bullish momentum carried over from the previous month.

- The Reserve Bank Australia (RBA) Minutes may not include comments regarding China’s devaluation process, but dovish comments from the committee may put the bullish RSI momentum at risk as the central bank continues to see below-trend growing in the $1T economy.

- Break/close above 0.7450 (23.6% retracement) should bring up the next topside target around 0.7500 (61.8% expansion).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: Euro & The Obvious

GBPAUD Putting in a High or Time to Buy?

USDOLLAR(Ticker: USDollar):

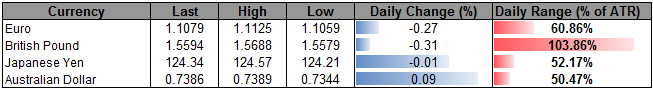

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 11988.83 | 11998.94 | 11970.83 | 0.08 | 53.35% |

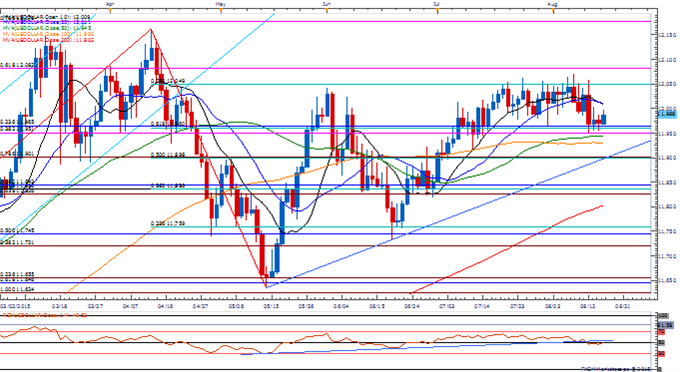

Chart - Created Using FXCM Marketscope 2.0

- Despite the ongoing mixed data prints coming out of the U.S. economy, the Dow Jones-FXCM U.S. Dollar looks poised to retain the range-bound price action from earlier this month as market participants continue to weigh the timing of the Fed liftoff.

- The U.S. Consumer Price Index (CPI) will be in focus as Fed officials continue to highlight subdued inflation, but may see a dismal print amid the renewed decline in oil/energy prices.

- Ongoing closes above 11,898 (50% retracement) to 11,901 (78.6% expansion) may pave the way for a test of near-term resistance around 12,049 (78.6% retracement).

Join DailyFX on Demand for Real-Time SSI Updates!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums