Talking Points:

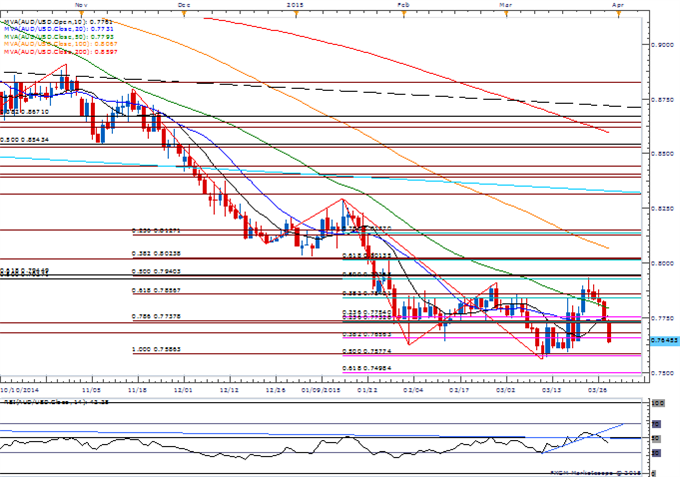

- AUD/USD Fails to Retain Bullish Momentum- Eyes Monthly Low (0.7559) Ahead of RBA.

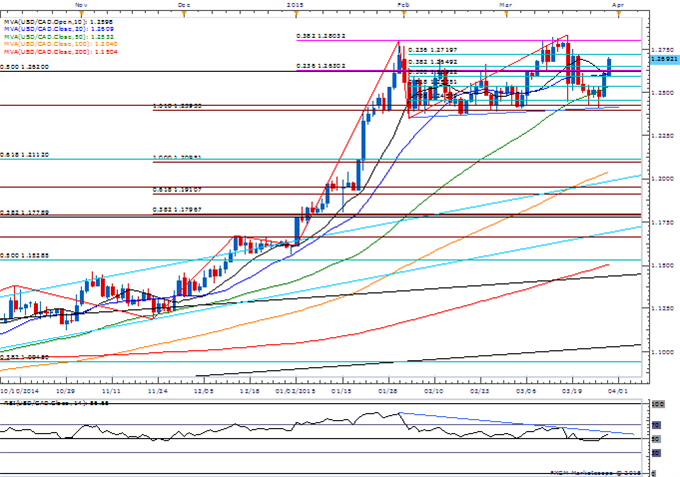

- USD/CAD Continues to Come Off of Key Support Despite Rising Canadian Input Costs.

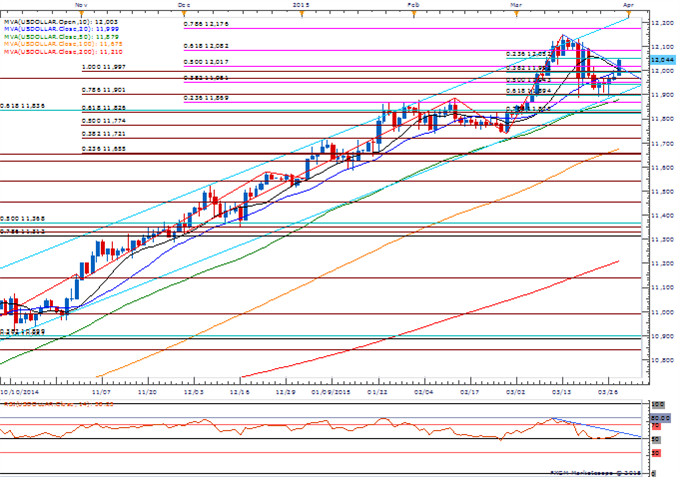

- USDOLLAR Rebound Gathers Pace on Stick PCE Inflation- Fed Rhetoric in Focus.

For more updates, sign up for David's e-mail distribution list.

Chart - Created Using FXCM Marketscope 2.0

- AUD/USD may have carved a near-term top amid the string of failed attempts to close above 0.7890, while the RSI struggles to retain the bullish structure.

- Will continue to watch the 0.7570 (50% expansion) to 0.7590 (100% expansion) region for near-term support, especially on a close-basis.

- Seeing increased volatility in the DailyFX Speculative Sentiment Index (SSI) heading into the end of the month, with the retail crowd turning net-long AUD/USD following the Sunday open, with the ratio currently sitting at +1.28.

USD/CAD

- Will continue to watch the broader range for USD/CAD as the pair continues to come off the 1.2390 (161.8% expansion) to 1.2420 (161.8% expansion) support zone, with the 1.2800 region in focus.

- Despite the neutral tone laid out by Bank of Canada (BoC) Governor Stephen Poloz, a contraction in the Gross Domestic Product (GDP) print may heighten the bearish sentiment surrounding the loonie as it drags on interest rate expectations even though the Industrial Produce Price Index and Raw Material Price Index highlight rising input costs.

- Close above 1.2650 (38.2% retracement) should bring up the 1.2720 region (23.6% retracement), but need a break of the bearish RSI momentum to favor fresh highs.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: Big Week For Stocks?

AUDUSD Reversal Scalp- Shorts Favored Sub 7850

USDOLLAR(Ticker: USDollar):

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 12044.35 | 12051.98 | 11977.34 | 0.55 | 83.05% |

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar index looks as though its ready to resume the long-term bullish trend as it attempts to breakout of the consolidation phase; waiting for a topside break in the RSI for confirmation/conviction.

- Despite forecasts for another 250K expansion in U.S. Non-Farm Payrolls (NFP), will keep a very close eye on the slew of Fed commentary lined up this week (Stanley Fischer, Jeffrey Lacker, Dennis Lockhart, Loretta Mester, Esther George, John Williams Janet Yellen, Lael Brainard and Narayana Kocherlakota) as there appears to be a growing dissent amongst the 2015 voting-members.

- Break/close above 12,052 (23.6% retracement) may produce a more meaningful run at 12,176 (78.6% expansion) especially if data supports expectations for a mid-2015 rate hike.

Join DailyFX on Demand for Real-Time SSI Updates!

| Release | GMT | Expected | Actual |

|---|---|---|---|

| Personal Income (FEB) | 12:30 | 0.3% | 0.4% |

| Personal Spending (FEB) | 12:30 | 0.2% | 0.1% |

| Personal Consumption Expenditure Deflation (MoM) (FEB) | 12:30 | 0.2% | 0.2% |

| Personal Consumption Expenditure Deflation (YoY) (FEB) | 12:30 | 0.3% | 0.3% |

| Personal Consumption Expenditure Core (MoM) (FEB) | 12:30 | 0.1% | 0.1% |

| Personal Consumption Expenditure Core (YoY) (FEB) | 12:30 | 1.3% | 1.4% |

| Pending Home Sales (MoM) (FEB) | 10:00 | 0.3% | 3.1% |

| Pending Home Sales n.s.a (YoY) (FEB) | 10:00 | 8.7% | 12.0% |

| Dallas Fed Manufacturing Activity (MAR) | 10:30 | -8.8 |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums