US Dollar (USD) Talking Points

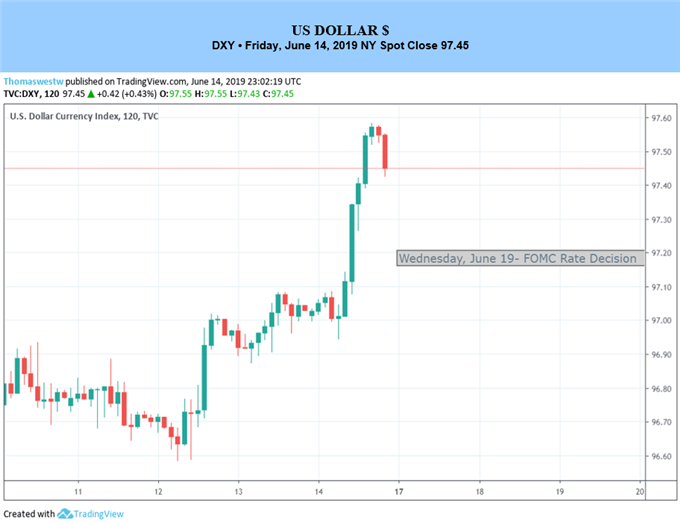

- Wednesday’s FOMC meeting will decide the US dollar’s short- and medium-term direction.

- US dollar should remain ‘the cleanest shirt in the dirty laundry basket’.

Q2 2019 USD Forecast and Top Trading Opportunity

Fundamental Forecast for the US Dollar: Neutral

The DailyFX Economic Calendar covers all market moving data releases and events.

I remain Neutral on the US dollar in the week ahead as the latest FOMC meeting looms. While a 0.25% rate cut is fully priced-in for July, and should be fully signposted next week, the USD may well hold its value against its G7 counterparts who are suffering their own bouts of weakness. Saying that, expectations of a Fed policy U-turn are running high and any disappointment Wednesday may have an out-sized effect.

The FOMC monetary policy meeting on Wednesday is likely to see Fed Chair Jerome Powell indicate the start of monetary easing in the US with the first 0.25% interest rate cut likely in July or September at the latest. In recent weeks Powell has shifted his language on rate cuts from being ‘patient’ to now ‘closely monitoring’ economic conditions, leaving the central bank maximum flexibility to slash rates. Next week’s meeting is expected to confirm market expectations that rates will be lowered in July, followed by one, or maybe two, further 0.25% interest rate cuts during 2019.

DailyFX senior currency strategist John Kicklighter will be covering the FOMC Decision Live on June 19 from 17:45 GMT

Political and trade tensions will also be closely watched next week with the US-China trade dispute unresolved, while the latest attack on two oil tankers in the Gulf of Oman threatens to escalate tension between the US and Iran, with neither side giving an inch at the moment. The Fed has already highlighted that ongoing global trade disruptions may well dampen growth in H2, confirming the need for maximum flexibility on the timing of US rate cuts.

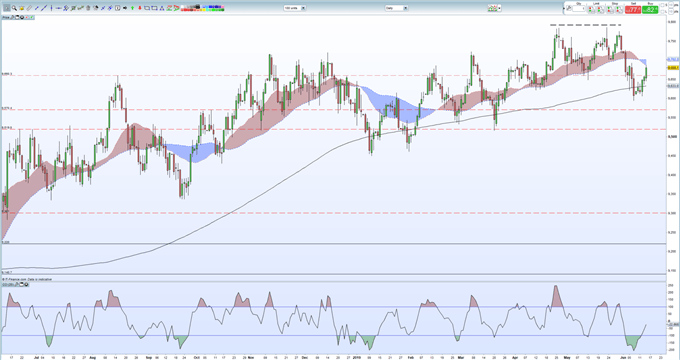

The US dollar, while off its recent two-year high, has not broken decisively lower. While currencies normally fall before and during a rate cut cycle, the US dollar has benefitted from weakness seen in other G7 currencies. The Euro continues to edge lower as expectations grow of further monetary loosening, while Sterling continues to fear a No-Deal Brexit, especially now that Brexiteer Boris Johnson looks likely to take over from caretaker PM Theresa May.

USD Daily Price Chart (August 2018 – June 14, 2019)

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.